- United States

- /

- Media

- /

- NasdaqGS:CHTR

Should You Reconsider Charter Stock After Its 30% Slide and Accelerating Free Cash Flow?

Reviewed by Simply Wall St

If you are holding or eyeing Charter Communications stock right now, you are probably wondering if this is a moment of opportunity or caution. With the market always in flux, CHTR has certainly kept investors on their toes over the past year. After peaking, the share price has come back down significantly, sitting at $267.01 at the latest close. Over the last month, the stock slid by about 30%. The drop over a full year is even more striking, with a total return of -23%. It is not all gloom, though. While some might see heavy declines, others might spot a market overreaction or a stock that has grown undervalued.

One of the key things to watch is how the market’s mood can shift quickly. Just look at Charter’s five-year return, down more than 56 percent, suggesting years of skepticism. Yet, recently, even small positive developments have pushed the price up by over 1 percent in a single day or nearly 1.5 percent in the past week. This tells us the market is paying close attention and that investor sentiment could be changing, possibly on news of performance improvement or strategic shifts.

Now for a number that stands out if you are a value-focused investor: Charter’s current valuation score is 5 out of 6. This means the company is undervalued in five major assessment categories. That rare kind of score is bound to catch the eye of investors hunting for bargains. In the next section, we will walk through each of the valuation approaches individually to see exactly what is driving that high score. Stick around, because at the end, we will talk about one method that might give you an even clearer edge as you gauge Charter’s true value.

Charter Communications delivered -23.1% returns over the last year. See how this stacks up to the rest of the Media industry.Approach 1: Charter Communications Cash Flows

The Discounted Cash Flow (DCF) model is a classic valuation approach that estimates a company's worth by forecasting its future cash flows and then discounting them back to reflect today's value. The idea is to answer this: what is Charter Communications worth now, based on how much cash it is expected to generate in the years ahead?

Currently, Charter Communications is producing $4.1 billion in Free Cash Flow. Analysts expect this figure to grow year after year, reaching approximately $13.9 billion by 2035. The model projects Free Cash Flow steadily climbing, with notable year-on-year increases along the way.

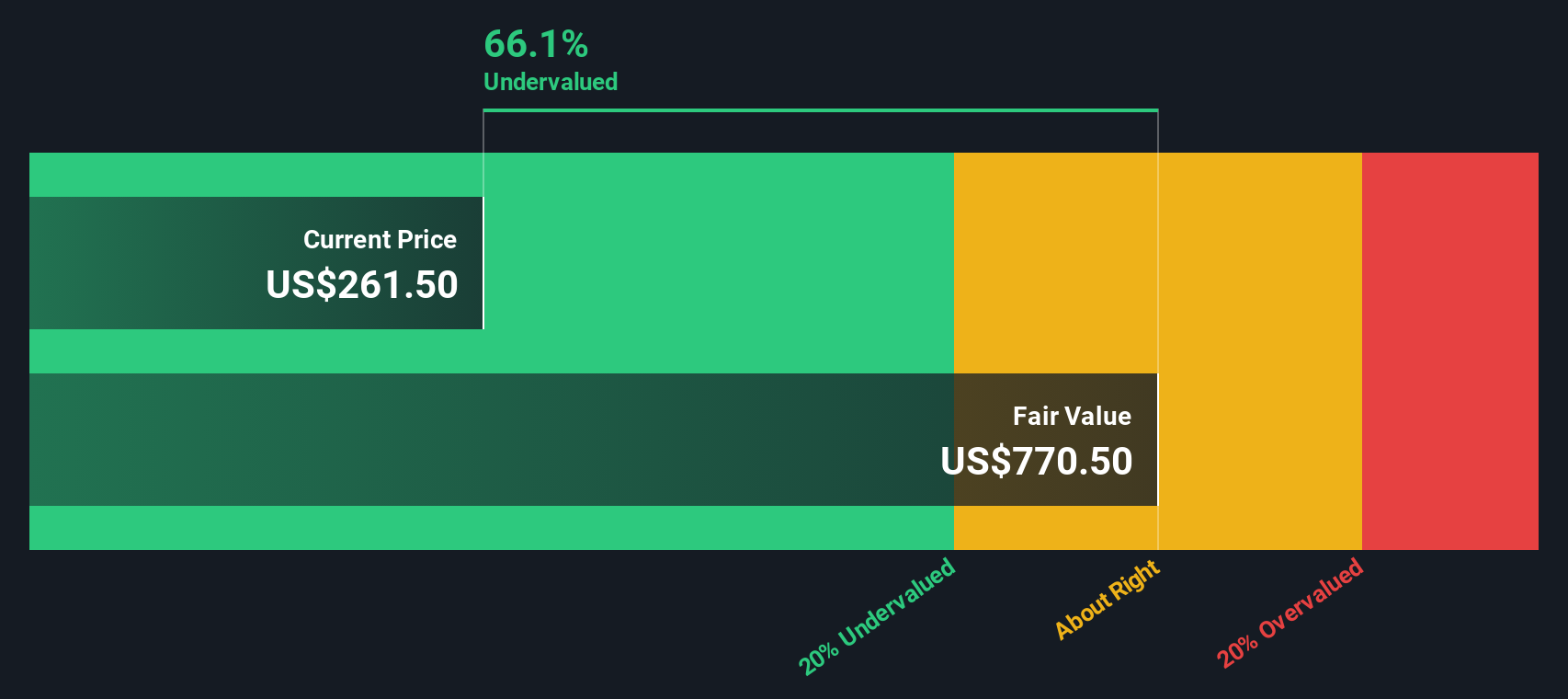

When Charter’s future cash flows are totaled and discounted back to the present, the result is an intrinsic value of about $826.61 per share. This compares to a recent share price of $267.01.

According to the DCF calculation, Charter stock appears to be around 67.7% undervalued. In other words, the shares would have to nearly triple to reach their fair value based on these projections. For value-minded investors, this may indicate that the market is overlooking certain factors.

Result: UNDERVALUED

Approach 2: Charter Communications Price vs Earnings

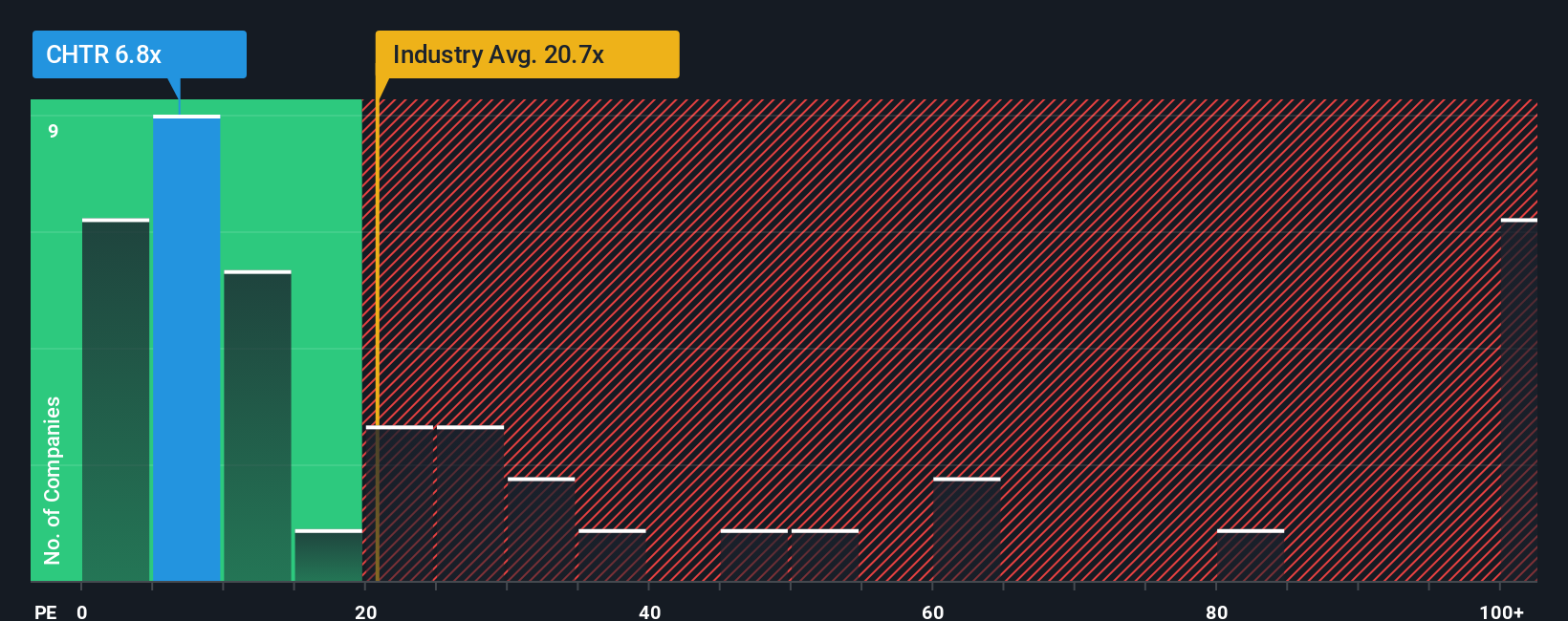

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for companies that consistently generate profits like Charter Communications. The PE ratio helps investors quickly compare how much the market is willing to pay today for a dollar of earnings, which is especially meaningful for established businesses with visible track records.

What counts as a “normal” PE ratio can vary based on growth expectations and risks. Companies expected to grow earnings quickly, or those perceived as safer, tend to command higher PE ratios. In contrast, lower-growth or riskier firms typically trade at lower multiples. Market conditions, industry dynamics, and overall investor sentiment can all influence what investors see as fair.

Currently, Charter trades at a PE ratio of just 6.93x. This stands out when compared to the media industry average of 20.54x and its peer group average of 13.28x. Simply Wall St’s proprietary Fair Ratio, which considers factors such as Charter’s earnings growth, margins, industry environment, and risk profile, is 19.35x. This means Charter’s current multiple is well below what would typically be justified by its business fundamentals.

With the Fair Ratio sitting far above the company’s actual PE, Charter Communications appears undervalued when viewed through this lens.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Charter Communications Narrative

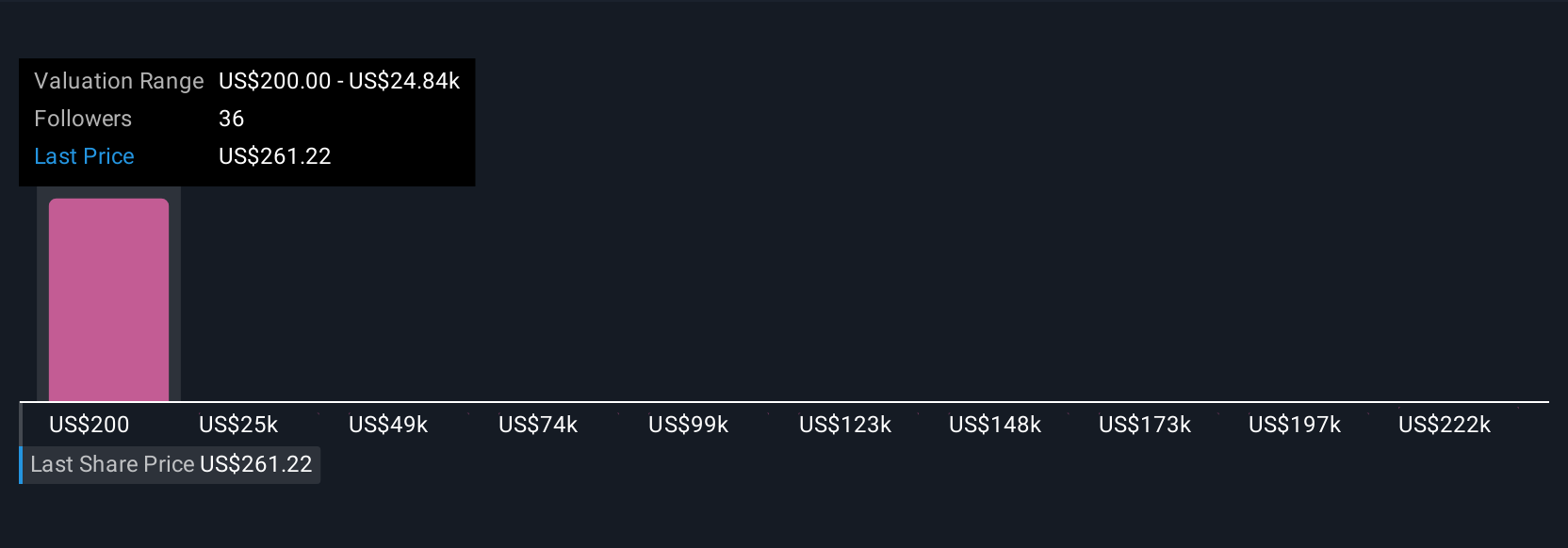

While traditional valuation models like PE ratios are useful, many investors are turning to “Narratives,” a way of telling the company’s story using the numbers behind the scenes. A Narrative connects your perspective on Charter Communications to real financial forecasts and, ultimately, to your estimate of fair value. With Narratives on Simply Wall St, you can easily set your own assumptions about revenue, earnings, and profit margins, see how they shape fair value, and share or compare your story with millions of other investors in the community.

This approach helps you decide when to buy, hold, or sell, by seeing how your fair value compares to the latest share price. Best of all, Narratives update dynamically as new facts come in, such as company news or earnings releases, so your analysis keeps pace with reality. For instance, you may see one investor anticipating Charter’s fair value as high as $500.00 based on bullish growth and strategic improvements, while a more cautious peer values it as low as $230.00 due to concerns about debt and competition. Narratives let you explore these perspectives, refine your own, and invest with confidence.

Do you think there's more to the story for Charter Communications? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHTR

Charter Communications

Operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives