- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:CMCSA

Comcast (NasdaqGS:CMCSA) Q1 Earnings Show Decrease In Sales And Net Income

Reviewed by Simply Wall St

Comcast (NasdaqGS:CMCSA) recently reported a decline in quarterly sales and earnings, which coincided with a 1.35% price move over the past week. Despite the dip in earnings figures, the broader market experienced significant gains, driven by strong tech earnings and optimism over potential tariff rollbacks. While the company's earnings report would have added weight to a broader market move, the market's overall upward trend, reflected in the 2.3% rise in major indexes, suggests that any negative sentiment from Comcast's performance may have been counteracted by positive global market trends.

The recent decline in Comcast's quarterly sales and earnings, alongside the broader market's significant gains, may exert additional pressure on the company's future revenue and earnings projections. While the market seemed to dismiss the short-term negative sentiment by focusing on robust tech earnings and potential tariff rollbacks, Comcast's strategic initiatives, such as integrating wireless offerings and media repositioning, could lead to earnings strains due to high capital demands and execution risks. These factors, along with the broadband subscriber losses, have potential implications on future expectations and profitability.

Over the past year, Comcast's stock underperformed the US Market and Media industry, which returned 5.9% and negative 6.3% respectively. However, over the longer term, its total return, including dividends, was 4.41% over five years. Despite the underperformance in the short term, this long-term context suggests continuous, albeit modest, growth.

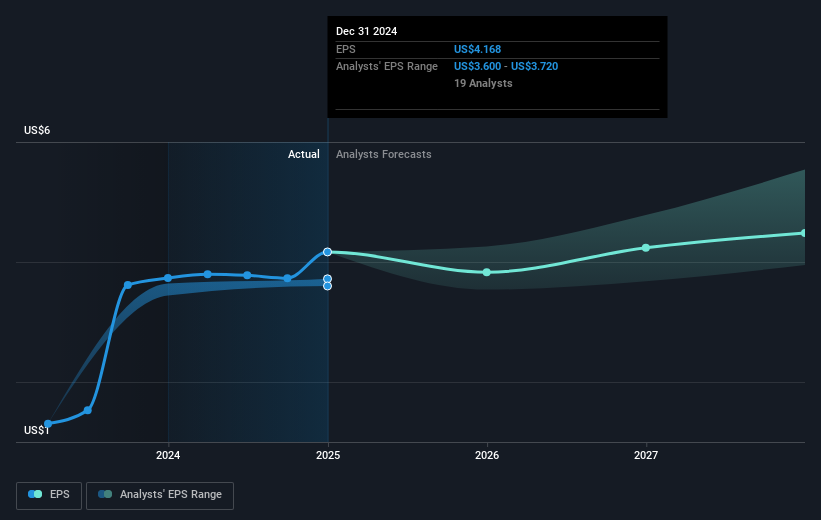

The current share price is trading with a 23.6% discount to the analyst price target, indicating potential growth according to consensus. Analysts are relatively aligned on future prospects, though bearish forecasts suggest revenue may fall by 0.4% annually over the next three years, with earnings potentially declining to US$13.5 billion by April 2028. This movement reflects varying levels of confidence and projections about Comcast's ability to manage competition and execution risks effectively.

Review our historical performance report to gain insights into Comcast's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCSA

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

Intuit Stock: When Financial Software Becomes the Operating System for Small Business

Meta’s Bold Bet on AI Pays Off

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).