- United States

- /

- Insurance

- /

- NYSE:WDH

Spotlight On 3 Penny Stocks With Market Caps Over $60M

Reviewed by Simply Wall St

Recently, the major U.S. stock indexes have shown resilience, snapping a four-week losing streak with gains fueled by a rally in big tech stocks. Amidst this backdrop of cautious optimism and market volatility, penny stocks continue to capture attention as potential investment opportunities. Although the term "penny stock" may seem outdated, these smaller or newer companies can offer significant growth potential when supported by strong financials and solid fundamentals. In this article, we will highlight several noteworthy penny stocks that stand out for their financial strength and long-term promise.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.74 | $392.12M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $3.49 | $2.08B | ✅ 3 ⚠️ 3 View Analysis > |

| Global Self Storage (NasdaqCM:SELF) | $5.00 | $56.35M | ✅ 3 ⚠️ 3 View Analysis > |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.71 | $77.69M | ✅ 5 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ✅ 1 ⚠️ 5 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $3.35 | $443.52M | ✅ 5 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.55 | $77.35M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.8499 | $6.17M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $140.05M | ✅ 3 ⚠️ 1 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8203 | $73.78M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 761 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Definitive Healthcare (NasdaqGS:DH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Definitive Healthcare Corp. offers a SaaS healthcare commercial intelligence platform operating both in the United States and internationally, with a market cap of approximately $428.10 million.

Operations: The company generates revenue from its Internet Information Providers segment, totaling $252.20 million.

Market Cap: $428.1M

Definitive Healthcare, with a market cap of US$428.10 million, is navigating challenges typical for penny stocks. Despite being unprofitable and reporting increased net losses of US$413.12 million in 2024, the company maintains a cash runway exceeding three years due to positive free cash flow. It trades significantly below estimated fair value and has avoided shareholder dilution recently. However, its share price remains highly volatile, and recent goodwill impairment charges of US$97.06 million highlight financial pressures. Leadership changes are underway with Casey Heller set to become CFO in June 2025 amidst ongoing strategic adjustments.

- Dive into the specifics of Definitive Healthcare here with our thorough balance sheet health report.

- Examine Definitive Healthcare's earnings growth report to understand how analysts expect it to perform.

Waterdrop (NYSE:WDH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Waterdrop Inc. operates as an online insurance brokerage, connecting users with insurance products in China, and has a market cap of approximately $564.48 million.

Operations: The company's revenue is derived from its insurance segment, which generated CN¥2.36 billion, and its crowdfunding segment, contributing CN¥267.65 million.

Market Cap: $564.48M

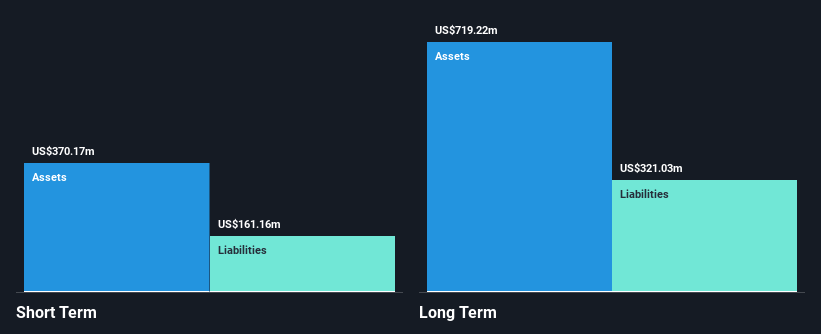

Waterdrop Inc., with a market cap of approximately US$564.48 million, demonstrates characteristics appealing to penny stock investors. The company has shown strong earnings growth, increasing by 119.8% over the past year, and maintains a stable weekly volatility of 8%. Its financial position is robust, with short-term assets exceeding liabilities and more cash than total debt. Recent board changes introduced Chen Lin as an independent director. Waterdrop declared dividends totaling approximately US$7.3 million for shareholders in April 2025, reflecting its commitment to shareholder returns while aiming for continued growth and profitability through technological enhancements.

- Click here to discover the nuances of Waterdrop with our detailed analytical financial health report.

- Explore Waterdrop's analyst forecasts in our growth report.

Liquidmetal Technologies (OTCPK:LQMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liquidmetal Technologies, Inc. is a materials technology company that designs, develops, and sells custom products and parts made from bulk amorphous alloys to various industries globally, with a market cap of $68.34 million.

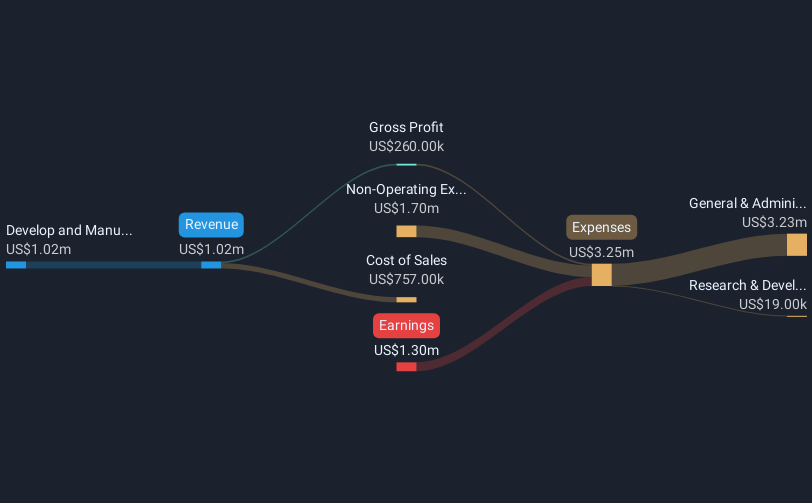

Operations: The company's revenue is primarily derived from developing and manufacturing products and applications using amorphous alloys, totaling $0.86 million.

Market Cap: $68.34M

Liquidmetal Technologies, Inc., with a market cap of US$68.34 million, operates as a pre-revenue company with annual revenue of US$0.86 million. Despite its current unprofitability, it has reduced losses by 25.8% annually over the past five years and remains debt-free with no long-term liabilities. The company's short-term assets of US$16.1 million comfortably cover its short-term liabilities of US$1.3 million, ensuring financial stability for more than three years based on free cash flow trends. However, the stock exhibits high volatility with weekly fluctuations increasing to 26%, posing potential risks for investors seeking stability in penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Liquidmetal Technologies.

- Evaluate Liquidmetal Technologies' historical performance by accessing our past performance report.

Summing It All Up

- Jump into our full catalog of 761 US Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waterdrop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WDH

Waterdrop

Through its subsidiaries, provides online insurance brokerage services to match and connect users with related insurance products underwritten by insurance companies in the People’s Republic of China.

Solid track record with excellent balance sheet.