- United States

- /

- Media

- /

- NasdaqGS:CRTO

A Fresh Look at Criteo (CRTO) Valuation After Google Partnership Expands Retail Media Reach

Reviewed by Simply Wall St

Most Popular Narrative: 42% Undervalued

According to the most widely followed narrative, Criteo is seen as significantly undervalued. This view is based on future earnings growth, margin expansion, and assumed improvements in the company's strategic positioning in digital advertising.

The rapid adoption of AI-powered ad targeting and the development of Agentic AI solutions leveraging Criteo's structured commerce data are expected to boost campaign performance and unlock new monetization channels. This supports both revenue growth and potential margin expansion as productized, automated offerings gain scale.

Curious how a traditional ad-tech player could be priced so far below its potential? There is a surprising catalyst hidden in the key financial assumptions behind this narrative’s fair value, one that could transform Criteo’s earnings trajectory and valuation multiple. Want to see exactly which growth drivers and forecasts justify such a bold upside call? Dive deeper to discover the precise numbers that power this dramatic value gap.

Result: Fair Value of $38.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, uncertainties around AI monetization and intense competition from larger digital platforms could undermine the bullish case for Criteo’s future valuation.

Find out about the key risks to this Criteo narrative.Another View: The DCF Perspective

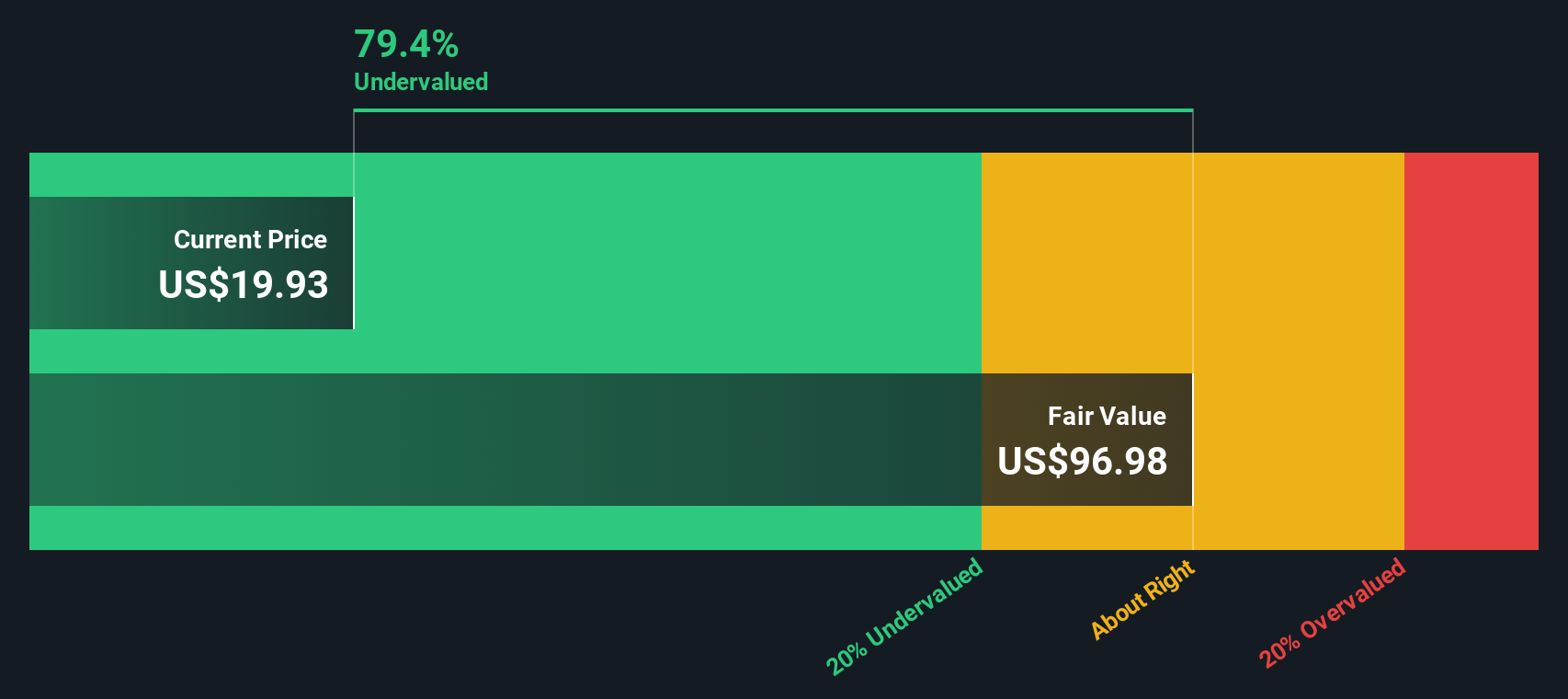

While analysts’ price targets highlight future earnings potential, our SWS DCF model takes a different approach by estimating fair value based on projected cash flows. This method also suggests the stock may be undervalued. Could both views be correct, or is there still an element missing from the story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Criteo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Criteo Narrative

If you see things differently, or you want to dive deeper into Criteo’s numbers yourself, you can quickly shape your own narrative and view the data your way by using Do it your way.

A great starting point for your Criteo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't let the best stocks slip by while you wait. Let Simply Wall Street's powerful filters help you pinpoint the next standout opportunity in seconds. When it comes to investing, timing and insights are everything.

- Spot penny stocks with untapped potential and strong balance sheets by checking out the latest penny stocks with strong financials.

- Capture tomorrow’s most disruptive returns by targeting companies leading breakthroughs in artificial intelligence with our handpicked AI penny stocks.

- Secure undervalued stocks trading at a discount to their true worth by running the tailored undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRTO

Criteo

A technology company, provides marketing and monetization services and infrastructure on the open internet in North and South America, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026