- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Alphabet (GOOGL) Valuation in Focus as AI Expansion and Pixel Launches Highlight Growth Potential

Reviewed by Simply Wall St

If you’re wondering what to do next with shares of Alphabet (GOOGL), there’s a lot to unpack right now. Alphabet has been everywhere this month, announcing fresh hardware at the recent Pixel launch, expanding AI-powered Google services into defense and government applications, and rolling out new partnerships that deeply weave Gemini AI into the company’s core and emerging businesses. These announcements carry weight, as they show not just a steady pace but a real escalation in the ways Alphabet is monetizing and scaling its investments in AI and cloud infrastructure.

Zooming out, this push into AI isn’t just creating buzz. Alphabet’s stock has steadily powered higher this year, gaining over 30% in the past 12 months with momentum picking up in the last quarter alone. Investors have also seen the company drive strong revenue and net income growth from its core services and cloud business, while new strategic agreements in both enterprise and government segments signal that the competitive moat may actually be widening. Recent events, from Pixel product launches to new government deals and visibility in defense, reflect a business that is both flexible and well-positioned for continued growth.

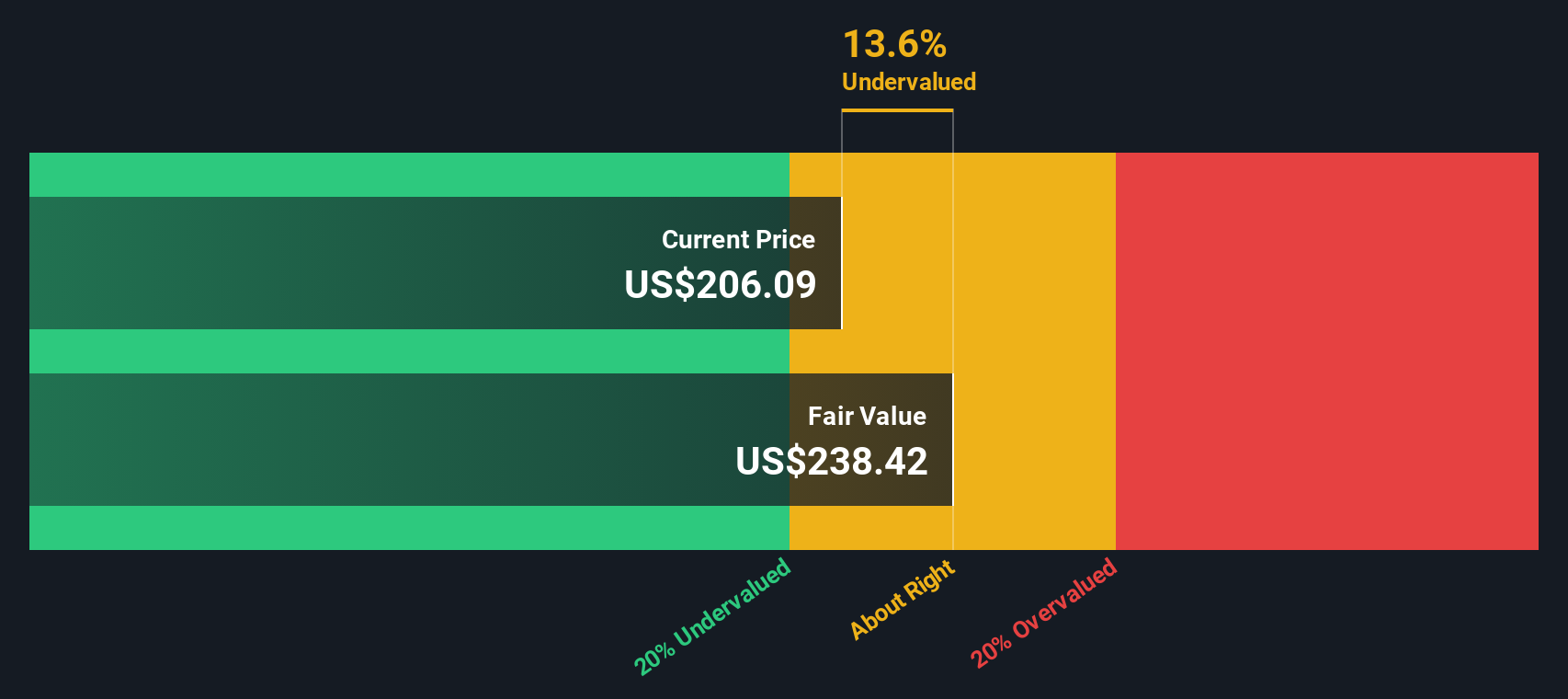

The question that naturally follows, given all this activity and the share price rally, is whether there is still a real buying opportunity in Alphabet or if the market has already priced in the company’s future AI-powered expansion.

Most Popular Narrative: 10.3% Undervalued

According to the narrative by Investingwilly, Alphabet is currently trading at a significant discount to its estimated fair value. This positions the stock as a compelling opportunity for investors seeking growth at a reasonable price.

Alphabet Inc. combines market dominance, innovation, and financial strength, making it one of the most compelling investment opportunities in the tech sector. As the cheapest stock among the Magnificent 7, it offers a unique blend of value and growth potential.

Curious about what’s really powering this bold undervaluation? The narrative hinges on several surprising core metrics, such as relentless revenue growth, healthy profit margins, and an earnings multiple that defies current market expectations. Interested in finding out how one of tech’s biggest names could be priced for upside? There is one key assumption in play. Explore the full narrative to see what might drive Alphabet’s valuation even higher.

Result: Fair Value of $237.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory scrutiny and unpredictable macroeconomic shifts remain potential catalysts that could challenge Alphabet's bullish narrative and impact future performance.

Find out about the key risks to this Alphabet narrative.Another View: What Does the SWS DCF Model Say?

Instead of focusing on company price multiples, our DCF model takes a deep dive into Alphabet's cash flow projections. Interestingly, this approach also finds the stock to be undervalued. So, which lens tells the truer story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Alphabet Narrative

If you’re interested in digging into the numbers and building your own perspective, you can easily craft your own narrative in just a few minutes using the following tool: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Alphabet.

Looking for more investment ideas?

Why stop at Alphabet when there is an entire world of smart opportunities at your fingertips? The Simply Wall Street Screener offers unique investment angles within reach, allowing you to act quickly on trends that others may miss. Let these tailored picks inspire your next move:

- Unlock high yield potential and secure steady income streams by checking out dividend stocks with yields > 3%.

- Tap into tomorrow's healthcare breakthroughs with companies pioneering medical AI and innovation via healthcare AI stocks.

- Catch the emerging wave of blockchain and crypto growth by focusing on visionary businesses through cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)