What underlying fundamental trends can indicate that a company might be in decline? When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that's often how a mature business shows signs of aging. Basically the company is earning less on its investments and it is also reducing its total assets. On that note, looking into AMC Networks (NASDAQ:AMCX), we weren't too upbeat about how things were going.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for AMC Networks, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = US$430m ÷ (US$4.4b - US$703m) (Based on the trailing twelve months to December 2024).

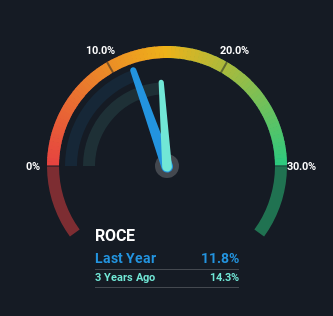

So, AMC Networks has an ROCE of 12%. On its own, that's a standard return, however it's much better than the 9.4% generated by the Media industry.

View our latest analysis for AMC Networks

Above you can see how the current ROCE for AMC Networks compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering AMC Networks for free.

What Can We Tell From AMC Networks' ROCE Trend?

The trend of ROCE at AMC Networks is showing some signs of weakness. To be more specific, today's ROCE was 15% five years ago but has since fallen to 12%. On top of that, the business is utilizing 24% less capital within its operations. The combination of lower ROCE and less capital employed can indicate that a business is likely to be facing some competitive headwinds or seeing an erosion to its moat. If these underlying trends continue, we wouldn't be too optimistic going forward.

In Conclusion...

In summary, it's unfortunate that AMC Networks is shrinking its capital base and also generating lower returns. This could explain why the stock has sunk a total of 75% in the last five years. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

On a separate note, we've found 1 warning sign for AMC Networks you'll probably want to know about.

While AMC Networks isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AMCX

AMC Networks

An entertainment company, distributes contents in the United States, Europe, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026