- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:QNST

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it is up 24% over the past year with earnings forecast to grow by 15% annually. In this environment, identifying high growth tech stocks can be pivotal for investors looking to capitalize on innovation and robust earnings potential.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.36% | 24.28% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Bitdeer Technologies Group | 51.06% | 122.94% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.37% | 56.70% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kanzhun (NasdaqGS:BZ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kanzhun Limited, with a market cap of $6.41 billion, operates in the People's Republic of China offering online recruitment services through its subsidiaries.

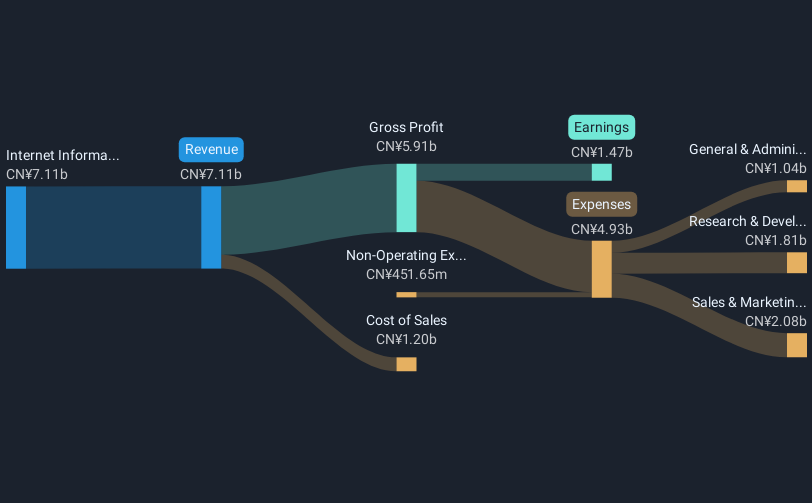

Operations: Kanzhun Limited generates revenue primarily from its online recruitment services, reporting CN¥7.11 billion from this segment. The company operates within the Internet Information Providers sector in China.

Kanzhun Limited has demonstrated robust financial health, with a significant 151.4% earnings growth over the past year, outpacing the Interactive Media and Services industry's average of 11.6%. This growth trajectory is supported by high-quality earnings and a positive free cash flow status. The company's strategic R&D investments are evident in its consistent innovation and competitive edge in the tech sector, although specific R&D expenditure figures are not provided. Looking ahead, Kanzhun is expected to maintain strong momentum with forecasted annual revenue and earnings growth rates of 11.5% and 25%, respectively—both figures surpassing broader market averages. This performance highlights Kanzhun’s potential resilience and adaptability in a dynamic technological landscape.

- Click to explore a detailed breakdown of our findings in Kanzhun's health report.

Assess Kanzhun's past performance with our detailed historical performance reports.

Halozyme Therapeutics (NasdaqGS:HALO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Halozyme Therapeutics, Inc. is a biopharma technology platform company that focuses on researching, developing, and commercializing proprietary enzymes and devices globally, with a market cap of $7.10 billion.

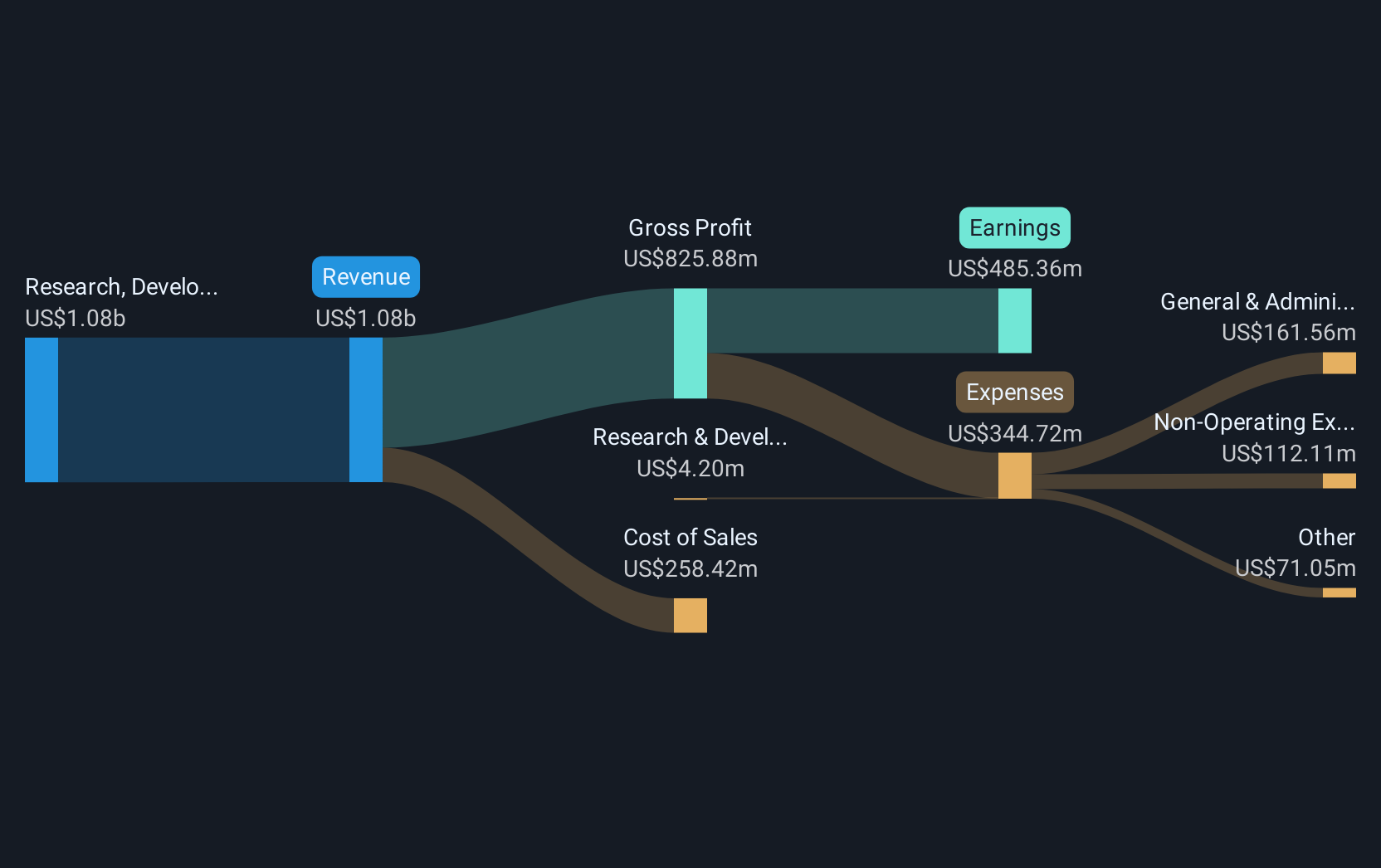

Operations: Halozyme generates revenue primarily through the research, development, and commercialization of proprietary enzymes, with this segment contributing $947.36 million.

Halozyme Therapeutics recently raised its 2025 earnings guidance, reflecting robust growth driven by increased royalty revenues and product sales from XYOSTED. This adjustment forecasts a revenue surge to between $1.15 billion and $1.225 billion—a significant leap from earlier projections. The company's strategic use of its ENHANZE® drug delivery technology has not only facilitated new product approvals but also enhanced its market positioning in therapeutic administration, as evidenced by recent approvals in Japan for HYQVIA® and VYVDURA. These developments underscore Halozyme's ability to innovate within biopharmaceutical delivery, potentially setting the stage for sustained growth in a competitive landscape.

- Click here to discover the nuances of Halozyme Therapeutics with our detailed analytical health report.

Evaluate Halozyme Therapeutics' historical performance by accessing our past performance report.

QuinStreet (NasdaqGS:QNST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: QuinStreet, Inc. is an online performance marketing company that offers customer acquisition services for clients both in the United States and internationally, with a market cap of $1.33 billion.

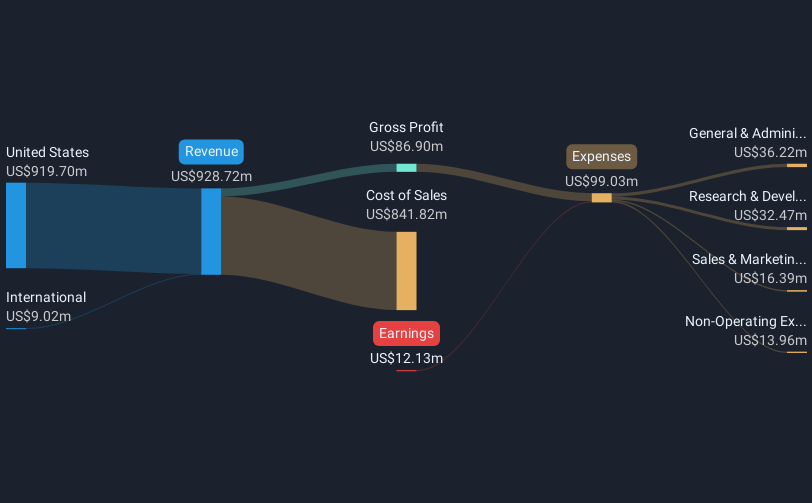

Operations: The company generates revenue primarily from direct marketing, amounting to $768.81 million.

QuinStreet's recent performance and strategic endeavors paint a mixed yet promising picture for its future in the tech sector. Despite reporting a net loss of $1.37 million in Q1 2025, this marks a significant improvement from the previous year's $10.57 million loss, underscoring effective cost management and operational adjustments. The company has also demonstrated commitment to shareholder value through its buyback program, successfully repurchasing shares worth $23.14 million. Furthermore, QuinStreet's participation in key industry conferences such as the Stephens Annual Investment Conference highlights its proactive approach to stakeholder engagement and market presence enhancement. With an expected revenue growth rate of 16.3% per year, QuinStreet is strategically positioned to capitalize on market opportunities despite current unprofitability, setting a foundation for potential future profitability and growth within the competitive tech landscape.

Taking Advantage

- Dive into all 231 of the US High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuinStreet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QNST

QuinStreet

An online performance marketing company, provides customer acquisition services for its clients in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives