- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

Is It Too Late To Consider Baidu After Its 44% 2025 Rally?

Reviewed by Bailey Pemberton

- Investors may be asking whether Baidu at around $119 is still a smart way to gain exposure to China’s AI and search story, or if most of the potential upside is already reflected in the price.

- Despite a choppy week with a 3.7% dip, the stock is still up 2.9% over the last month, 44.3% year to date, and 32.3% over the past year, which highlights how quickly sentiment on Baidu can shift.

- Recently, Baidu has been in the spotlight for its push into generative AI and autonomous driving, as China emphasizes homegrown tech champions. At the same time, shifting expectations around Chinese regulatory pressure and tech spending have added new considerations for how investors think about the company’s long term growth prospects.

- On our valuation checks, Baidu scores just 1/6. This suggests the market might be closer to fair, or even optimistic, on some metrics, even after its longer term 37.6% slide over five years. Next, we will break down how Baidu looks through different valuation lenses and then finish with a more nuanced way to assess whether today’s price makes sense.

Baidu scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Baidu Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today. For Baidu, this is done using a 2 stage Free Cash Flow to Equity approach.

Baidu’s latest twelve month free cash flow is slightly negative at about CN¥13.7 billion, reflecting a period of heavy investment. Analysts then expect a recovery, with free cash flow rising to roughly CN¥20.3 billion by 2028. Beyond the explicit analyst window, Simply Wall St extrapolates cash flows further out, tapering growth over time to reflect a more mature business profile.

When all those projected cash flows are discounted back, the model arrives at an intrinsic value of about $99.82 per share. With the stock trading around $119, the DCF implies Baidu is roughly 19.5% overvalued on this framework. This suggests investors are paying up for future AI and autonomous driving optionality.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Baidu may be overvalued by 19.5%. Discover 910 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Baidu Price vs Earnings

For profitable companies like Baidu, the price to earnings ratio is a useful yardstick because it directly links what investors pay today to the profits the business is generating. In general, faster earnings growth and lower perceived risk justify a higher PE, while slower growth or higher risk should translate into a lower, more conservative multiple.

Baidu currently trades on a PE of about 34.3x, which is more than double the Interactive Media and Services industry average of roughly 16.6x and still below the broader peer group average of around 59.0x. Simply Wall St also calculates a proprietary Fair Ratio of 32.7x, which represents the PE you would expect given Baidu’s earnings growth outlook, profitability, industry, size and risk profile. This Fair Ratio is more tailored than a simple peer or industry comparison because it adjusts for Baidu specific fundamentals rather than assuming one size fits all.

With Baidu’s actual PE only modestly above its 32.7x Fair Ratio, the stock screens as slightly expensive on earnings but not extreme.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Baidu Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which Simply Wall St makes available on the Community page.

A Narrative is your story for a company, where you connect your view of its business, like how Baidu’s AI cloud, chips and robotaxis might play out, to concrete numbers such as future revenue, earnings, margins, and your own estimate of fair value.

In practice, Narratives link three things in a straight line: Baidu’s business story, a financial forecast, and then a Fair Value that you can compare against today’s price to decide whether it looks like a buy, hold or sell.

The tool is designed to be simple and accessible, used by millions of investors on Simply Wall St. It updates dynamically as new information like earnings reports or major AI announcements arrive, so your Baidu Narrative can stay current without you rebuilding a model from scratch.

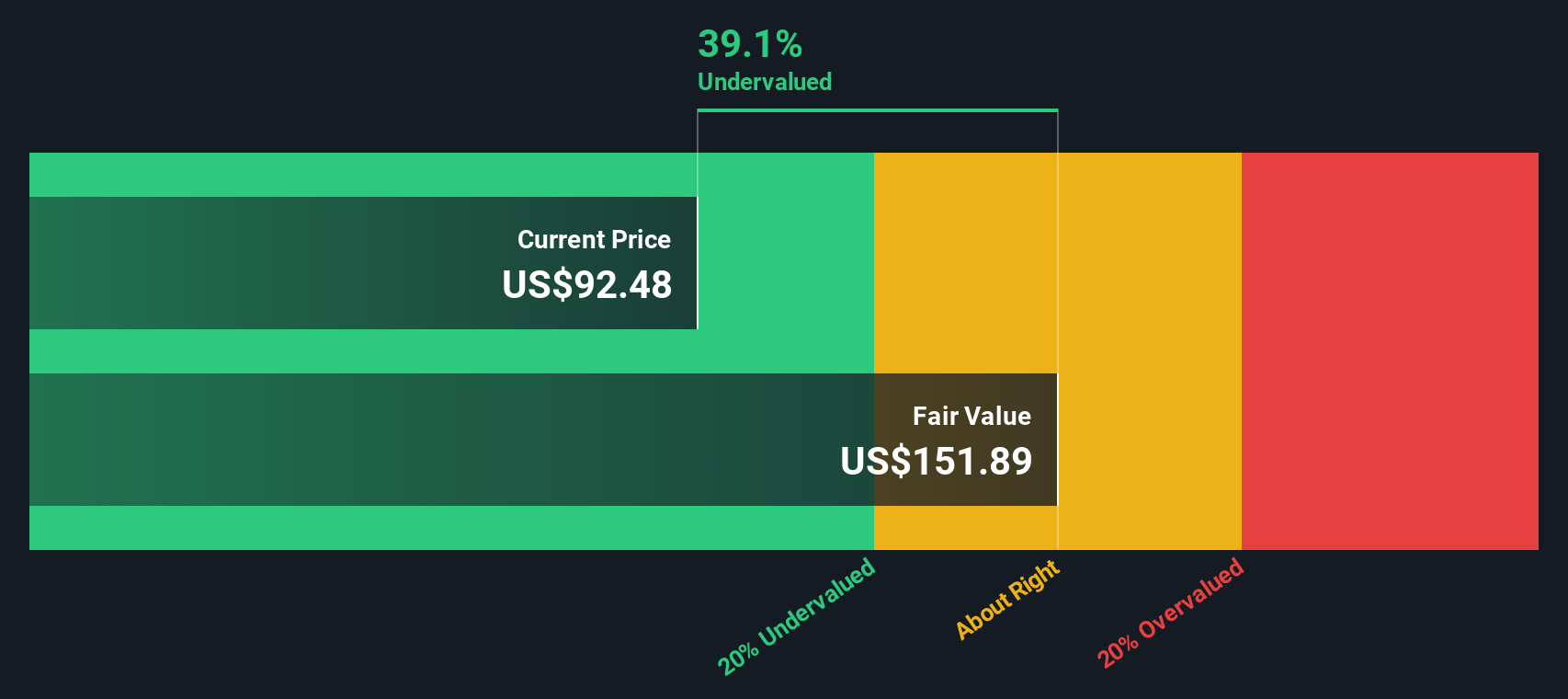

For example, one Baidu Narrative on the platform might assume robust AI driven growth and assign a Fair Value near $152. A more cautious Narrative might only see support for something closer to $71, illustrating how different perspectives on the same facts can lead to very different investment decisions.

Do you think there's more to the story for Baidu? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)