- United States

- /

- Media

- /

- NasdaqGS:CMCSA

Comcast (NasdaqGS:CMCSA) Unveils US$5 Million Fund For E-Commerce TV Advertising

Reviewed by Simply Wall St

Comcast (NasdaqGS:CMCSA) launched a new Incrementality Fund through its subsidiary Universal Ads, offering ad credits to Shopify Plus merchants, as part of its support for e-commerce businesses. This development follows the company's Q1 earnings report showing a slight decline in revenue and net income compared to the previous year. Additionally, Comcast's ongoing share repurchase program and network expansions signal commitment to growth. The market's upward trajectory, including the Dow and S&P 500, likely supported the company's 1.2% price increase over the past month, while the broader industry trends and product innovations might have added weight to this performance.

The launch of Comcast's Incrementality Fund through Universal Ads could boost its e-commerce partnerships, potentially aiding revenue growth. This move may offset some profitability concerns, particularly in its competitive broadband and wireless segments. However, market competition and pricing strategies might still present challenges. The new initiative might not immediately influence revenue forecasts significantly, given the Q1 earnings report's slight declines. Still, over time, it could improve the outlook if it manages to drive meaningful engagement with e-commerce merchants.

Over the longer term, Comcast’s total return, combining share price and dividends, was 0.57% over a five-year period, reflecting modest growth. Relative to the broader market over the past year, Comcast's shares underperformed, with the US market achieving a return of 10.6%. This contrast highlights challenges the company faces in maintaining competitive returns amidst industry and economic pressures.

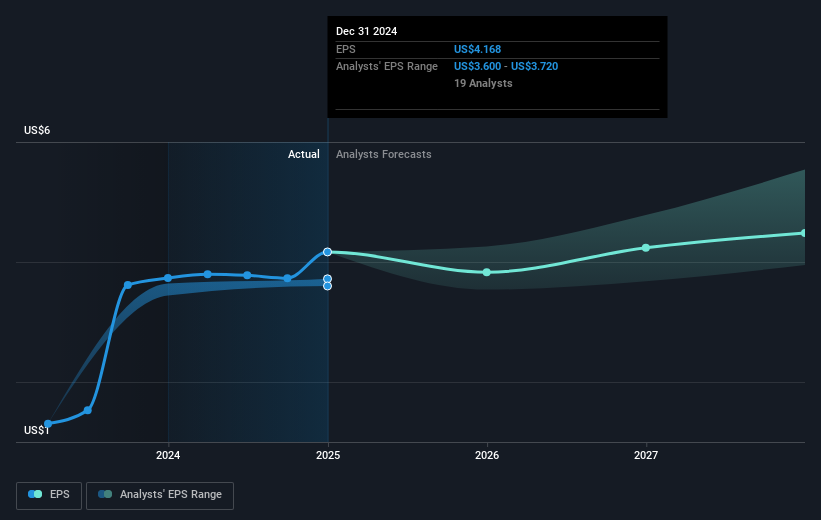

Comcast's current share price of US$34.49 shows a discount to the average analyst price target of US$40.17, suggesting potential upside if projected earnings materialize. Despite current pressures on profit margins, the analyst consensus indicates expectations for longer-term stabilization and modest improvement. However, with a bearish price target of US$30.0 considered feasible by some analysts, there’s an acknowledgment of potential downside risks and market skepticism regarding future performance. The company’s ongoing share repurchase program may help to provide some support to its share price in the interim.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Comcast, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCSA

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives