- United States

- /

- Entertainment

- /

- NasdaqGS:FWON.K

Will Formula One Group's (FWON.K) Apple TV Deal Accelerate Digital Growth or Test U.S. Engagement?

Reviewed by Sasha Jovanovic

- Liberty Formula One recently announced a new five-year U.S. broadcast partnership with Apple TV, moving coverage from ESPN and aiming to broaden its platform and audience reach.

- This collaboration underscores a shift towards digital media distribution, leveraging Apple’s global presence to seek stronger long-term growth opportunities despite some immediate viewership risks.

- We'll explore how the Apple TV deal may reshape Formula One Group's investment narrative through expanded digital exposure in the U.S. market.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Formula One Group Investment Narrative Recap

To be a Formula One Group shareholder today, you need to believe that its digital transformation and expanding fan base can drive recurring revenue and margin gains beyond one-off media or event spikes. The Apple TV deal does bring short-term uncertainty around US audience migration but is now the primary catalyst for unlocking new growth streams and reinforcing the company’s media rights leverage; the biggest risk remains the volatility of media rights negotiations in a rapidly changing streaming environment, which could impact forward revenue visibility, but the news meaningfully strengthens management’s hand.

Of the recent announcements, the F1 movie’s mid-teens contribution to quarterly revenue stands out as particularly relevant. While it illustrates the company’s ability to maximize episodic opportunities, it also highlights that repeatable digital media partnerships, like Apple TV, are even more vital for supporting sustainable, year-over-year earnings momentum beyond these one-time boosts.

Yet, in contrast to the optimism over digital expansion, investors should also be aware of the risks if streaming adoption lags and US rights renewals become less lucrative than...

Read the full narrative on Formula One Group (it's free!)

Formula One Group's narrative projects $5.3 billion revenue and $758.1 million earnings by 2028. This requires 11.3% yearly revenue growth and a $485.1 million earnings increase from $273.0 million.

Uncover how Formula One Group's forecasts yield a $115.87 fair value, a 18% upside to its current price.

Exploring Other Perspectives

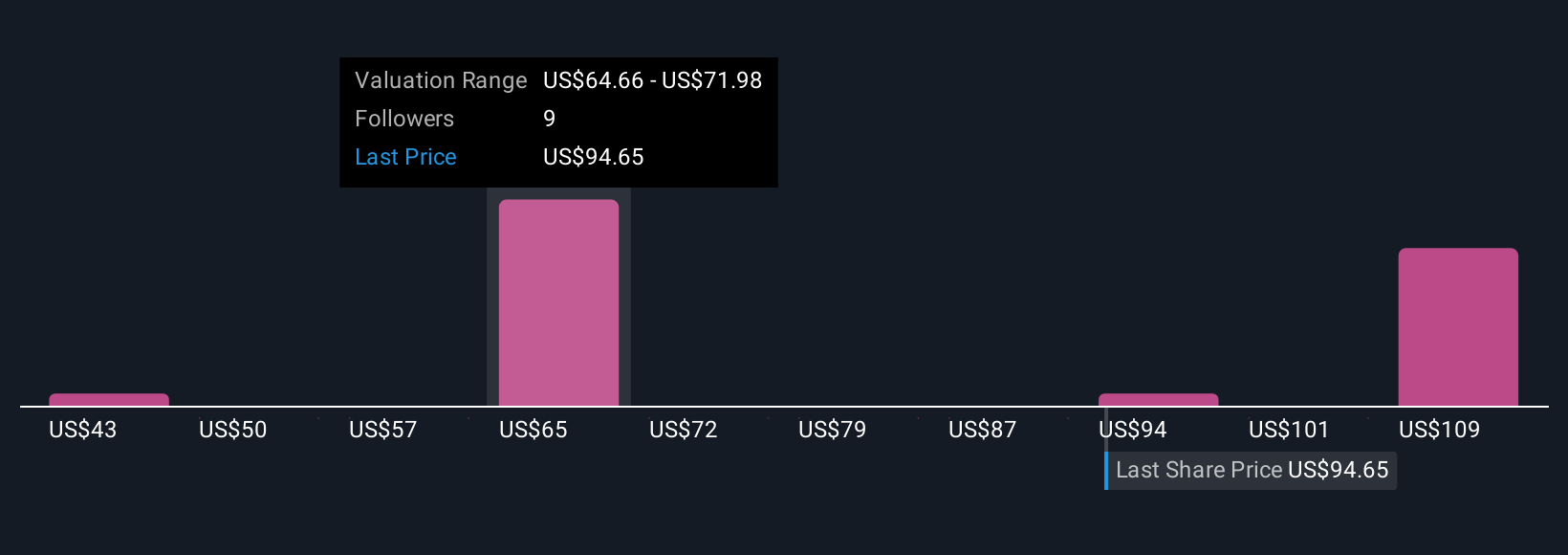

Simply Wall St Community fair value estimates for Formula One Group span from US$42.72 to US$115.87 across four independent analyses. Many see digital expansion as a key catalyst, yet future US media rights remain a swing factor for performance, explore these views to see how your outlook compares.

Explore 4 other fair value estimates on Formula One Group - why the stock might be worth as much as 18% more than the current price!

Build Your Own Formula One Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Formula One Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Formula One Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Formula One Group's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FWON.K

Formula One Group

Engages in the motorsports business in the United States and the United Kingdom.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives