- United States

- /

- Media

- /

- NasdaqGM:CDLX

Cardlytics, Inc.'s (NASDAQ:CDLX) 29% Share Price Plunge Could Signal Some Risk

Unfortunately for some shareholders, the Cardlytics, Inc. (NASDAQ:CDLX) share price has dived 29% in the last thirty days, prolonging recent pain. Still, a bad month hasn't completely ruined the past year with the stock gaining 32%, which is great even in a bull market.

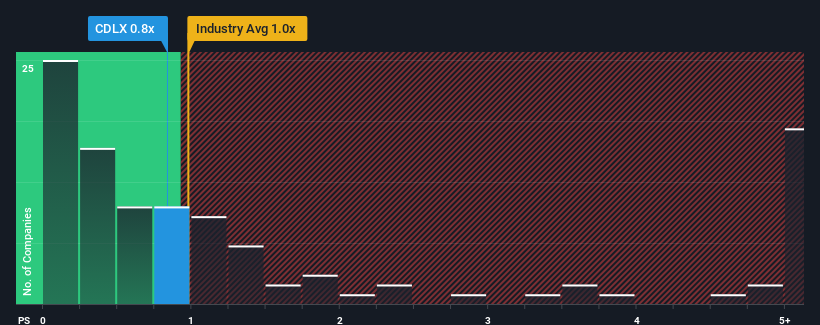

Although its price has dipped substantially, it's still not a stretch to say that Cardlytics' price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Media industry in the United States, where the median P/S ratio is around 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Cardlytics

What Does Cardlytics' Recent Performance Look Like?

Cardlytics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Cardlytics will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Cardlytics would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 1.2% decrease to the company's top line. Still, the latest three year period has seen an excellent 60% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 5.4% over the next year. With the industry predicted to deliver 30% growth, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Cardlytics' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Cardlytics' P/S?

With its share price dropping off a cliff, the P/S for Cardlytics looks to be in line with the rest of the Media industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given that Cardlytics' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Cardlytics (at least 1 which is significant), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CDLX

Cardlytics

Operates an advertising platform in the United States and the United Kingdom.

Very undervalued with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)