- United States

- /

- Media

- /

- NasdaqGS:FOXA

Fox (FOXA): How a New AI Ad Partnership Fits Into the Current Valuation

Reviewed by Kshitija Bhandaru

Fox (FOXA) is grabbing investor attention after announcing a new partnership with Mobian, aiming to elevate its digital advertising game. The collaboration focuses on harnessing AI to create smarter and more measurable ad experiences across Fox’s vast media holdings.

See our latest analysis for Fox.

Fox’s new partnership builds on a year of real momentum for shareholders. Despite short-term volatility, the 12-month share price return sits at an impressive 18.6%. Long-term holders have seen a stellar 40.2% total return over the past year. With fresh innovation in advertising and another earnings call on the horizon, there is a sense that growth potential is building as Fox leans into digital transformation.

If you’re keen to see which other media and tech names are making strategic plays, now’s the perfect time to check out See the full list for free..

With shares not far off analyst targets and recent innovations fueling headlines, the key question for investors is whether Fox’s stock still offers real value, or if the market is already accounting for this next phase of growth.

Most Popular Narrative: 5.7% Undervalued

Fox's most widely followed valuation narrative points to a fair value that sits moderately above its latest close, suggesting room for upside as analyst projections balance optimism around digital expansion with the realities of industry headwinds. The price target reflects long-term expectations that go deeper than headline returns.

The widespread shift away from traditional linear television toward streaming services, especially among younger audiences, poses a major risk to Fox's core broadcast and cable businesses. This has led to persistent declines in advertising revenue and a shrinking addressable market, which will likely have a negative impact on top-line growth and future earnings. Generational changes in media consumption, where younger viewers increasingly prefer non-traditional news and sports content, threaten the long-term sustainability of Fox's ratings strength. This strength underpins both advertising rates and affiliate fee negotiations, and the trend could drive long-term revenue and net margin contraction as the audience base erodes.

Is Fox's future built on its unique position in live content, or are tough forecasts on margins and profitability the real driver? Want to know which metrics analysts are zeroing in on, and what bold assumptions lie beneath the surface? Only the full narrative reveals the numbers and logic that anchor this valuation.

Result: Fair Value of $61.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust demand for live sports or a surge in digital growth could still defy expectations and improve Fox’s long-term outlook.

Find out about the key risks to this Fox narrative.

Another View: Multiples Tell a Different Story

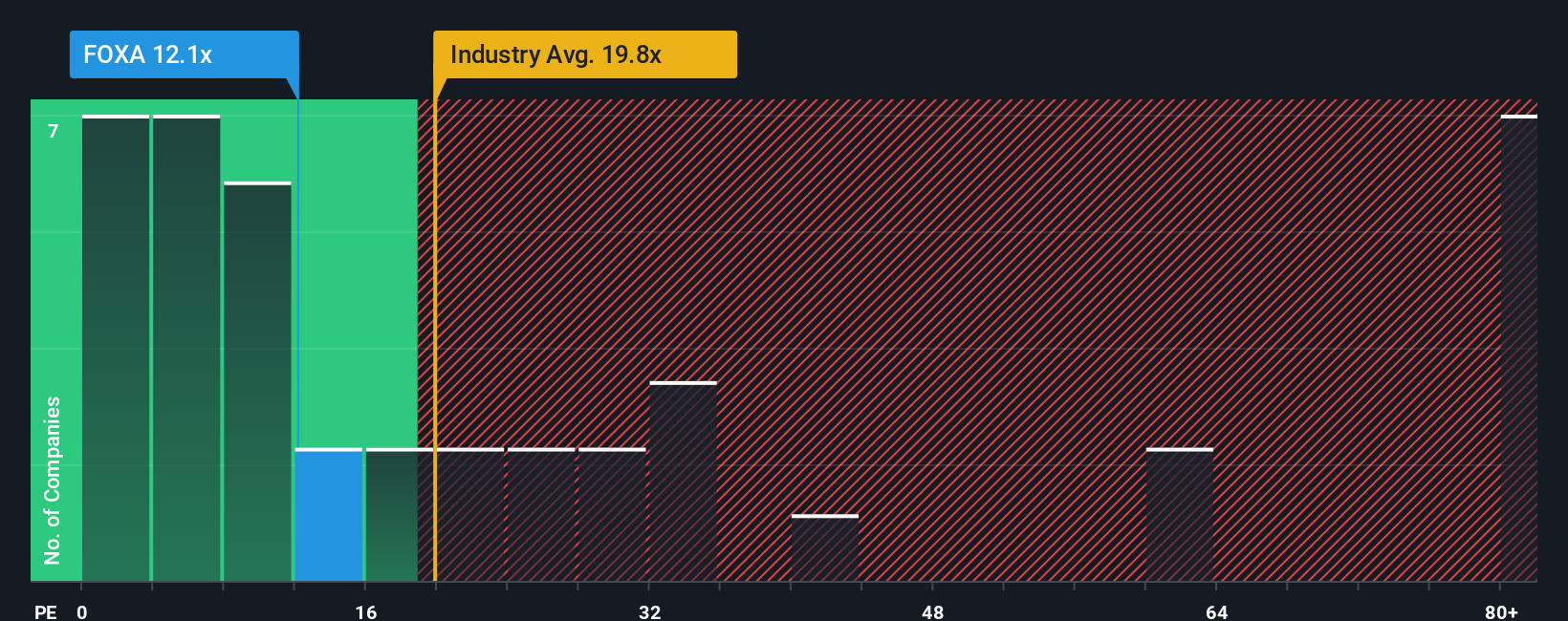

Taking a look at valuation through the lens of the price-to-earnings ratio, Fox trades at 11.5 times earnings, which is a premium to similar peer companies that average just 9.6, but still sits well below the broader US Media industry’s 19. If the market moves toward the fair ratio of 18.5, that could signal upside or a normalization ahead. The gap between these numbers raises big questions. Is Fox's stock priced for steady potential, or could a re-rating catch investors off guard?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fox Narrative

If you see the story differently, or want to draw your own conclusions, it's quick and easy to craft your own perspective from the data in just a few minutes. Do it your way

A great starting point for your Fox research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead by checking out other fast-moving opportunities. The smartest investors constantly scan beyond the headlines to spot tomorrow’s winners before everyone else.

- Tap into tomorrow’s tech with these 25 AI penny stocks, where innovative companies are unlocking new growth through artificial intelligence.

- Boost your portfolio’s income by checking out these 18 dividend stocks with yields > 3% paying reliable yields above 3% to shareholders.

- Ride the next wave of digital disruption with these 79 cryptocurrency and blockchain stocks, featuring industry leaders building the future of blockchain and cryptocurrency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FOXA

Fox

Operates as a news, sports, and entertainment company in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives