- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

3 Elite Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

The market in the United States has been relatively stable over the past week, but it has shown a 10% increase over the past year, with earnings projected to grow by 15% annually. In such an environment, stocks that combine robust growth potential with strong insider ownership can be particularly appealing as they often indicate confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 15.4% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| QT Imaging Holdings (QTIH) | 26.7% | 84.5% |

| Prairie Operating (PROP) | 34.6% | 92.4% |

| OS Therapies (OSTX) | 22% | 16.5% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 47% |

| Credo Technology Group Holding (CRDO) | 11.8% | 36.9% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.7% |

| Astera Labs (ALAB) | 13% | 44.4% |

Let's dive into some prime choices out of the screener.

Bilibili (BILI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. offers online entertainment services targeting young generations in China, with a market cap of $9.13 billion.

Operations: The company's revenue from Internet Information Providers amounts to CN¥28.17 billion.

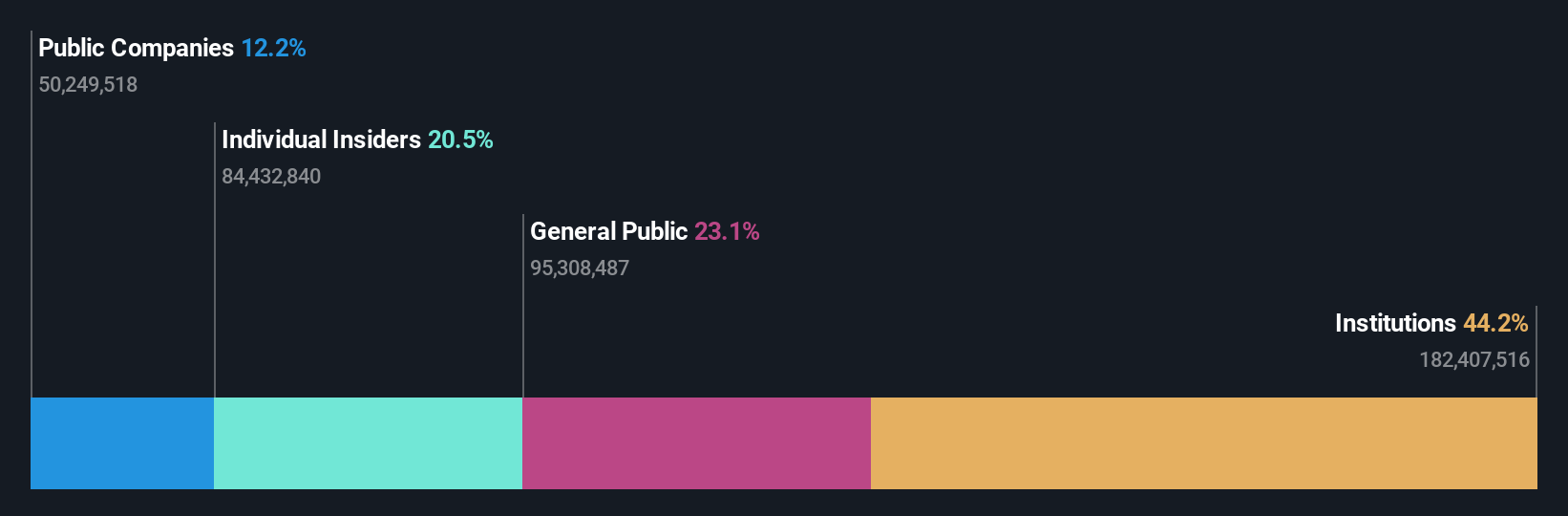

Insider Ownership: 20.6%

Bilibili is positioned for growth with expected annual profit growth above market averages, anticipating profitability within three years. Despite slower revenue growth at 8.8% annually, it outpaces the US market's average. Recently, Bilibili completed $600 million in fixed-income offerings and reported significant improvement in financial performance for Q1 2025, reducing net loss from CNY 748.55 million to CNY 9.1 million year-over-year, reflecting strategic financial management and operational adjustments.

- Click here and access our complete growth analysis report to understand the dynamics of Bilibili.

- The analysis detailed in our Bilibili valuation report hints at an deflated share price compared to its estimated value.

Mach Natural Resources (MNR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mach Natural Resources LP is an independent upstream oil and gas company engaged in acquiring, developing, and producing oil, natural gas, and natural gas liquids reserves in the Anadarko Basin region of Western Oklahoma, Southern Kansas, and the Texas panhandle with a market cap of $1.79 billion.

Operations: The company's revenue primarily comes from its oil and gas exploration and production segment, which generated $941.85 million.

Insider Ownership: 11.6%

Mach Natural Resources is poised for significant growth, with earnings forecast to increase 30.9% annually, surpassing the US market average. Revenue is also expected to grow at a robust 21.6% per year. Recent M&A discussions indicate strategic expansion efforts, yet the dividend yield of 18.46% raises sustainability concerns due to insufficient coverage by earnings or cash flows. Despite past shareholder dilution, analysts predict a potential stock price rise of 51%, suggesting favorable market sentiment.

- Navigate through the intricacies of Mach Natural Resources with our comprehensive analyst estimates report here.

- Our valuation report here indicates Mach Natural Resources may be undervalued.

MNTN (MNTN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MNTN, Inc. is a performance TV software company offering advertising services in the United States, with a market cap of $1.79 billion.

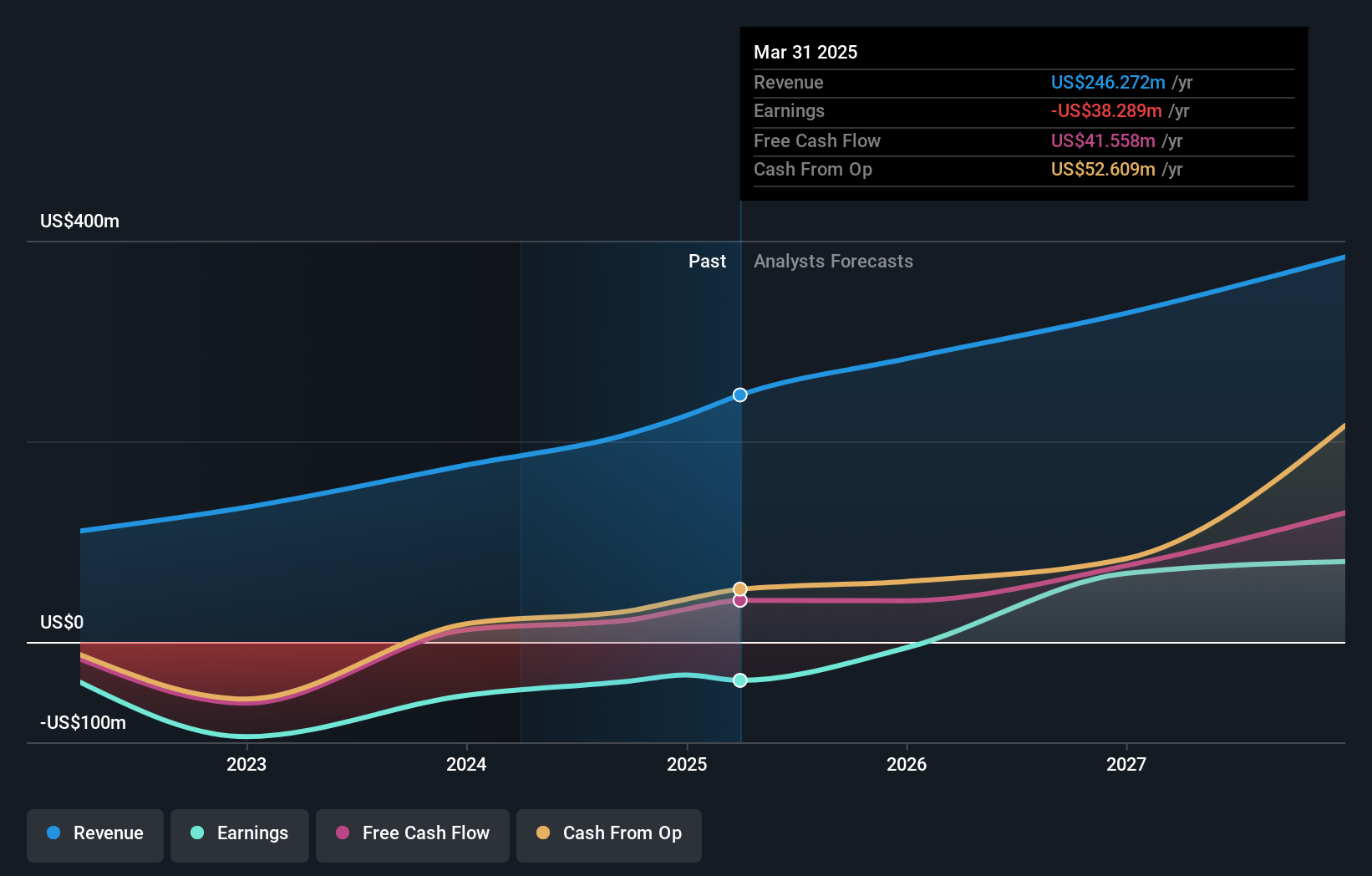

Operations: The company generates revenue from its Internet Software & Services segment, amounting to $246.27 million.

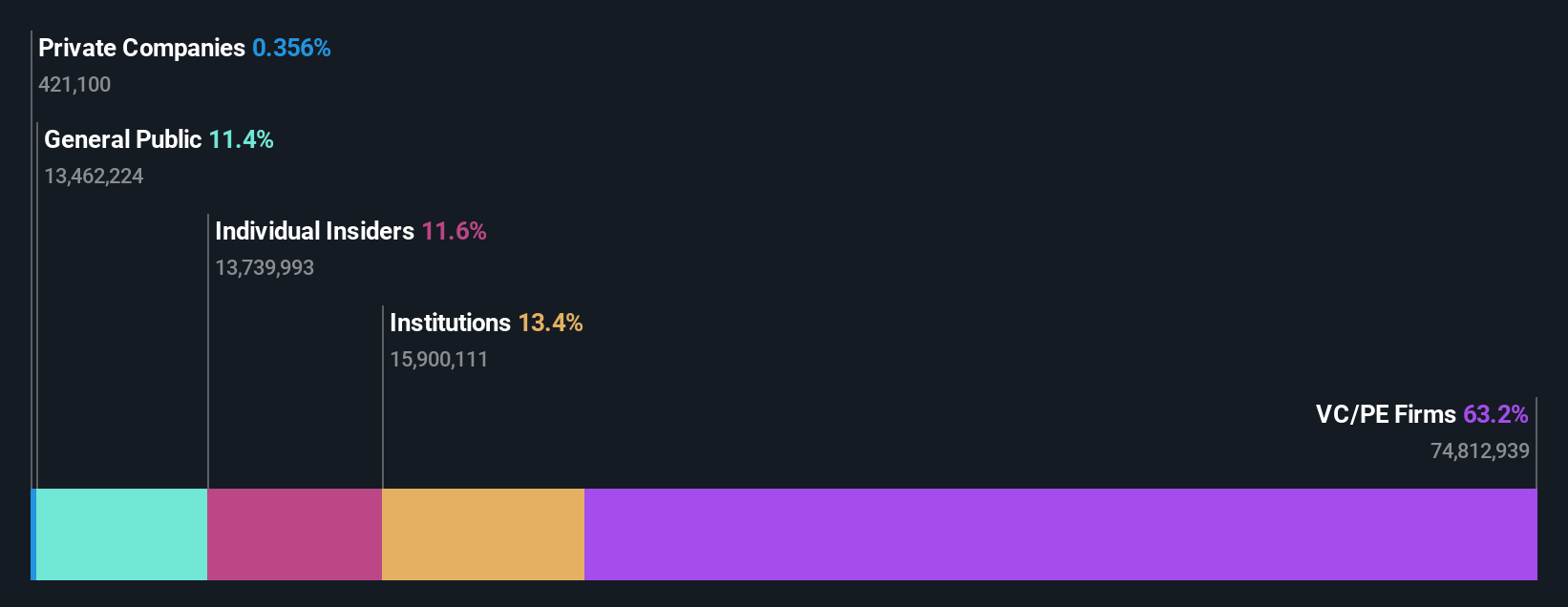

Insider Ownership: 12.5%

MNTN's recent partnership with ZoomInfo opens a $39 billion advertising market, enhancing its growth potential. Despite significant insider selling recently, the company is forecast to become profitable within three years, with high expected earnings growth of 74.53% annually and a very high return on equity projection of 62.3%. Although its revenue growth rate of 14.8% per year is below the desired threshold for rapid expansion, it still outpaces the US market average.

- Click here to discover the nuances of MNTN with our detailed analytical future growth report.

- According our valuation report, there's an indication that MNTN's share price might be on the expensive side.

Make It Happen

- Navigate through the entire inventory of 194 Fast Growing US Companies With High Insider Ownership here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives