- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

Baidu (BIDU) Is Up 9.6% After Unveiling ERNIE X1.1 and Next-Gen AI Models at WAVE SUMMIT

Reviewed by Simply Wall St

- At the recent WAVE SUMMIT 2025, Baidu unveiled significant advancements in artificial intelligence, including the ERNIE X1.1 reasoning model, an upgraded PaddlePaddle framework, a next-generation AI coding assistant, and the open-sourcing of its ERNIE-4.5-21B-A3B-Thinking model.

- These developments have positioned Baidu’s latest AI models to perform on par with global leaders such as GPT-5 and demonstrate the company's rapid progress in core machine learning technology.

- We'll now examine how Baidu's latest leap in AI model performance could influence its long-term AI monetization potential and market leadership narrative.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Baidu Investment Narrative Recap

To consider owning Baidu stock, an investor needs to believe that the company's leadership in advanced AI, now exemplified by its ERNIE X1.1 model, will ultimately unlock large-scale monetization of AI-driven search and cloud services, outweighing the persistent challenges of declining core search revenues and margin pressures. While the advancements announced at WAVE SUMMIT 2025 showcase rapid progress and global competitiveness, they do not meaningfully change the near-term need to deliver tangible gains in AI monetization or address fluctuating margins and free cash flow. Among the announcements, the open-sourcing of Baidu's ERNIE-4.5-21B-A3B-Thinking model is especially relevant, lowering the barriers for AI adoption and cementing Baidu’s role as a foundational technology supplier in China’s emerging AI ecosystem. This move could help drive broader industry uptake and future enterprise demand, supporting one of the stock’s key catalysts: scaling commercial applications for sustained growth. On the other hand, investors should not overlook that continued weakness in monetizing AI-enhanced search and ongoing margin pressures remain critical risks...

Read the full narrative on Baidu (it's free!)

Baidu's outlook forecasts CN¥150.8 billion in revenue and CN¥22.3 billion in earnings by 2028. This is based on a 4.0% annual revenue growth rate, but earnings are expected to decline by CN¥3.1 billion from current earnings of CN¥25.4 billion.

Uncover how Baidu's forecasts yield a $101.76 fair value, a 5% downside to its current price.

Exploring Other Perspectives

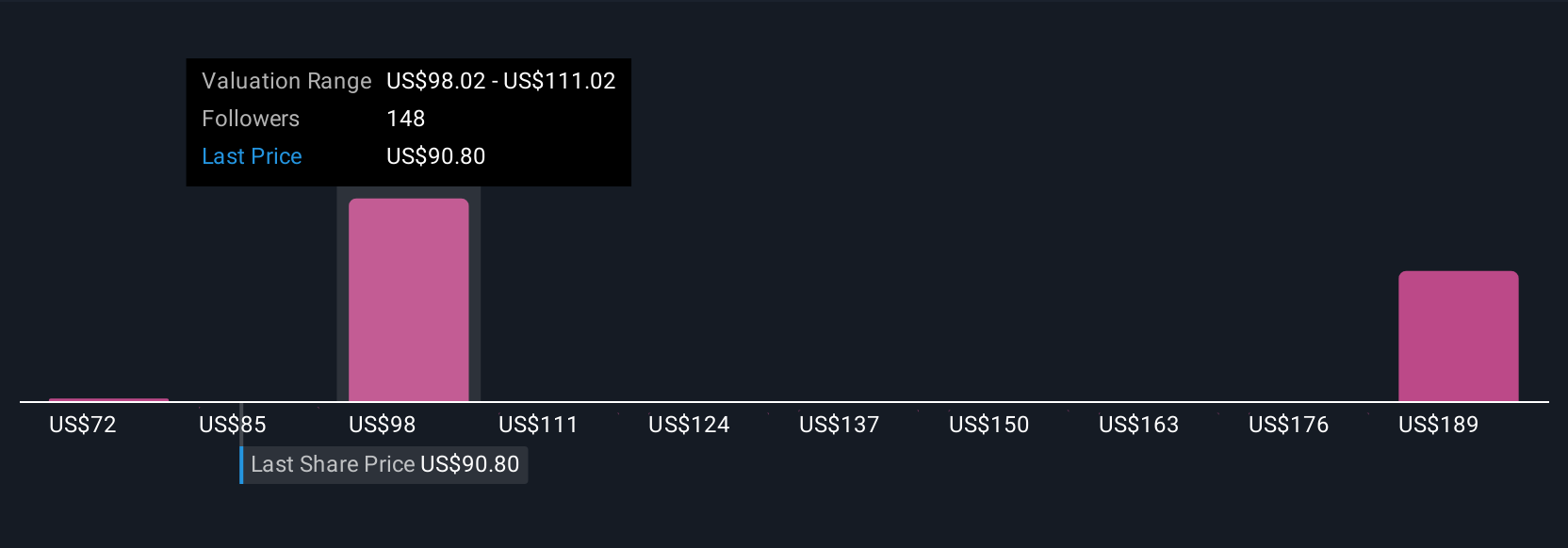

Seventeen private investors in the Simply Wall St Community see Baidu’s fair value in a wide band from CN¥71 to CN¥159. With margin compression still a major risk, these diverse views signal the importance of evaluating multiple scenarios for Baidu’s future performance.

Explore 17 other fair value estimates on Baidu - why the stock might be worth as much as 47% more than the current price!

Build Your Own Baidu Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baidu research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Baidu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baidu's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026