- United States

- /

- Semiconductors

- /

- NYSE:JKS

3 US Growth Stocks With High Insider Ownership Projecting Up To 68% Earnings Growth

Reviewed by Simply Wall St

As the U.S. stock market looks to rebound from a recent end-of-year slump, major indices like the Nasdaq and S&P 500 have still managed to post significant gains for the year. In this environment, growth companies with high insider ownership can be particularly appealing as they often align management interests with shareholder value, potentially fostering robust earnings growth even amid fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 34.7% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| OS Therapies (NYSEAM:OSTX) | 17.6% | 14.7% |

Here we highlight a subset of our preferred stocks from the screener.

Kanzhun (NasdaqGS:BZ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kanzhun Limited, along with its subsidiaries, offers online recruitment services in the People's Republic of China and has a market cap of approximately $6.03 billion.

Operations: The company's revenue primarily stems from its Internet Information Providers segment, generating CN¥7.11 billion.

Insider Ownership: 16.3%

Earnings Growth Forecast: 25.3% p.a.

Kanzhun exhibits strong growth potential with earnings forecasted to grow significantly at 25.3% annually, outpacing the US market's 15.3%. Recent third-quarter results showed revenue of CNY 1.91 billion and net income of CNY 468.37 million, indicating robust year-on-year growth. Despite trading at a discount to its estimated fair value, insider activity over the past three months has been minimal. The company completed a share buyback worth US$200 million, enhancing shareholder value amidst steady revenue expansion expectations in China.

- Click here to discover the nuances of Kanzhun with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Kanzhun is trading beyond its estimated value.

Cadre Holdings (NYSE:CDRE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cadre Holdings, Inc. manufactures and distributes safety equipment for protection in hazardous situations both in the United States and internationally, with a market cap of approximately $1.30 billion.

Operations: The company's revenue segments consist of $449.48 million from Product and $99.39 million from Distribution.

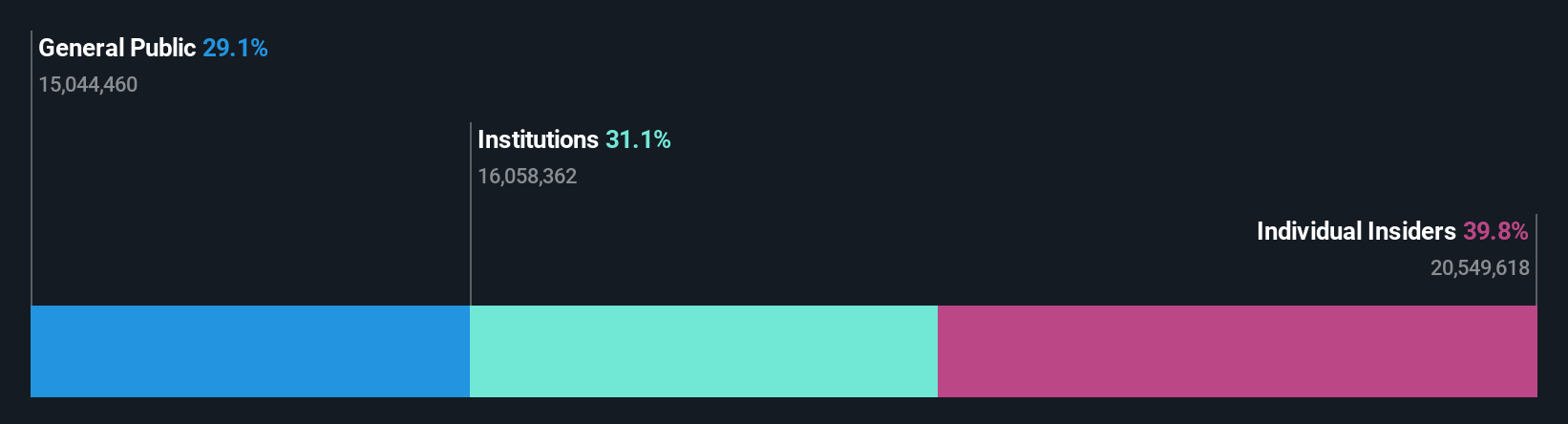

Insider Ownership: 34.1%

Earnings Growth Forecast: 27.4% p.a.

Cadre Holdings is poised for strong growth, with earnings expected to rise significantly at 27.4% annually, surpassing the US market's 15.3%. Despite recent insider selling and past shareholder dilution, the company trades at a substantial discount to its estimated fair value. Recent financing arrangements provide up to US$590 million in credit facilities, bolstering capital for growth initiatives and acquisitions. Third-quarter revenue was US$109.41 million with net income of US$3.66 million amidst evolving corporate strategies.

- Dive into the specifics of Cadre Holdings here with our thorough growth forecast report.

- According our valuation report, there's an indication that Cadre Holdings' share price might be on the cheaper side.

JinkoSolar Holding (NYSE:JKS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JinkoSolar Holding Co., Ltd. is involved in the design, development, production, and marketing of photovoltaic products and has a market cap of approximately $1.34 billion.

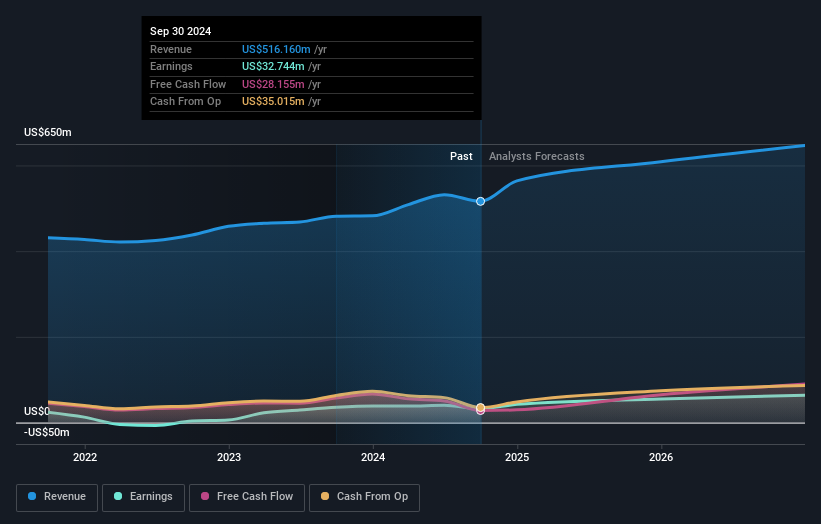

Operations: The company generates its revenue primarily from its manufacturing segment, which accounts for CN¥104.44 billion.

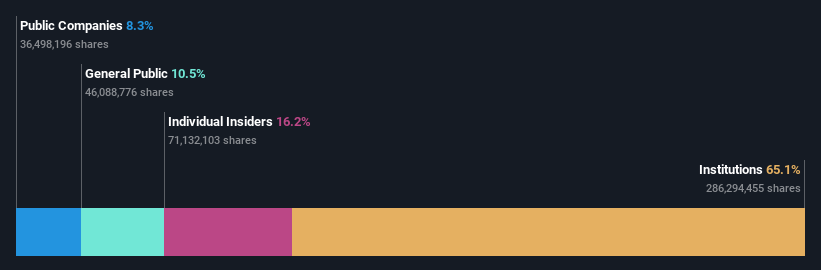

Insider Ownership: 37.4%

Earnings Growth Forecast: 68.4% p.a.

JinkoSolar Holding demonstrates potential for growth with earnings forecasted to increase significantly, outpacing the US market. Despite a decline in profit margins and volatility in share price, the company trades at a substantial discount to its estimated fair value. Recent developments include an expanded $350 million buyback plan and plans to issue up to CNY 4.5 billion in A shares for funding new projects, highlighting strategic financial maneuvers amidst challenging earnings results.

- Take a closer look at JinkoSolar Holding's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, JinkoSolar Holding's share price might be too pessimistic.

Make It Happen

- Access the full spectrum of 201 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade JinkoSolar Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JKS

JinkoSolar Holding

Engages in the design, development, production, and marketing of photovoltaic products.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives