- United States

- /

- IT

- /

- NasdaqGM:GDS

3 High Growth Tech Stocks To Watch In The US Market

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it has seen a 10% increase over the past year with earnings forecasted to grow by 15% annually. In this environment, identifying high growth tech stocks that can capitalize on these positive trends involves looking for companies with innovative technologies and strong growth potential.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.14% | 38.20% | ★★★★★★ |

| Circle Internet Group | 30.80% | 60.64% | ★★★★★★ |

| Ardelyx | 21.16% | 61.61% | ★★★★★★ |

| TG Therapeutics | 26.05% | 39.12% | ★★★★★★ |

| AVITA Medical | 27.39% | 61.05% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.97% | 59.24% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 34.90% | 59.91% | ★★★★★★ |

| Caris Life Sciences | 24.80% | 72.64% | ★★★★★★ |

| Lumentum Holdings | 21.30% | 105.07% | ★★★★★★ |

Click here to see the full list of 226 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

GDS Holdings (GDS)

Simply Wall St Growth Rating: ★★★★☆☆

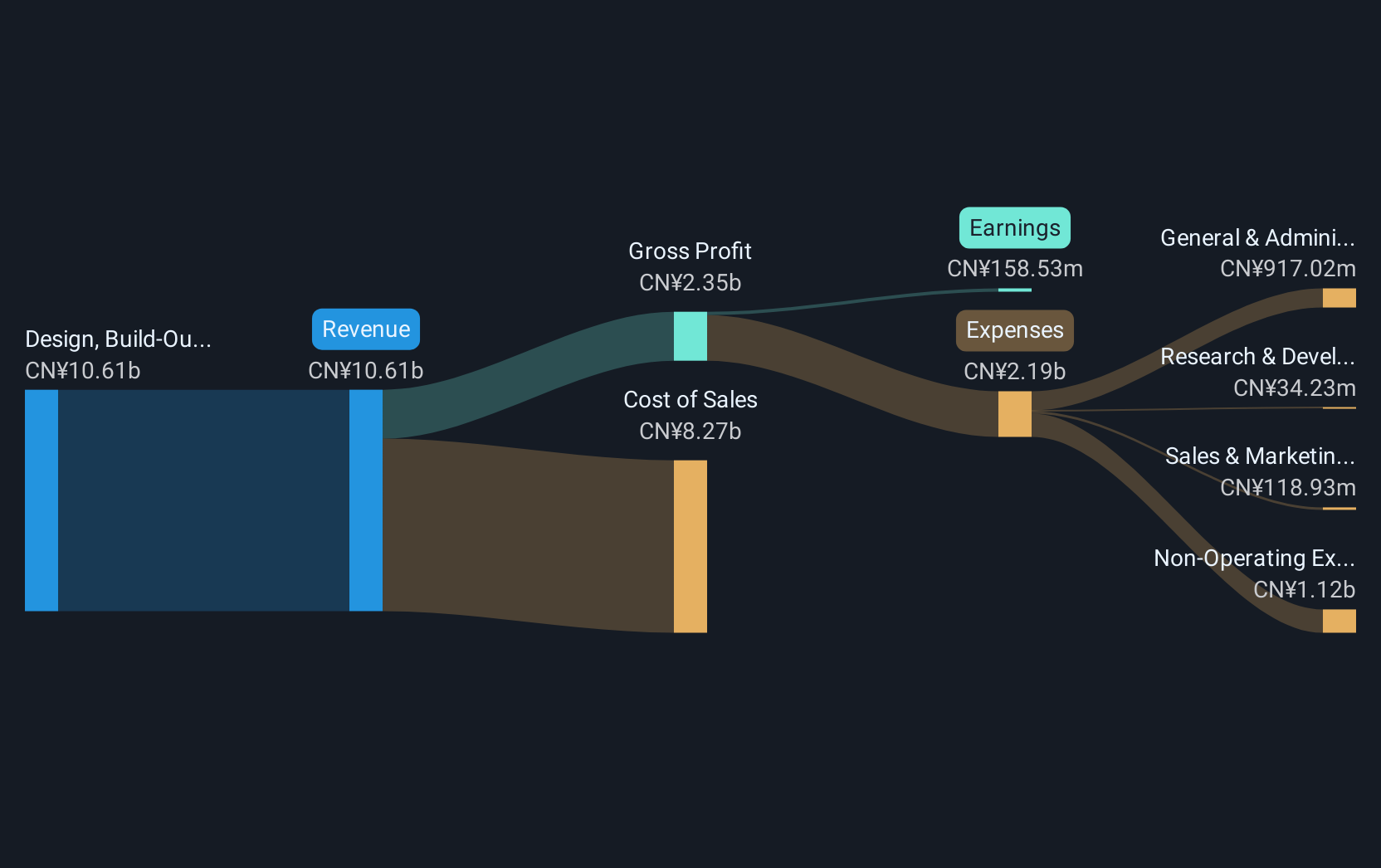

Overview: GDS Holdings Limited, along with its subsidiaries, specializes in the development and operation of data centers in China, with a market capitalization of approximately $7.01 billion.

Operations: GDS focuses on designing, building, and operating data centers in China, generating revenue primarily from these activities. The company's market capitalization stands at approximately $7.01 billion.

GDS Holdings has demonstrated a robust turnaround, posting a net income of CNY 763.02 million for Q1 2025, reversing from a net loss the previous year, with revenue climbing to CNY 2,723.16 million. This performance is underpinned by significant strategic moves including a successful follow-on equity offering raising $147 million and entering the fixed-income market with a $500 million issuance. These financial maneuvers not only bolster its capital structure but also reflect confidence in its operational trajectory, supported by an annual revenue growth forecast of 12.5% and earnings growth predicted at an impressive 37.2%.

- Take a closer look at GDS Holdings' potential here in our health report.

Examine GDS Holdings' past performance report to understand how it has performed in the past.

Bilibili (BILI)

Simply Wall St Growth Rating: ★★★★☆☆

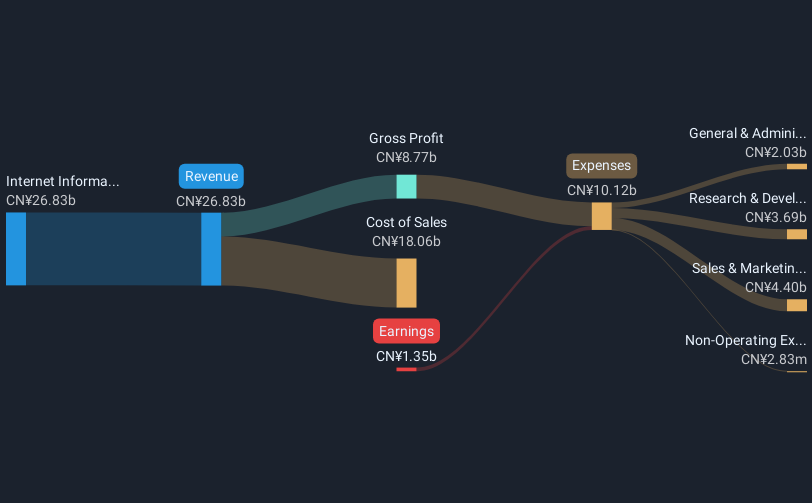

Overview: Bilibili Inc. offers online entertainment services targeting young audiences in China, with a market capitalization of approximately $9.13 billion.

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to CN¥28.17 billion.

Bilibili has recently shown promising signs of growth, with an 8.8% annual revenue increase and a projected earnings surge of 47.22% per year. Despite its current unprofitability, the company's strategic financial activities, including a $600 million fixed-income offering, underscore its robust efforts to stabilize and expand. This move, coupled with the restructuring of its governance committees, reflects a proactive approach to corporate management and investor relations—key indicators that Bilibili is gearing up for future profitability within an evolving tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Bilibili.

Understand Bilibili's track record by examining our Past report.

Shopify (SHOP)

Simply Wall St Growth Rating: ★★★★☆☆

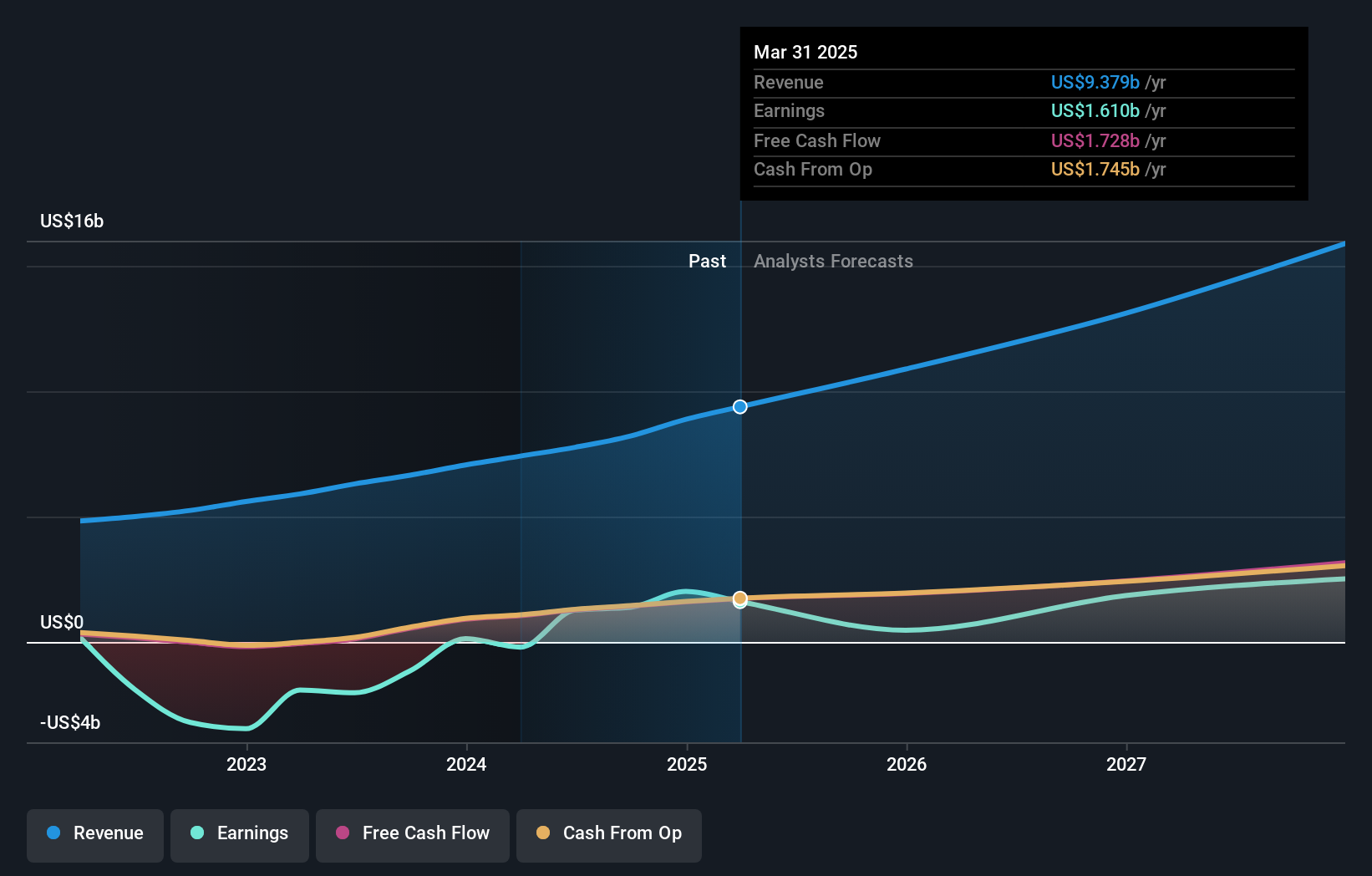

Overview: Shopify Inc. is a commerce technology company that offers tools for businesses of all sizes to start, scale, market, and operate across various regions globally, with a market cap of $151.46 billion.

Operations: Shopify generates revenue primarily through its Internet Software & Services segment, which reported $9.38 billion. The company provides a comprehensive suite of tools to help businesses operate across multiple regions, including Canada, the United States, and various international markets.

Shopify, amid a dynamic tech landscape, has demonstrated a robust commitment to innovation and market expansion. The company's recent integration with ai12z not only enhances eCommerce capabilities through real-time data connectivity but also positions Shopify at the forefront of AI-driven commerce solutions. This strategic move is underscored by a 17.3% annual revenue growth and an ambitious R&D expenditure that bolsters its technological edge. Moreover, Shopify's election of Joe Natale as Director reflects its focus on leadership that can navigate the evolving demands of digital commerce, ensuring it remains competitive in a rapidly changing industry.

Summing It All Up

- Discover the full array of 226 US High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GDS

GDS Holdings

Develops and operates data centers in the People's Republic of China.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives