- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

Does Baidu’s Robotaxi Profits Signal a New Opportunity After 45.6% Stock Surge?

Reviewed by Bailey Pemberton

Trying to figure out what to do about Baidu stock? You are definitely not alone. After all, Baidu's last close was $140.23. If you have been watching the charts lately, you have seen some impressive movement, with a 3.6% gain this past week and a staggering 45.6% jump over the last month. Year-to-date, Baidu is up 69.6%. That is not a typo. Over the past year, investors have been rewarded with a 28.4% gain, and even the longer-term numbers are solid, with 14.3% over three years and 10.6% over five years.

Those numbers do not happen in a vacuum. Much of the recent attention centers on Baidu’s expansion efforts in autonomous driving, as their Apollo Go robotaxi operations reached profitability in China and now have their sights set on new markets such as Australia and Southeast Asia. On the financial side, Baidu's move to sell more offshore bonds and its pivot to using homegrown chips for AI are also part of a broader story of innovation and adaptation. Both of these factors can impact how the market values the business.

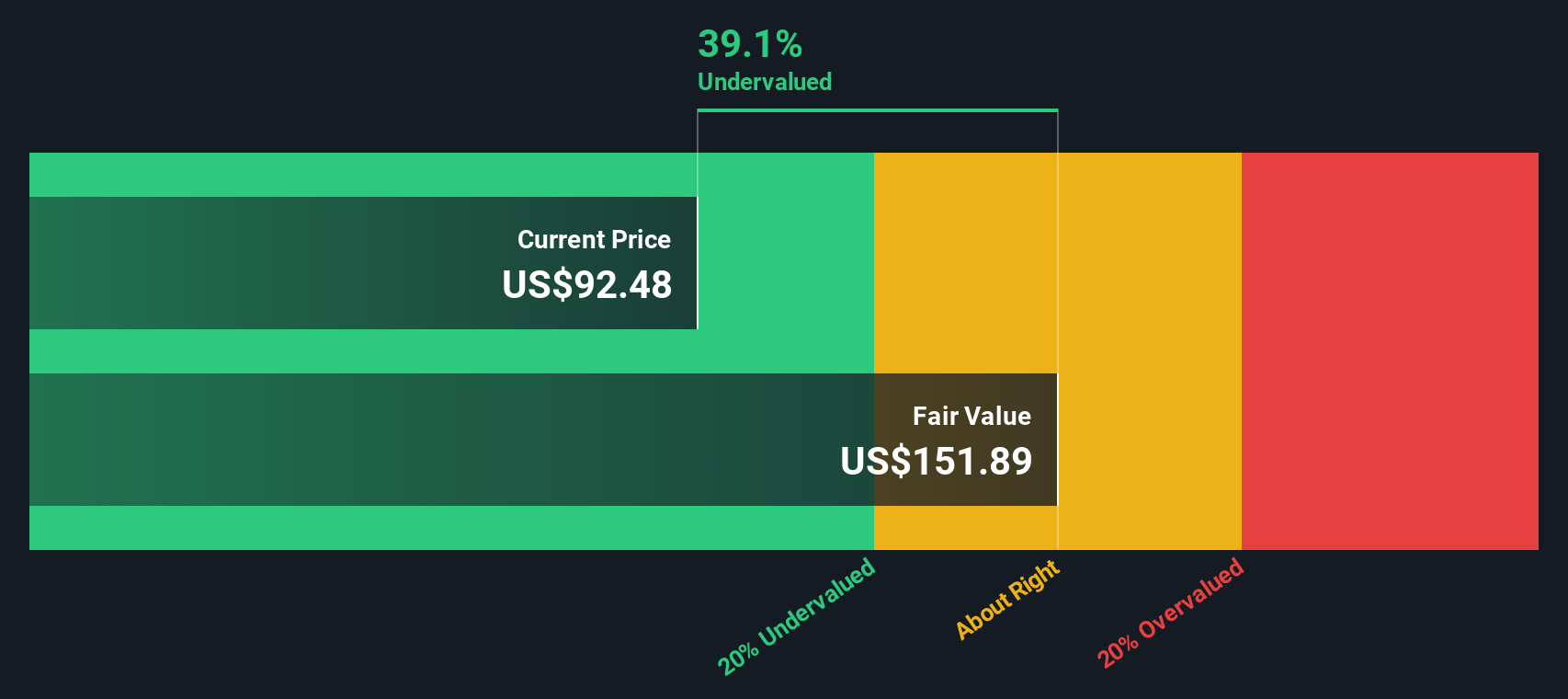

So what is Baidu really worth right now? According to major valuation checks, Baidu is undervalued in 5 out of 6 categories, giving it an impressive value score of 5. That sounds promising, but which valuation methods are telling this undervaluation story, and are they the best tools for understanding the real opportunity here? Next, let’s break down exactly how these valuations stack up, and then explore a smarter way to look at value that could change how you view Baidu going forward.

Why Baidu is lagging behind its peers

Approach 1: Baidu Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting all future cash flows and discounting them back to present value. In Baidu’s case, this model uses a two-stage approach with free cash flow (FCF) estimates available from analysts for the next five years, and further projections extrapolated by Simply Wall St for the years that follow.

Currently, Baidu’s last twelve months of free cash flow sit at a negative CN¥10.4 billion. However, analysts and model projections expect a significant turnaround. By 2028, free cash flow is forecast to reach CN¥27.4 billion, and by 2035, it could climb to over CN¥37.4 billion. Each of these figures represents solid growth in Baidu’s ability to generate cash, which is critical for valuing a technology leader like this.

Based on these cash flow projections, the DCF approach calculates Baidu’s intrinsic value per share as $180.84. This is 22.5% above the current share price of $140.23, suggesting that the stock is meaningfully undervalued according to these assumptions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Baidu is undervalued by 22.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Baidu Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used valuation tool, especially for profitable companies like Baidu. It helps investors understand how much the market is willing to pay for each dollar of current earnings. As companies grow and manage risk, their expected "normal" PE can rise or fall. Higher growth prospects or lower perceived risks often justify a higher PE. On the other hand, slower or riskier companies may deserve a discount.

Baidu’s current PE ratio stands at 12.6x, which is notably lower than the Interactive Media and Services industry average of 17.0x and the average of its direct peers at 20.2x. This suggests that, at first glance, Baidu is trading at a discount compared to both broader industry trends and its competitors.

However, comparing companies using only industry or peer averages can be misleading, as it ignores key differences in earnings growth, profit margins, market cap, and company-specific risks. For this reason, Simply Wall St’s proprietary “Fair Ratio” is useful. The Fair Ratio adjusts for Baidu’s unique fundamentals, estimating what its multiple should be when considering its growth prospects, level of risk, profitability, and how it stacks up within its sector.

For Baidu, the Fair PE Ratio is calculated at 20.1x, which is significantly above its actual PE of 12.6x. This comprehensive perspective suggests that Baidu’s shares are undervalued relative to the risk and growth profile the company actually offers, not just compared to broad benchmarks.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Baidu Narrative

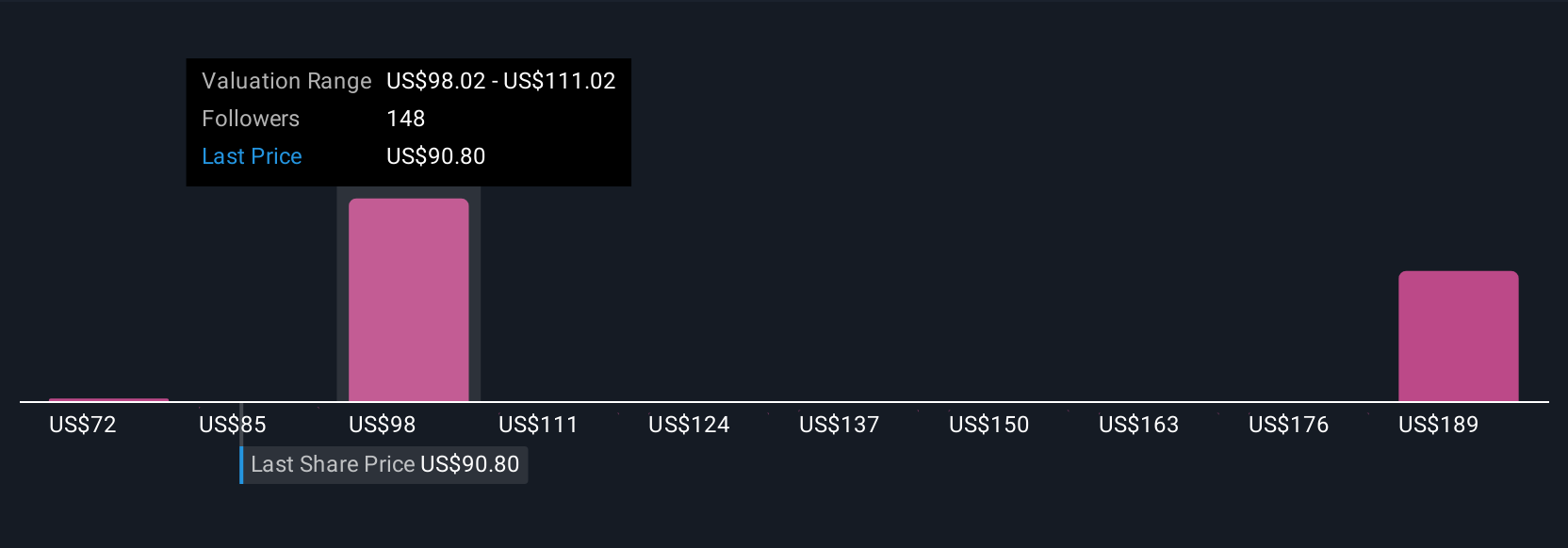

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives—a dynamic and intuitive way to link your investment story directly to a company’s forecast, and then see how that translates into fair value. In simple terms, a Narrative is your perspective on what really matters for a business, letting you connect your beliefs about Baidu’s future (like growth rates, margins, and risks) with your fair value estimate, all in one place.

Instead of relying solely on ratios or analyst consensus, Narratives invite you to tell Baidu’s story as you see it, and instantly compare your fair value to the current market price, making it easier to decide whether to buy, hold, or sell. Narratives are easy to use and accessible to everyone on Simply Wall St’s Community page, where millions of investors are already sharing their views.

Importantly, Narratives update automatically when new information such as fresh earnings reports or news changes the outlook for Baidu, ensuring your investment decisions always reflect the latest facts. For example, the most optimistic Baidu Narratives highlight robust AI and cloud leadership fueling future growth and assign a fair value of $145.76, while more cautious investors, concerned by regulatory risks and rising costs, come up with a much lower fair value near $71.14.

Do you think there's more to the story for Baidu? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives