- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Google (GOOGL): Taking Stock of Its Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Alphabet (GOOGL) made headlines this week with a price move that has piqued the interest of investors and onlookers alike. While there is no single event or announcement driving the action, the uptick in Alphabet’s share price has people wondering if it signals a shift in the company’s outlook or is simply a case of broader market enthusiasm.

Looking at the bigger picture, Alphabet’s stock has shown strong momentum this year, gaining 58% over the past year with an impressive 32% jump in the past 3 months. This builds on solid trends, supported by double-digit annual revenue and net income growth, and follows a stream of steady performances rather than a surprise news event. The story has become less about headline-making updates and more about Alphabet’s ability to execute and expand in a competitive tech landscape.

This recent surge raises the big question for investors: are shares still undervalued after such gains, or has the market already priced in the company’s future growth potential?

Most Popular Narrative: 1% Undervalued

According to the most popular narrative, Alphabet’s shares are trading just below their estimated fair value, suggesting the company remains attractively priced despite recent gains.

"Alphabet Inc. combines market dominance, innovation, and financial strength, making it one of the most compelling investment opportunities in the tech sector. As the cheapest stock among the Magnificent 7, it offers a unique blend of value and growth potential."

Curious what makes Alphabet’s fair value stand out? There is a bold set of projections at work, including stellar profit margins and a playbook for continued growth. The financial engine behind this estimate might surprise those tracking big tech’s next moves. Want to see what underpins the narrative’s confidence? Dive in for the surprising figures and the big assumptions fueling this valuation.

Result: Fair Value of $237.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, regulatory challenges or shifts in digital ad spending could quickly change Alphabet’s outlook and reshape the current valuation narrative.

Find out about the key risks to this Alphabet narrative.Another View: Market Multiples Tell a Different Story

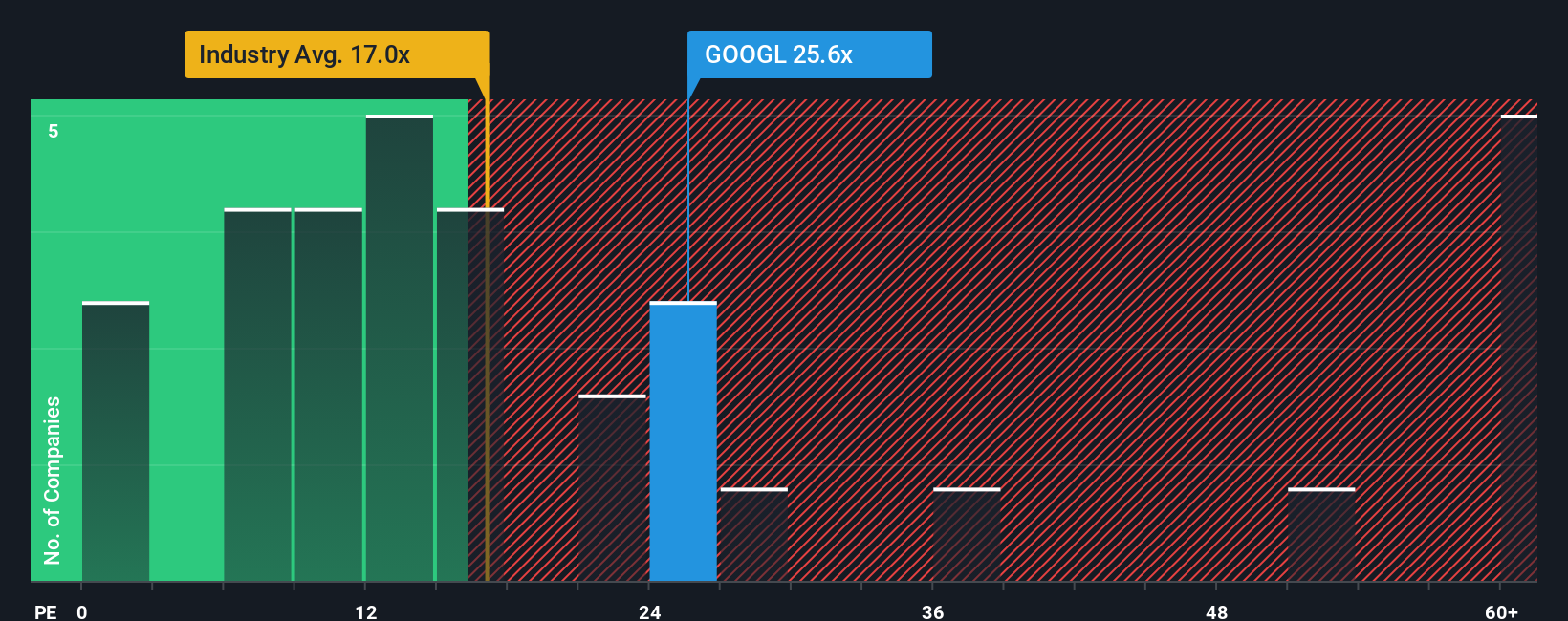

While some models suggest Alphabet is undervalued, a look at typical market valuation ratios paints a tougher picture. Compared to similar companies in its industry, Alphabet actually appears somewhat expensive. Could the market's optimism be outpacing fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alphabet Narrative

If you see things differently or want to dig deeper into the numbers, you can craft your own personalized take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Alphabet.

Looking for More Smart Investment Ideas?

Break away from the crowd and get ahead with unique stock ideas tailored to where the market is headed. These tailored tools could inspire your next move and help you avoid missing significant growth opportunities.

- Strengthen your portfolio by tracking companies earning solid payouts and benefiting from dividend stocks with yields > 3%. This approach can help create consistent income streams for the long term.

- Explore future-focused opportunities by targeting breakthroughs with quantum computing stocks and access pioneers leading advancements in quantum innovations.

- Find potential bargains before the market notices them by using undervalued stocks based on cash flows to identify stocks that may be well positioned for growth based on real cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)