- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

Bilibili (BILI): Sales Climb From CNY 1,007M To CNY 1,612M Year-Over-Year

Reviewed by Simply Wall St

Bilibili (BILI) recently reported significant improvements in its financial performance, with second-quarter sales jumping to CNY 1,612 million from CNY 1,007 million year-over-year, reflecting a turnaround with a net income of CNY 219 million from a net loss the previous year. Additionally, the company actively engaged in its share repurchase program, buying back 5.6 million shares. These financial victories contributed positively against broader market trends, as major indexes like the S&P 500 reached fresh record highs, supported by stable inflation data and hopes for potential rate cuts, aligning with Bilibili's share price increase of 19% last quarter.

We've spotted 1 risk for Bilibili you should be aware of.

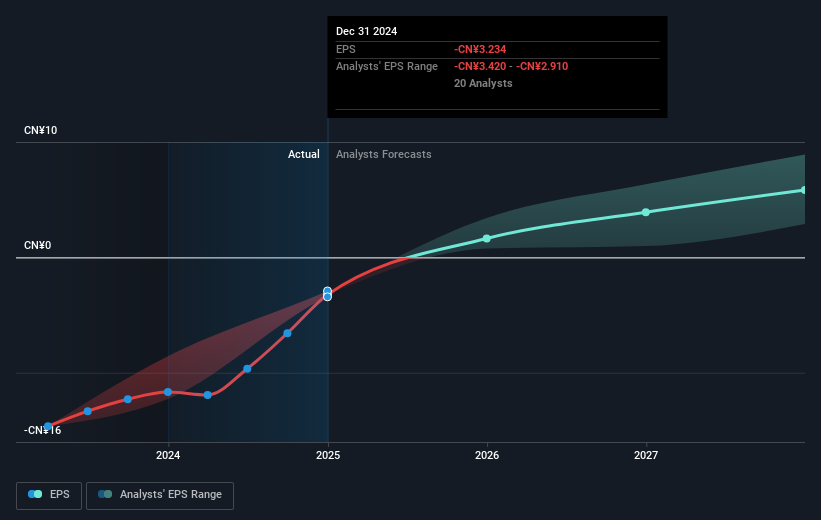

With Bilibili's recent financial improvements and strategic share repurchase program, the company's efforts seem aligned with sustaining long-term growth. The integration of enhanced user engagement and monetization strategies could potentially drive further revenue and earnings growth, supporting the positive turnaround reflected in the net income rise to CNY 219 million from a prior loss. Analysts are projecting an annual revenue growth of 9.3% over the next three years, with margins expected to increase from 0.8% to 8.8%, influenced by factors like AI adoption and strengthened content offerings.

Over the past year, Bilibili's total shareholder return, including share price and dividends, surged by 58.32%. This is a strong performance compared to the broader US Interactive Media and Services industry, which achieved a 55.2% return in the same period. However, compared to the general market, Bilibili's future earnings growth forecasts, at 42.3% per year, are expected to outpace the market's 15.2% annual growth projection. The current share price of $24.75 remains below the analyst consensus price target of $27.79, suggesting a potential upside. Nonetheless, disparities among analyst forecasts suggest differing views on Bilibili's valuation and growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives