- United States

- /

- Media

- /

- NasdaqGS:CHTR

Charter Communications (NasdaqGS:CHTR) Engages In M&A Discussions With Cox Communications

Reviewed by Simply Wall St

Charter Communications (NasdaqGS:CHTR) recently held discussions regarding a potential merger with Cox Communications, which could result in strategic advantages and growth opportunities for the company. Over the past month, Charter Communications' stock rose 22%, a significant move compared to broader market trends, including a 4.5% rise in the S&P 500. The company's positive earnings report with increased sales and net income, along with news of share buybacks and board changes, likely added momentum to this upward price movement. Economic indicators supporting the U.S. market's sound footing further buoyed investor sentiment, contributing to the company's impressive performance.

Charter Communications has 1 warning sign we think you should know about.

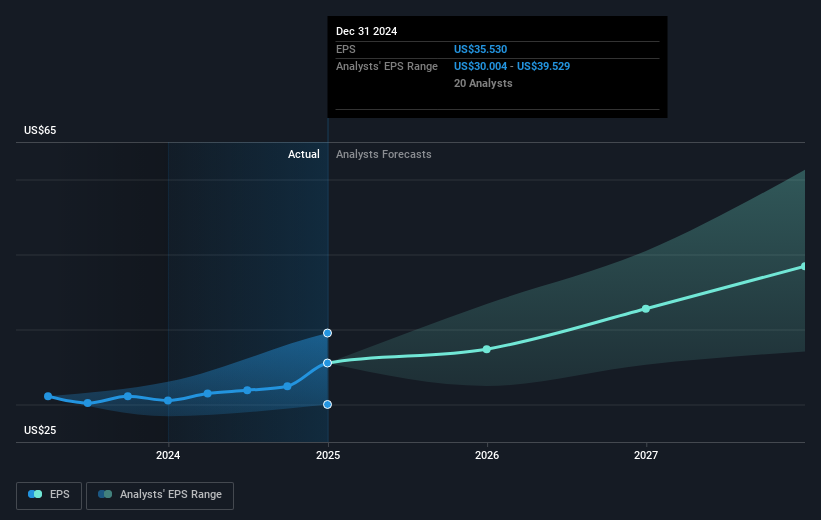

Charter Communications' recent discussions regarding a possible merger with Cox Communications could enhance its growth potential and drive future revenues. The expansion in Spectrum Mobile and upgrades in high-speed internet offerings have already started contributing to this narrative, with revenue currently at US$55.14 billion and earnings at US$5.19 billion. The company's emphasis on AI efficiencies and bundling strategies is expected to bolster customer satisfaction and retention, directly affecting revenue and earnings growth forecasts. Analysts project earnings to reach US$6 billion by 2028, while possible risks like advertising volatility and high debt levels could challenge these positive projections.

Over the past year, Charter Communications achieved a total shareholder return of 51.17%. This impressive performance dwarfs the 10.6% return of the broader US market, indicating a strong recovery in shareholder value. Over the longer term, the company's share price movements show resilience and a positive trajectory against industry benchmarks.

In terms of share price dynamics, Charter's current price is approximately US$402.01, which is close to the analysts' consensus price target of US$411.92, showing a minor 2.4% appreciation potential from here. This suggests that most of the prospects have been incorporated into the current valuation. Nevertheless, the assumed growth in revenue, earnings, and strategic benefits from potential mergers could be yet to fully reflect, offering a cushion for potential price recalibration.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHTR

Charter Communications

Operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives