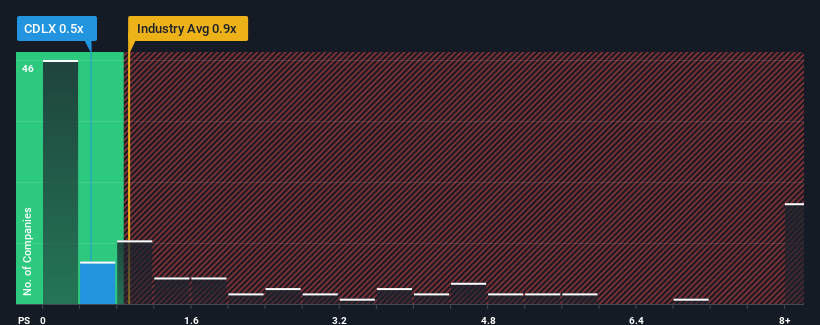

It's not a stretch to say that Cardlytics, Inc.'s (NASDAQ:CDLX) price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" for companies in the Media industry in the United States, where the median P/S ratio is around 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Cardlytics

What Does Cardlytics' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Cardlytics' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Cardlytics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Cardlytics' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.0%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 20% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 2.4% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 3.1% each year, which is not materially different.

With this information, we can see why Cardlytics is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A Cardlytics' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Media industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Cardlytics you should know about.

If you're unsure about the strength of Cardlytics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CDLX

Cardlytics

Operates an advertising platform in the United States and the United Kingdom.

Very undervalued with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)