- United States

- /

- Medical Equipment

- /

- NasdaqCM:POCI

Precision Optics Corporation And 2 More Promising US Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market continues to reach record highs fueled by post-election optimism and favorable monetary policies, investors are on the lookout for promising opportunities beyond the well-known large-cap names. Penny stocks, often representing smaller or newer companies, remain a relevant investment area despite being considered an outdated term. By focusing on those with strong financial health and potential for growth, investors can uncover valuable opportunities in this niche market segment.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7656 | $5.56M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.63 | $2.07B | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $170.72M | ★★★★★★ |

| AsiaFIN Holdings (OTCPK:ASFH) | $0.97 | $79.11M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $4.10 | $51.05M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.44 | $128.99M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $88.26M | ★★★★☆☆ |

| Permianville Royalty Trust (NYSE:PVL) | $1.55 | $51.15M | ★★★★★★ |

| Puma Biotechnology (NasdaqGS:PBYI) | $2.88 | $141.25M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $96.23M | ★★★★★☆ |

Click here to see the full list of 740 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Precision Optics Corporation (NasdaqCM:POCI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Precision Optics Corporation, Inc. designs, develops, manufactures, and sells specialized optical and illumination systems and related components primarily in the United States, with a market cap of $31.75 million.

Operations: The company generates revenue of $19.10 million from its Surgical & Medical Equipment segment.

Market Cap: $31.75M

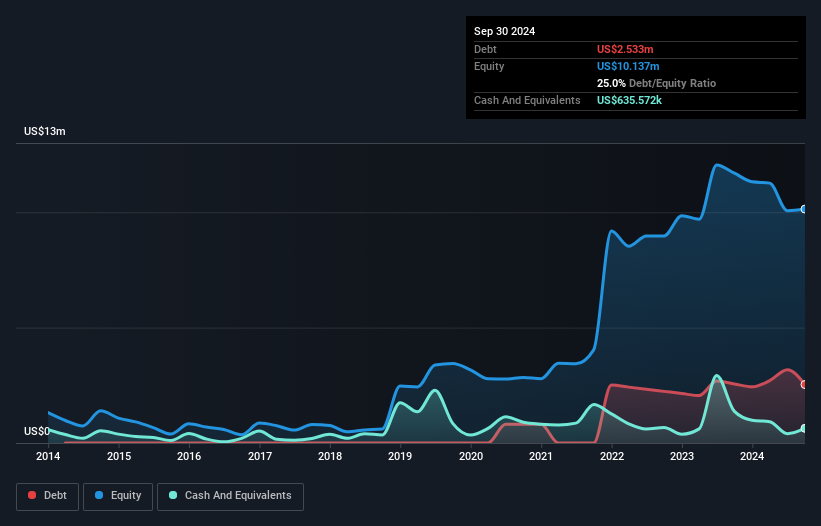

Precision Optics Corporation, with a market cap of US$31.75 million, faces challenges typical of penny stocks, including recent unprofitability and increased losses over the past year. Despite a decline in annual sales to US$19.1 million from US$21.04 million and a net loss increase to US$2.95 million, the company anticipates double-digit revenue growth for fiscal 2025 following resolution of production issues and strong product development sales. However, shareholders have faced dilution due to equity offerings while management's short tenure may raise concerns about leadership stability amidst these financial hurdles.

- Navigate through the intricacies of Precision Optics Corporation with our comprehensive balance sheet health report here.

- Explore historical data to track Precision Optics Corporation's performance over time in our past results report.

United States Antimony (NYSEAM:UAMY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: United States Antimony Corporation is involved in the production and sale of antimony, silver, gold, precious metals, and zeolite products in the United States and Canada, with a market cap of $71.45 million.

Operations: The company's revenue is primarily derived from its Antimony operations in the United States ($6.49 million), supplemented by sales of Zeolite ($2.79 million) and Precious Metals ($0.09 million).

Market Cap: $71.45M

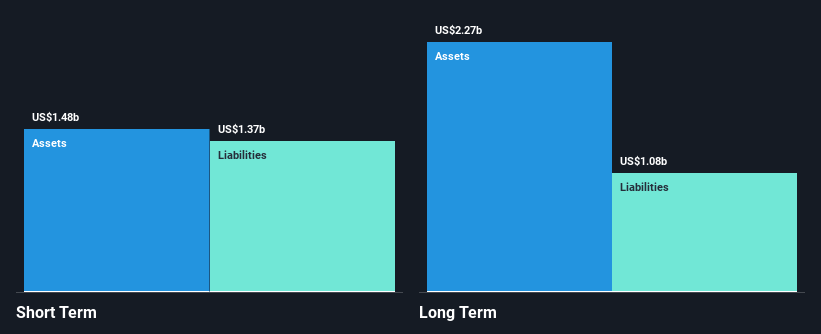

United States Antimony Corporation, with a market cap of US$71.45 million, is navigating the complexities typical of penny stocks. Despite being unprofitable and experiencing increased losses over the past five years, its strategic expansion into Alaska and Canada strengthens its position in securing critical minerals like antimony and copper. The company’s short-term assets significantly exceed both short- and long-term liabilities, providing some financial stability amidst high share price volatility. Recent acquisitions bolster UAMY's domestic resource base as it aims to mitigate risks from global supply chain disruptions, particularly given China's export restrictions on antimony.

- Click here to discover the nuances of United States Antimony with our detailed analytical financial health report.

- Understand United States Antimony's track record by examining our performance history report.

Liberty TripAdvisor Holdings (OTCPK:LTRP.A)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Liberty TripAdvisor Holdings, Inc. operates a travel guidance platform connecting users with travel partners globally and has a market cap of $53.35 million.

Operations: The company's revenue is primarily generated from its Brand Tripadvisor segment at $963 million, followed by Viator at $816 million and Thefork at $172 million, with a segment adjustment of -$137 million.

Market Cap: $53.35M

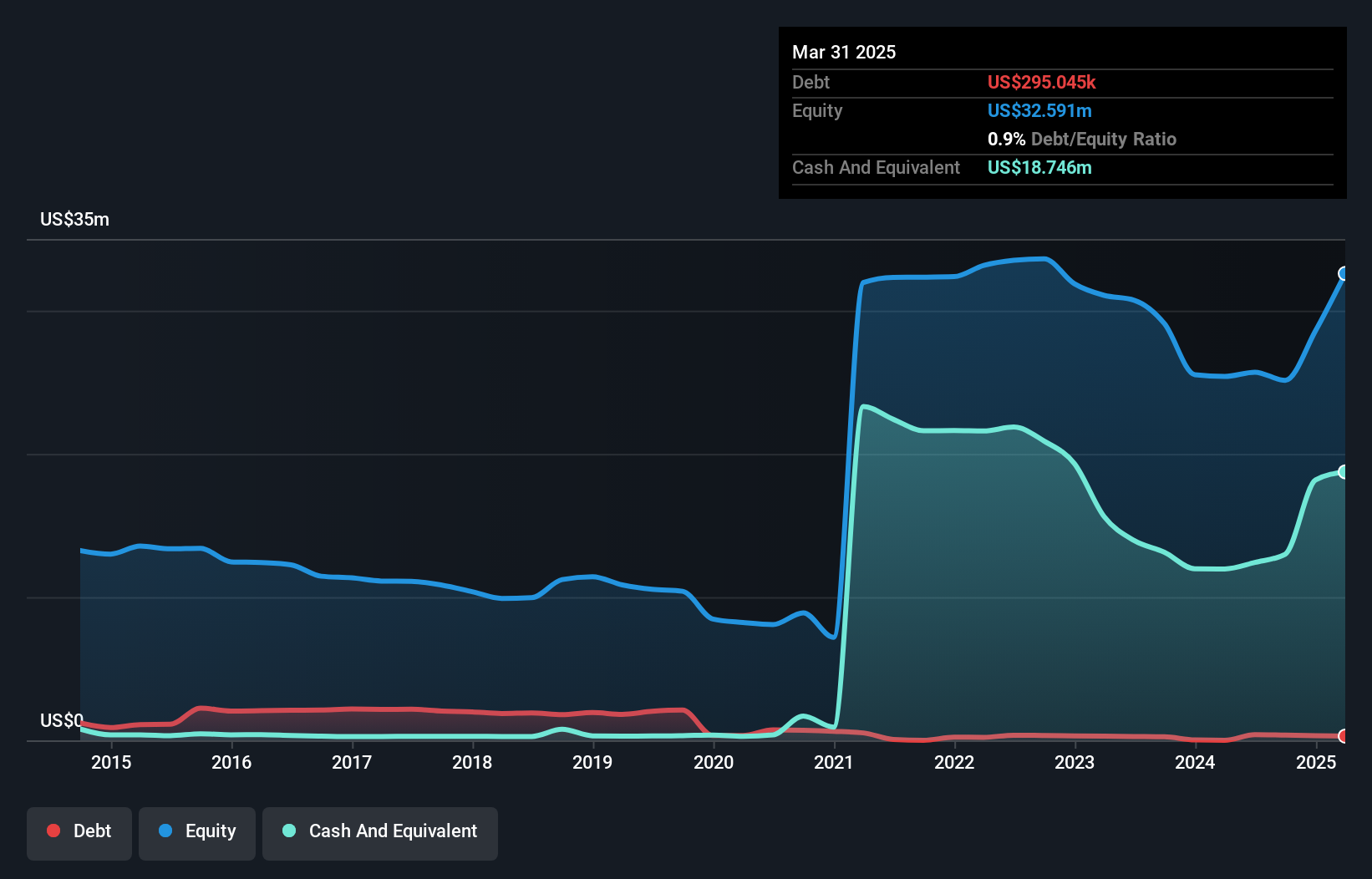

Liberty TripAdvisor Holdings, with a market cap of US$53.35 million, presents a mixed picture in the realm of penny stocks. The company reported third-quarter sales of US$532 million and managed to turn a net income of US$4 million from a previous loss, indicating some financial improvement despite ongoing unprofitability. Its short-term assets surpass both short- and long-term liabilities, suggesting financial stability despite high share price volatility. Although trading below estimated fair value and possessing sufficient cash runway for over three years, its rising debt-to-equity ratio highlights potential leverage concerns that investors should consider carefully.

- Click here and access our complete financial health analysis report to understand the dynamics of Liberty TripAdvisor Holdings.

- Learn about Liberty TripAdvisor Holdings' historical performance here.

Next Steps

- Gain an insight into the universe of 740 US Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:POCI

Precision Optics Corporation

Designs, develops, manufactures, and sells specialized optical and illumination systems and related components primarily in the United States.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives