- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

This is why Facebook's (NASDAQ:FB) high Returns can Convert into double-digit Revenue Growth

Facebook (NASDAQ:FB) has had a great run on the share market, with its stock up by a significant 14% over the last three months. Since the market usually pay for a company's long-term fundamentals, we decided to study the company's key performance indicators to see if they could be influencing the market. In this article, we decided to focus on Facebook's return measures, particularly on its ROE. If some parts feel a bit more complex, jump to the conclusion to get the important takeaways!

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors' money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Facebook

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Facebook is:

28% = US$39b ÷ US$138b (Based on the trailing twelve months to June 2021).

The 'return' is the yearly profit. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.28.

In contrast, we can look at additional return measures such as the ROCE and Sales to Capital. Return on Capital Employed has the same function as ROE, but integrates the returns from debt financing as well. The Sales to Capital ratio was devised from Prof. Aswath Damodaran and it shows us the income generated from 1 USD in invested capital (both debt & equity). These two supplementary ratios show us that:

- Facebook has a ROCE of 28.6% which grew from 27.8% from 3 years ago. We can conclude that Facebook has managed to uphold a high ROCE over the years, which helps create value for investors.

- Facebook gains 1.42 USD for every 1 dollar it invests in the business. This is great as it indicates that the management is investing in projects that return more than was put in.

By analyzing ROE a bit more, we can come up with a sustainable growth rate, which is the maximum growth rate which a company can sustain in the long term while growing (before it matures and has low/flat growth).

- Facebook's long term sustainable growth rate (after next year), is 19.32%. This calculation is based on the ROE and Retention ratio, calculated as: ROE * Retained Earnings. Note that while Facebook does not have dividends, it engages in buybacks, and the sum of buybacks in the last 12 months is used to calculate a payout ratio (retention ratio = 1 - payout ratio). The payout ratio includes the US$14.7b in buybacks in the last year.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Facebook's Earnings Growth And 28% ROE

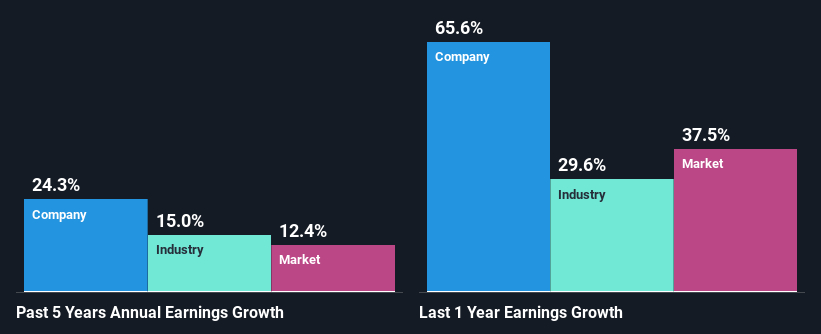

First thing first, we like that Facebook has an impressive ROE. Secondly, even when compared to the industry average of 12% the company's ROE is quite impressive. As a result, Facebook's exceptional 24% net income growth seen over the past five years, doesn't come as a surprise.

Next, on comparing with the industry net income growth, we found that Facebook's growth is quite high when compared to the industry average growth of 15% in the same period, which is great to see.

Is Facebook Efficiently Re-investing Its Profits?

As mentioned before, Facebook has a retention ration of 62%, which allows it a maximum long term sustainable revenue growth rate of 19%. This is why ROE is so important, and gives us a preview of future growth rates, barring any large scale shake-ups.

With that in mind, it is important to remind investors, that regulators are increasingly looking at Facebook as an antitrust case and this risk factor is hard to quantify, but we can see how it can put some pressure on future margins. Additionally, Facebook's competitor, Apple Inc., (NASDAQ:AAPS) is pushing changes that will additionally affect Facebook's profitability. That is why, extrapolation based on the current state of affairs is risky for investors.

Conclusion

All three return measures suggest that Facebook is investing capital at a high rate of return. This has implications for the long term growth rates, and suggests a maximum sustainable growth rate of 19%.

The measures compared in this analysis were: ROE and ROCE at 28%, Sales to Capital at 142%. The latter means that Facebook is generating more income than the capital it invests. Specifically, for every 1 USD of capital, Facebook gains 1.42 dollars of income!

In total, we are pretty happy with Facebook's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings.

With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives