- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

Can Baidu’s (BIDU) Latest AI Advances Redefine Its Competitive Edge in the Global Market?

Reviewed by Simply Wall St

- At its recent WAVE SUMMIT 2025 developer conference, Baidu unveiled major AI advancements including the ERNIE X1.1 reasoning model, upgrades to its PaddlePaddle deep learning framework, and the open-sourcing of new AI tools for developers and enterprises.

- Among these releases, the ERNIE X1.1 model achieved performance levels comparable to leading global AI models, showcasing Baidu’s increasing competitiveness in advanced artificial intelligence technology.

- We'll explore how ERNIE X1.1's enhanced reasoning and open-source model access could strengthen Baidu's investment case in the evolving AI landscape.

The latest GPUs need a type of rare earth metal called Terbium and there are only 30 companies in the world exploring or producing it. Find the list for free.

Baidu Investment Narrative Recap

To be a Baidu shareholder, you typically must believe that its AI innovation and digital services can offset ongoing pressures in core advertising and drive long-term profitability. The recent WAVE SUMMIT 2025 announcements bolster Baidu's standing in advanced AI but don't materially shift the urgent near-term catalyst: successful monetization of AI-powered search and services. The most significant risk continues to center on delayed or weak monetization of AI products, which could prolong margin and revenue strain.

Among the newly announced AI advancements, the ERNIE X1.1 model stands out for its performance gains and global competitiveness, potentially enhancing Baidu's product value proposition. The model’s deployment across enterprise platforms and open access to developers could support revenue catalysts tied to AI adoption across Baidu’s ecosystem. However, these innovations are not yet reflected in cash flows, so the outlook for improved monetization remains a key focus.

By contrast, investors should keep in mind that ongoing delays in scaling AI monetization could lead to...

Read the full narrative on Baidu (it's free!)

Baidu's outlook anticipates CN¥150.8 billion in revenue and CN¥22.3 billion in earnings by 2028. This is based on a 4.0% annual revenue growth rate and a decrease of CN¥3.1 billion in earnings from the current CN¥25.4 billion.

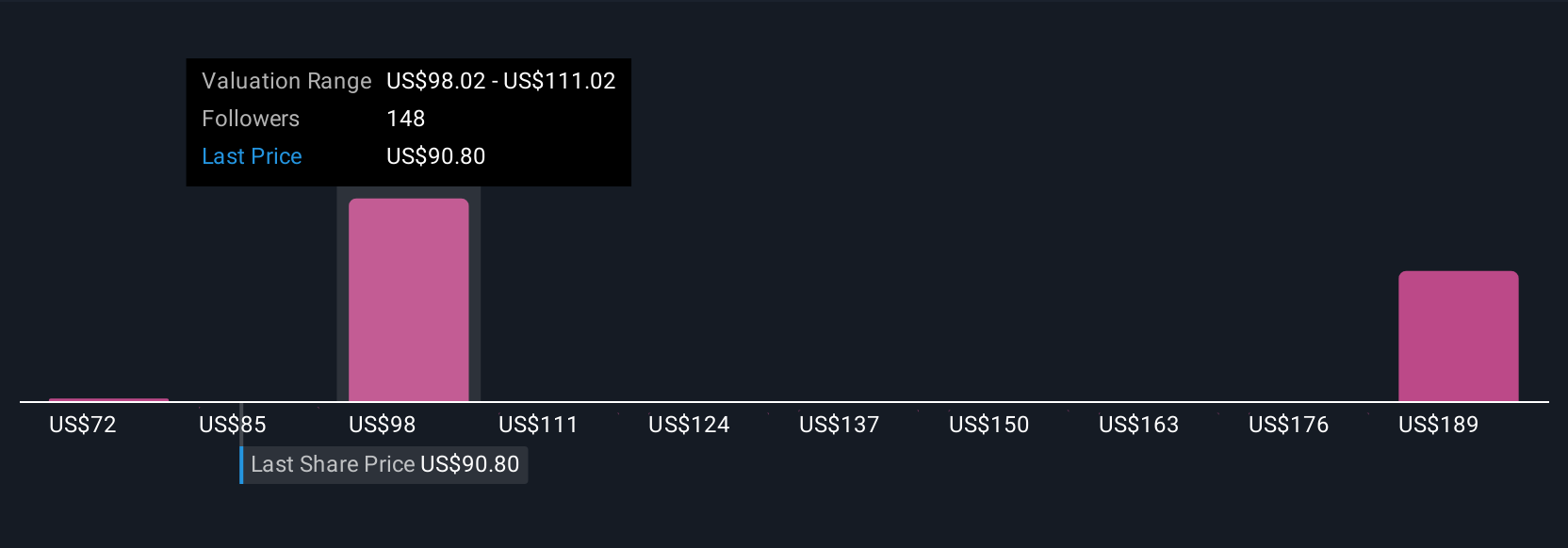

Uncover how Baidu's forecasts yield a $101.76 fair value, a 25% downside to its current price.

Exploring Other Perspectives

Seventeen fair value estimates from the Simply Wall St Community span a wide CNY74.22 to CNY163.98 range. With AI-powered product monetization still an early catalyst, your view on Baidu’s performance could vary significantly from others, explore the full spectrum of opinions for a broader perspective.

Explore 17 other fair value estimates on Baidu - why the stock might be worth as much as 21% more than the current price!

Build Your Own Baidu Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baidu research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Baidu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baidu's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives