- United States

- /

- Pharma

- /

- NYSE:ANRO

3 Penny Stocks With Market Caps Over $5M To Watch

Reviewed by Simply Wall St

As U.S. markets continue to rise, with major indices setting fresh records despite concerns over a government shutdown, investors are exploring opportunities beyond the traditional blue-chip stocks. Penny stocks, often seen as relics of past speculative trading days, still hold potential when backed by strong financials and solid business models. These smaller or newer companies can offer unique growth prospects and hidden value for those willing to explore beyond the well-trodden paths of larger corporations.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.06 | $441.47M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.89 | $683.54M | ✅ 4 ⚠️ 0 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $24.24M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.89 | $654.03M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Table Trac (TBTC) | $4.59 | $21.81M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $1.00 | $6.9M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.83 | $85.87M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.60 | $11.06M | ✅ 2 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.88 | $168.52M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 365 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Alto Neuroscience (ANRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alto Neuroscience, Inc. is a clinical-stage biopharmaceutical company based in the United States with a market cap of $110.20 million.

Operations: Currently, there are no reported revenue segments for this clinical-stage biopharmaceutical company.

Market Cap: $110.2M

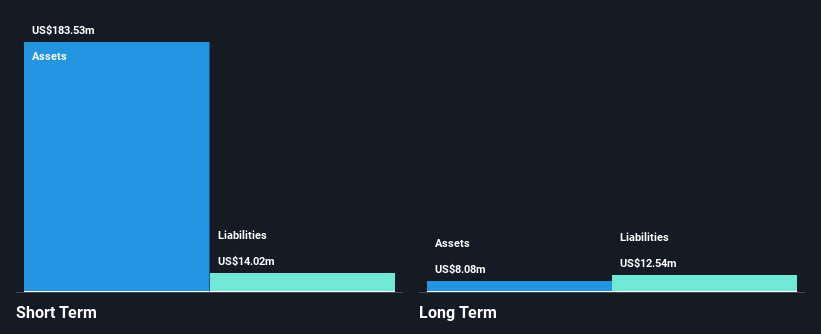

Alto Neuroscience, Inc., with a market cap of US$110.20 million, is a pre-revenue clinical-stage biopharmaceutical company focused on innovative neuropsychiatric treatments. Recent positive results from an EEG biomarker study in schizophrenia highlight its potential in precision psychiatry, though the company remains unprofitable with increasing losses reported. Despite being dropped from the S&P Global BMI Index and facing a class action lawsuit related to its IPO, Alto maintains strong short-term liquidity with cash assets exceeding liabilities significantly. The management team is experienced but relatively new; however, earnings are forecasted to decline over the next three years.

- Click here to discover the nuances of Alto Neuroscience with our detailed analytical financial health report.

- Examine Alto Neuroscience's earnings growth report to understand how analysts expect it to perform.

Chegg (CHGG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Chegg, Inc. offers personalized learning support aimed at enhancing academic, life, and job skills for students both in the United States and internationally, with a market cap of approximately $175.49 million.

Operations: The company generates revenue primarily through its Educational Services segment, specifically in Education & Training Services, amounting to $506.58 million.

Market Cap: $175.49M

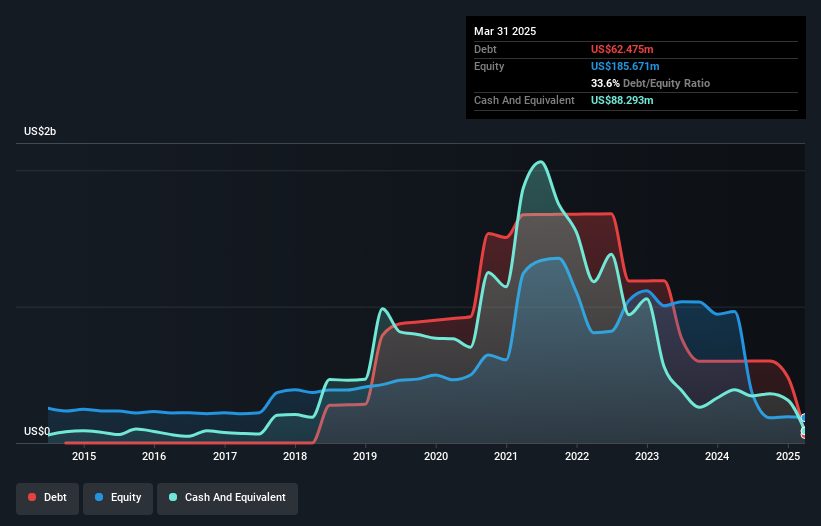

Chegg, Inc., with a market cap of US$175.49 million, faces challenges as it remains unprofitable with increasing losses over the past five years. Despite this, Chegg has reduced its debt-to-equity ratio significantly and maintains a cash runway exceeding three years due to positive free cash flow. Recent earnings guidance projects third-quarter revenue between US$75 million and US$77 million. Although sales have declined compared to the previous year, net losses have decreased substantially from prior periods. The company completed a significant share buyback program but has experienced high share price volatility recently.

- Unlock comprehensive insights into our analysis of Chegg stock in this financial health report.

- Evaluate Chegg's prospects by accessing our earnings growth report.

Lithium (LTUM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lithium Corporation is an exploration stage mining company focused on identifying, acquiring, and exploring metals and minerals in Nevada and British Columbia, with a market cap of $5.06 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: $5.06M

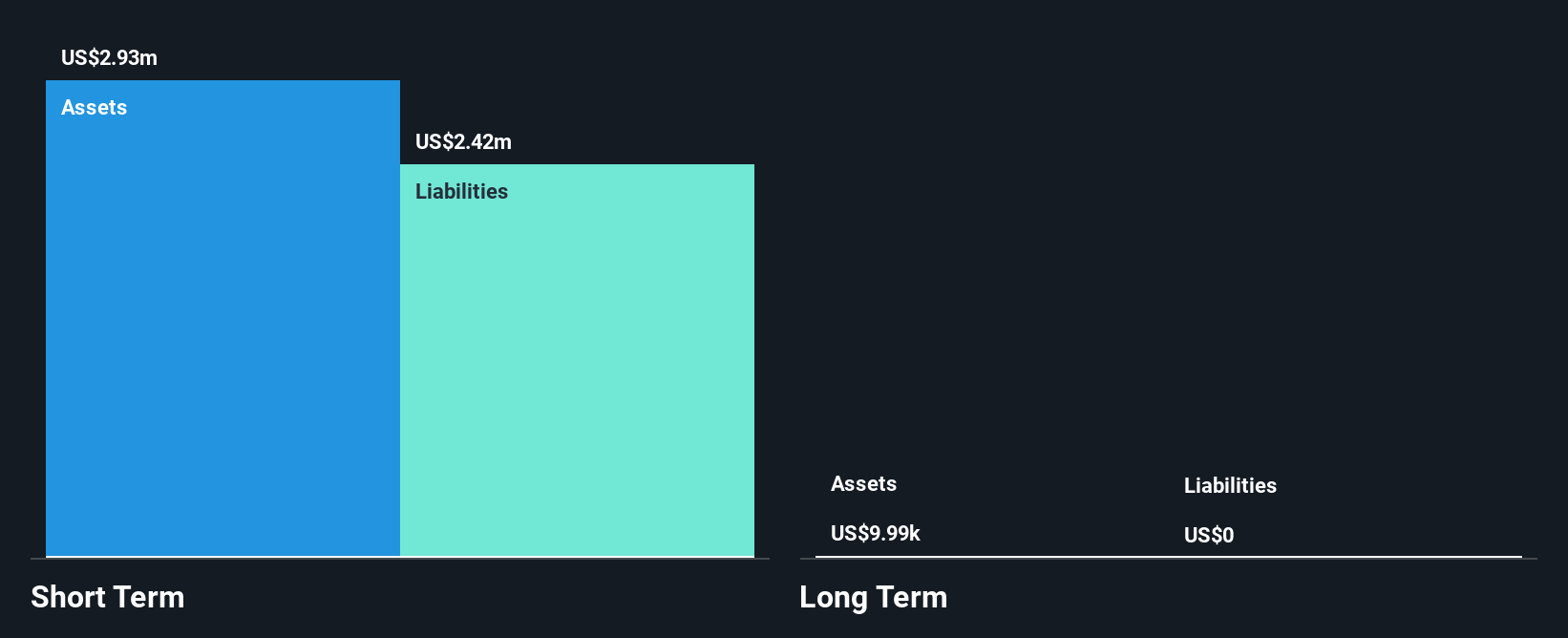

Lithium Corporation, with a market cap of US$5.06 million, is pre-revenue and faces challenges as it remains unprofitable. Despite this, the company has no debt and maintains sufficient cash runway for over three years even if free cash flow declines at historical rates. Recent earnings results show reduced net losses compared to the previous year. The board of directors is experienced with an average tenure of 12.8 years, but the stock exhibits high volatility with weekly fluctuations increasing significantly over the past year from 132% to 259%. Short-term assets exceed liabilities by US$0.5 million, providing some financial stability amidst its exploration activities in Nevada and British Columbia.

- Navigate through the intricacies of Lithium with our comprehensive balance sheet health report here.

- Evaluate Lithium's historical performance by accessing our past performance report.

Summing It All Up

- Get an in-depth perspective on all 365 US Penny Stocks by using our screener here.

- Curious About Other Options? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANRO

Alto Neuroscience

Operates as a clinical-stage biopharmaceutical company in the United States.

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion