- United States

- /

- Metals and Mining

- /

- OTCPK:LQMT

AMMO Leads The Pack Of 3 US Penny Stocks

Reviewed by Simply Wall St

The U.S. stock market is experiencing a positive trend, with major indexes like the Dow Jones, S&P 500, and Nasdaq Composite on track for monthly gains following favorable inflation data and strong earnings reports. For investors interested in exploring smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant area of interest. These stocks can offer growth opportunities at lower price points, especially when backed by solid financials and fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $119.09M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.91 | $6.62M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.274193 | $10.24M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.46 | $48.51M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.54 | $41.73M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.88 | $83.72M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.12 | $53.61M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.92 | $80.14M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.30 | $22.88M | ★★★★★☆ |

Click here to see the full list of 706 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

AMMO (NasdaqCM:POWW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AMMO, Inc. designs, produces, and markets ammunition and related products for various customers including recreational shooters, hunters, and law enforcement agencies with a market cap of $187.64 million.

Operations: The company's revenue is derived from two main segments: Ammunition, which generated $89.44 million, and Marketplace, contributing $52.31 million.

Market Cap: $187.64M

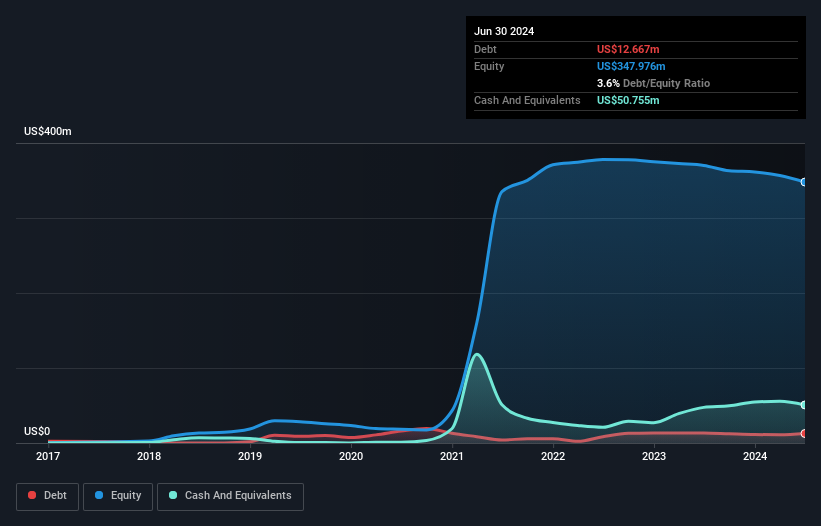

AMMO, Inc. faces challenges as it received a Nasdaq deficiency notice for delayed SEC filings, risking delisting if compliance isn't regained by May 2025. Despite this, the company maintains a solid financial position with short-term assets of US$134 million exceeding liabilities and more cash than total debt. Although unprofitable, AMMO has reduced losses over five years and possesses a sufficient cash runway for over three years due to positive free cash flow. Shareholders haven't faced significant dilution recently, and the board is experienced with an average tenure of 3.8 years.

- Dive into the specifics of AMMO here with our thorough balance sheet health report.

- Understand AMMO's earnings outlook by examining our growth report.

Tandy Leather Factory (NasdaqCM:TLF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tandy Leather Factory, Inc. operates as a retailer of leather and leathercraft-related products in the United States, Canada, and Spain, with a market cap of $42.20 million.

Operations: The company's revenue segment is primarily derived from its Apparel business, which generated $74.76 million.

Market Cap: $42.2M

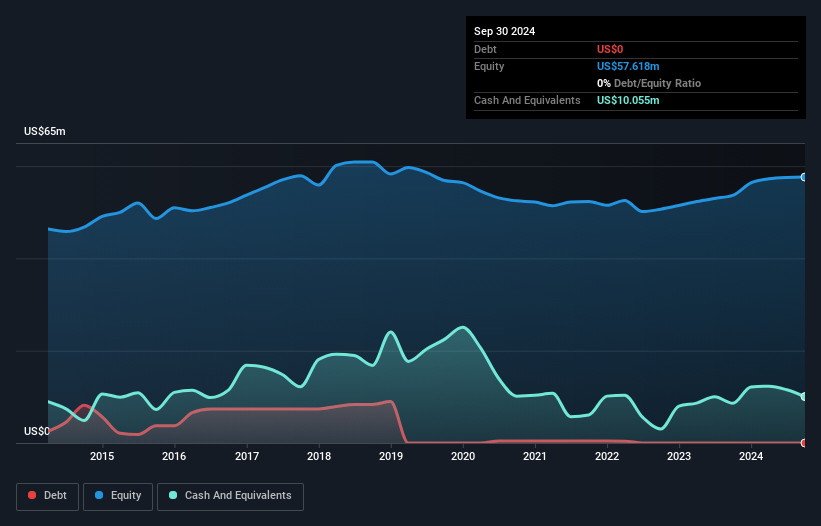

Tandy Leather Factory, Inc. recently announced a strategic move to new headquarters in Benbrook, Texas, signaling potential growth ambitions. The company declared a special dividend of $1.50 per share and appointed Johan Hedberg as CEO, bringing extensive retail leadership experience. Financially stable with no debt and short-term assets exceeding liabilities, Tandy's earnings grew 6.7% last year despite a slight revenue decline. The Price-To-Earnings ratio is favorable compared to the US market average, indicating potential value for investors interested in penny stocks with improving profit margins and high-quality earnings amidst board changes.

- Unlock comprehensive insights into our analysis of Tandy Leather Factory stock in this financial health report.

- Assess Tandy Leather Factory's previous results with our detailed historical performance reports.

Liquidmetal Technologies (OTCPK:LQMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liquidmetal Technologies, Inc. is a materials technology company that designs, develops, and sells custom products and parts made from bulk amorphous alloys to various industries globally, with a market cap of $36.87 million.

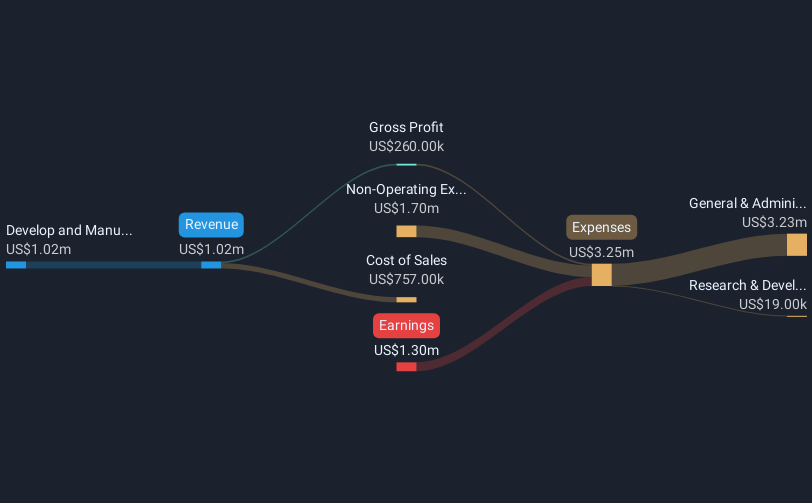

Operations: The company's revenue is derived entirely from the development and manufacturing of products and applications using amorphous alloys, totaling $1.02 million.

Market Cap: $36.87M

Liquidmetal Technologies, Inc. is a materials technology company with a market cap of US$36.87 million, focusing on amorphous alloys but remains pre-revenue with only US$1.02 million in revenue, indicating limited commercial traction. Despite being unprofitable, the company has reduced losses by 29.2% annually over five years and maintains financial stability with no debt and short-term assets of US$17.3 million exceeding liabilities of US$1.3 million. Recent developments include filing a shelf registration for US$18.9 million and changing auditors to BCRG Group, which could influence future financial reporting and capital structure adjustments.

- Click here and access our complete financial health analysis report to understand the dynamics of Liquidmetal Technologies.

- Explore historical data to track Liquidmetal Technologies' performance over time in our past results report.

Seize The Opportunity

- Take a closer look at our US Penny Stocks list of 706 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:LQMT

Liquidmetal Technologies

A materials technology company, designs, develops, and sells custom products and parts from bulk amorphous alloys to various industries in the United States and internationally.

Flawless balance sheet very low.

Market Insights

Community Narratives