- United States

- /

- Biotech

- /

- NasdaqGS:SLRN

3 US Penny Stocks With Market Caps Over $30M To Watch

Reviewed by Simply Wall St

As U.S. stock markets experience a downturn following disappointing jobs and consumer sentiment reports, investors are reassessing their portfolios amid broader economic uncertainties. In such times, exploring alternative investment opportunities like penny stocks can be intriguing for those looking to diversify beyond established market giants. Although the term "penny stocks" may seem outdated, these smaller or newer companies can still present unique growth potential when backed by strong financial health and strategic positioning.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.88875 | $6.46M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $125.23M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.94 | $89.18M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.71 | $43.29M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.42 | $46.86M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.69 | $46.67M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.41 | $25.01M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8834 | $79.45M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.60 | $384.4M | ★★★★☆☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Angi (NasdaqGS:ANGI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Angi Inc. connects home service professionals with consumers both in the United States and internationally, with a market cap of approximately $875.19 million.

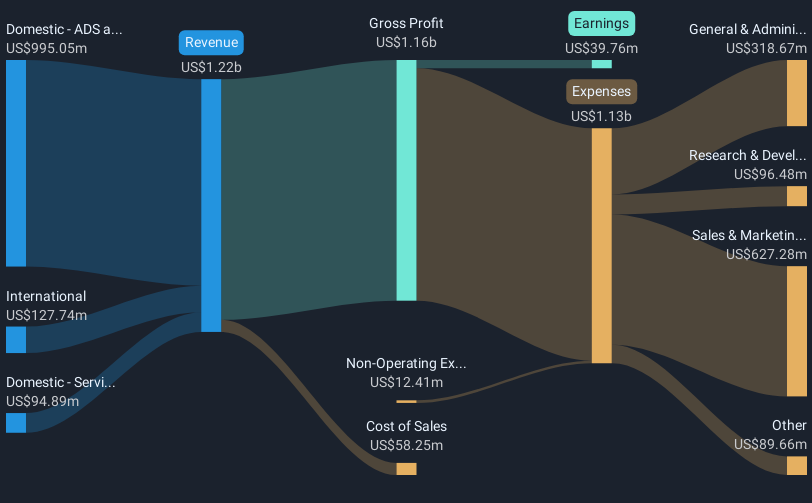

Operations: The company's revenue is segmented into International ($127.74 million), Domestic - Services ($94.89 million), and Domestic - ADS and Leads ($995.05 million).

Market Cap: $875.19M

Angi Inc. has recently achieved profitability, distinguishing itself within the penny stock category by demonstrating financial improvement. The company's short-term assets of US$499.5 million exceed its short-term liabilities, although its long-term liabilities remain uncovered. Angi's debt is well-managed with operating cash flow covering 26.6% of it, and interest payments are comfortably covered by EBIT at 48.5 times the amount needed for repayment. Recent changes include a planned spin-off from IAC Inc., which could impact corporate structure and governance, along with a reverse stock split proposal to potentially enhance share value and liquidity in the market.

- Jump into the full analysis health report here for a deeper understanding of Angi.

- Assess Angi's future earnings estimates with our detailed growth reports.

Acelyrin (NasdaqGS:SLRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Acelyrin, Inc. is a clinical biopharma company dedicated to identifying, acquiring, and accelerating the development and commercialization of transformative medicines, with a market cap of approximately $204.66 million.

Operations: Acelyrin, Inc. currently does not report any revenue segments.

Market Cap: $204.66M

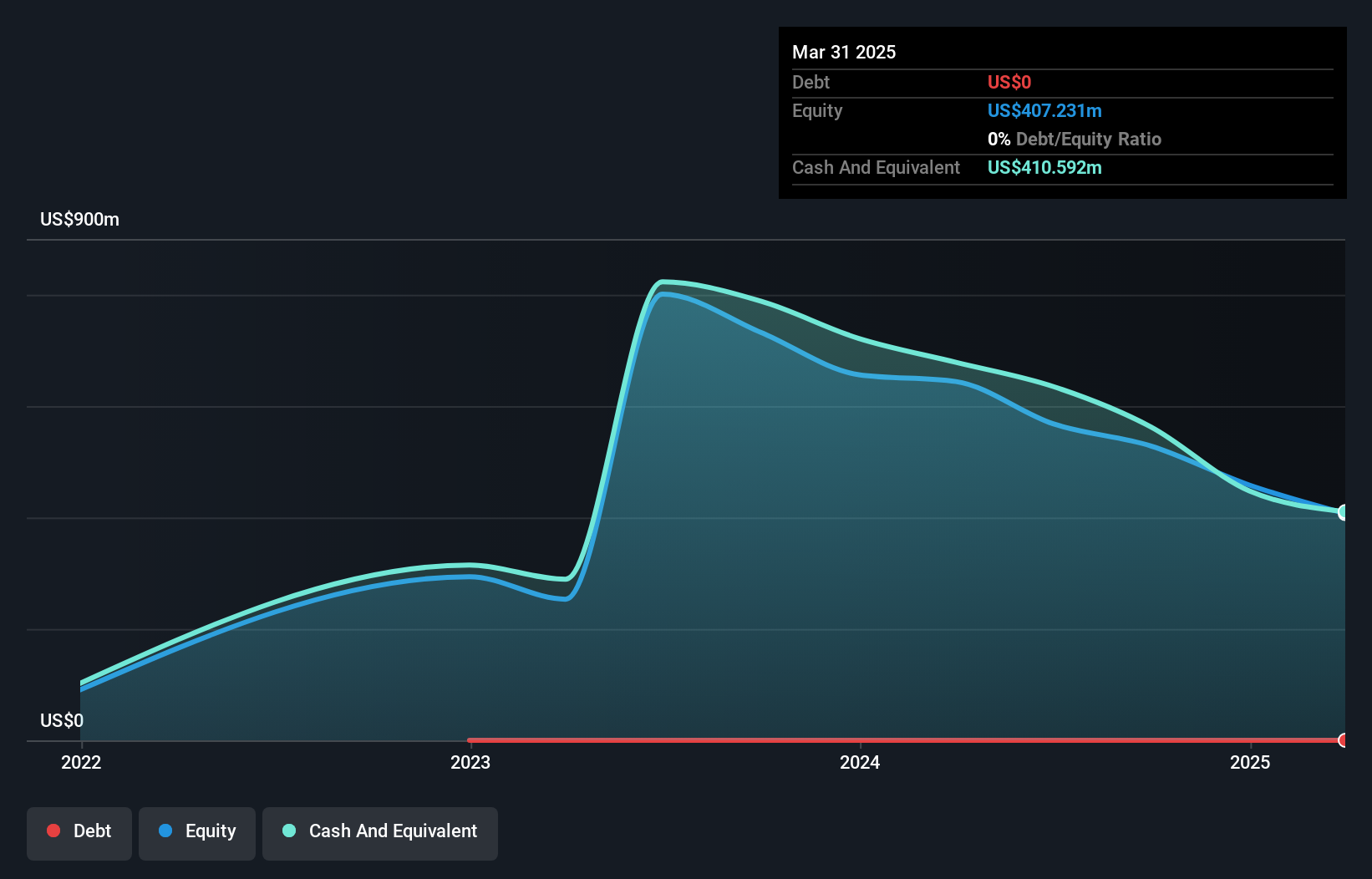

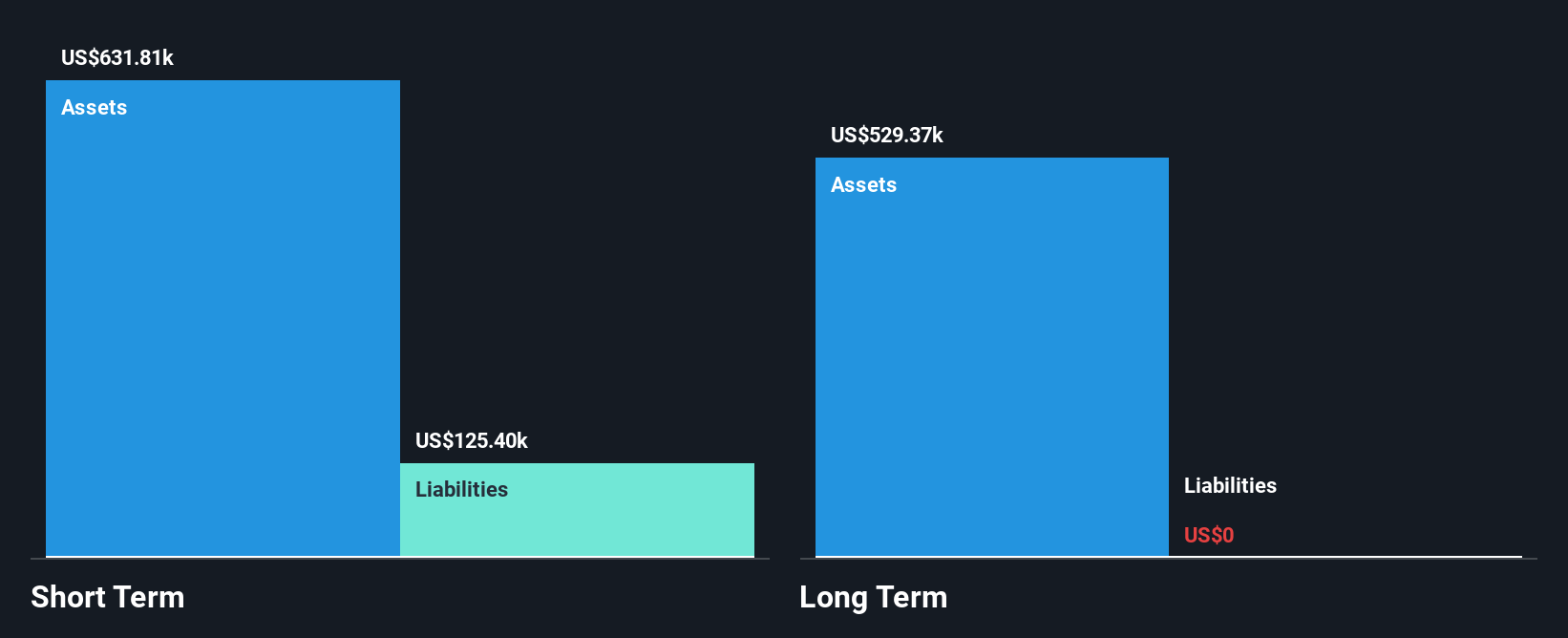

Acelyrin, Inc., a clinical biopharma company with a market cap of approximately US$204.66 million, is currently pre-revenue and unprofitable. The company's recent merger agreement with Alumis Inc., valued at around US$320 million, will see Acelyrin stockholders receiving 0.4274 shares of Alumis for each Acelyrin share owned. This transaction is expected to close in the second quarter of 2025, subject to customary approvals and conditions. Despite its lack of revenue, Acelyrin has a strong cash position with short-term assets significantly exceeding liabilities and no debt on its balance sheet, providing financial stability amid ongoing clinical developments.

- Take a closer look at Acelyrin's potential here in our financial health report.

- Gain insights into Acelyrin's outlook and expected performance with our report on the company's earnings estimates.

Texas Mineral Resources (OTCPK:TMRC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Texas Mineral Resources Corp. engages in the acquisition, exploration, and development of mineral properties in the United States with a market cap of $33.54 million.

Operations: Currently, the company does not report any revenue segments.

Market Cap: $33.54M

Texas Mineral Resources Corp., with a market cap of US$33.54 million, is pre-revenue and currently unprofitable, facing challenges such as a cash runway of less than a year and increased volatility. Recent executive resignations highlight concerns over project delays, particularly the Round Top project, impacting strategic focus. The company has entered into a non-binding letter of intent for potential mining ventures in New Mexico but lacks assurance on capital procurement or definitive agreements. Despite these hurdles, Texas Mineral Resources remains debt-free with short-term assets covering liabilities and an experienced board averaging 11 years in tenure.

- Navigate through the intricacies of Texas Mineral Resources with our comprehensive balance sheet health report here.

- Examine Texas Mineral Resources' past performance report to understand how it has performed in prior years.

Make It Happen

- Gain an insight into the universe of 709 US Penny Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLRN

Acelyrin

A clinical biopharma company, focuses on identifying, acquiring, and accelerating the development and commercialization of transformative medicines.

Flawless balance sheet and good value.

Market Insights

Community Narratives