- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

How Bilibili’s December Game Slate and “Trickster's Mischief” Push At Bilibili (BILI) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Earlier this month, Bilibili highlighted plans to distribute 13 new games in December, including the anime-style title “Trickster's Mischief,” developed by South Korea’s EPIDGAMES after its strong reception in the Korean market.

- This push into licensed game distribution underscores Bilibili’s efforts to deepen engagement with its core gaming audience and extend its reach beyond China.

- We’ll now examine how the December slate, especially “Trickster's Mischief,” could influence Bilibili’s investment narrative and long-term growth drivers.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Bilibili Investment Narrative Recap

To own Bilibili, you generally need to believe it can convert strong Gen Z engagement and a growing game and content ecosystem into durable profits, despite heavy competition and regulatory overhang in China. The December launch of 13 new titles, including “Trickster's Mischief,” is relevant for sentiment around near term games revenue concentration, but it does not by itself resolve the execution risk tied to a still limited, hit driven pipeline.

The most relevant recent announcement here is Bilibili’s Q3 2025 results, which showed CN¥7,685.46 million in revenue and a return to profitability with CN¥470.23 million in net income. Against that backdrop, the December game slate looks more like an incremental test of how well Bilibili can broaden its games portfolio and reduce reliance on a few blockbusters as a driver of earnings quality and consistency.

But while the new game launches may help, investors still need to be aware of the ongoing risk that...

Read the full narrative on Bilibili (it's free!)

Bilibili's narrative projects CN¥38.4 billion revenue and CN¥3.4 billion earnings by 2028. This requires 9.3% yearly revenue growth and about a CN¥3.2 billion earnings increase from CN¥220.3 million today.

Uncover how Bilibili's forecasts yield a $29.93 fair value, a 16% upside to its current price.

Exploring Other Perspectives

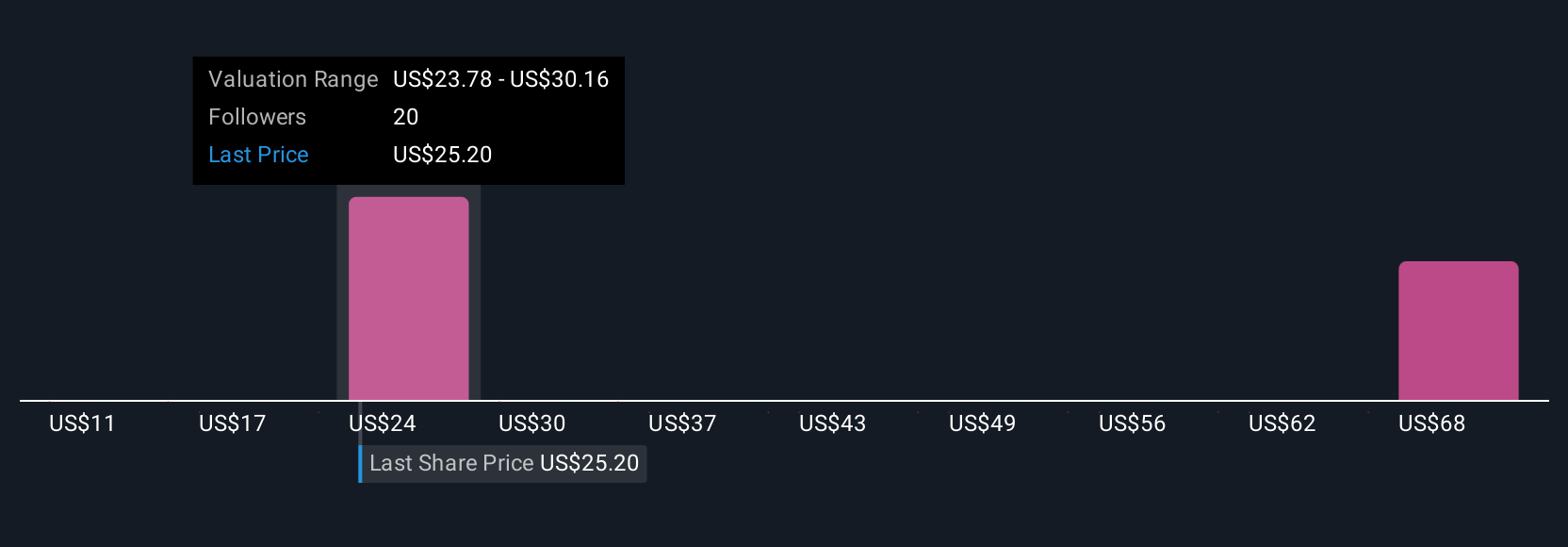

Six members of the Simply Wall St Community currently value Bilibili in a wide band between US$22.18 and US$36.70 per share. Against this backdrop, the concentration risk around blockbuster games and regulatory approvals becomes an important lens for readers who want to compare different views on how sustainable Bilibili’s recent profitability might be.

Explore 6 other fair value estimates on Bilibili - why the stock might be worth as much as 43% more than the current price!

Build Your Own Bilibili Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bilibili research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bilibili research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bilibili's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026