- United States

- /

- Metals and Mining

- /

- NYSE:WS

Worthington Steel (WS): Net Profit Margins Edge Higher, Undercutting Cautious Community Narrative

Reviewed by Simply Wall St

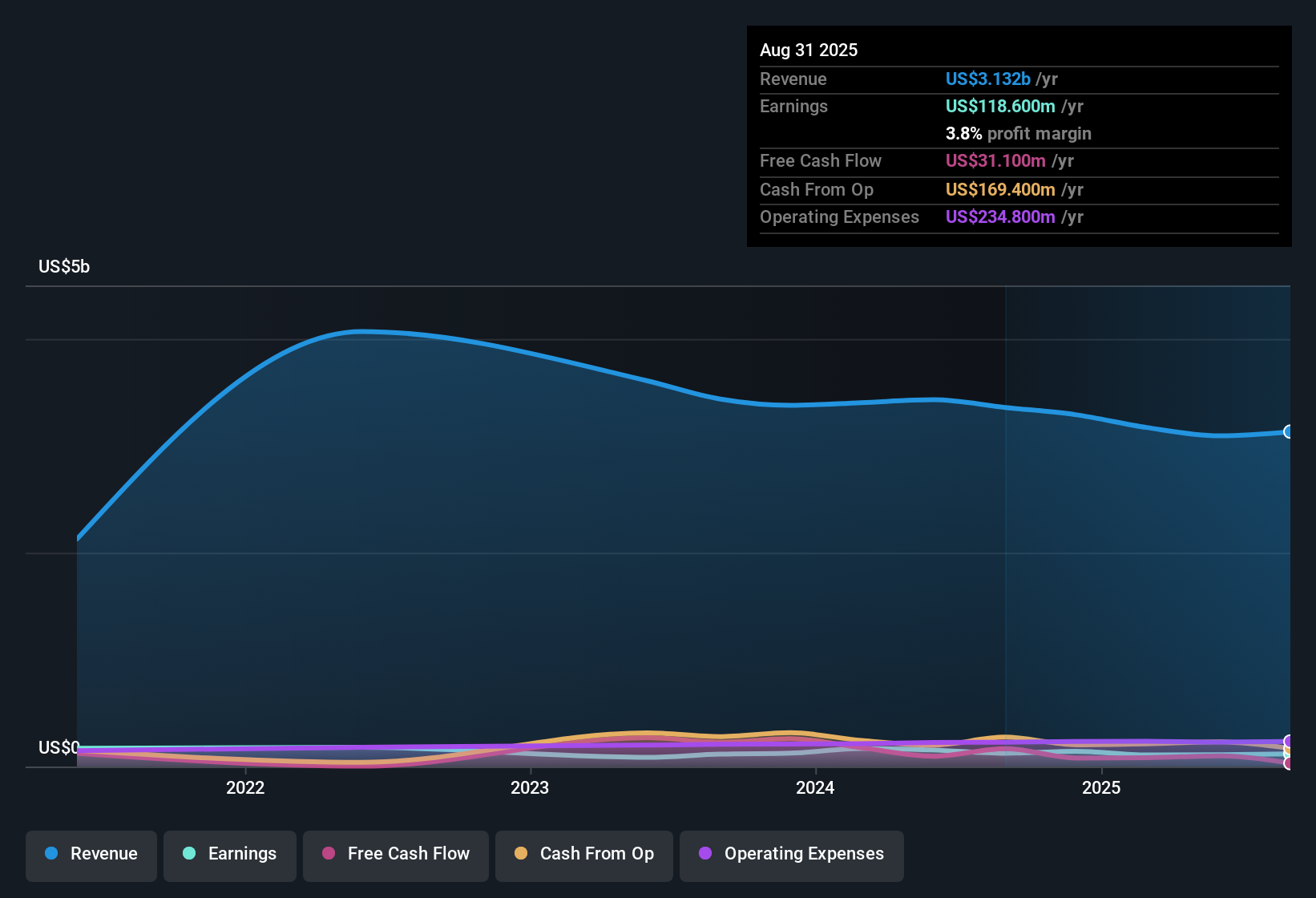

Worthington Steel (WS) reported net profit margins of 3.8%, edging out last year’s 3.7%, even as the company continues to face pressure from declining earnings. The five-year average shows earnings have dropped 9% annually and dipped again this year. Looking ahead, analysts expect earnings to bounce back at a 7.7% rate annually, with revenue forecasted for 3.5% growth per year. Shares are trading at a price-to-earnings ratio of 12.5x, undercutting both the peer average of 27.9x and the industry at 24.6x, and remain below the estimated fair value of $35.54, currently priced at $29.20. Investors appear to see value in the stock, but the sustainability of the dividend remains a key question mark.

See our full analysis for Worthington Steel.Now, let’s see how these headline numbers line up with the most widely discussed narratives in the investor community. Which stories hold up and where does the data step outside expectations?

See what the community is saying about Worthington Steel

Margins Edge Higher, but Still Trail Industry Potential

- Net profit margins reached 3.8%, just a fraction above last year’s 3.7%. Analysts see room for improvement, with projections targeting 5.0% in three years.

- According to analysts' consensus view, efficiency-driven transformation strategies such as cost reductions and process streamlining could help boost margins further. However, margin expansion depends on favorable market conditions and successful execution.

- The company's recent progress stands in contrast to the broader industry average margin. Gains may be possible if their initiatives deliver as intended.

- Consensus also highlights that anticipated easing in supply chains and interest rates may provide additional support for margin improvement.

- The latest results strengthen the consensus perspective that Worthington Steel is slowly building momentum but faces an uphill climb to catch up with top industry performers. See how analysts debate these margins in the full narrative. 📊 Read the full Worthington Steel Consensus Narrative.

Revenue Growth Relies on New Markets and Acquisitions

- Revenue is forecast to climb 3.5% annually, with strategic expansion into the electrical steel market and a pending 52% acquisition stake in Sitem expected to contribute to future growth.

- Consensus narrative notes revenue momentum is increasingly tied to investments in North America and Europe. Actual shipment volumes have decreased in core sectors due to weak demand in automotive, construction, and agriculture markets.

- Bulls will note expansion into electrified vehicles and data center steel is projected to offset some declines, but consensus remains cautious until clear volume recovery is seen.

- Sizable investments could pay off over the next three years, but there is risk if end-market demand fails to rebound quickly.

Valuation Discount Signals Market Skepticism

- Shares are priced at 12.5x earnings, undercutting both peers at 27.9x and the US Metals and Mining industry at 24.6x, and are currently trading at $29.20, below both DCF fair value of $35.54 and the analyst price target of $36.00.

- In line with the consensus narrative, analysts interpret this gap as the market baking in risks related to persistent earnings declines, sluggish end-market demand, and dividends that remain unproven in sustainability.

- The muted share price response reflects a “wait and see” approach. Investors may want clearer evidence of turnaround in both earnings and core sector volumes.

- While lower multiples could offer opportunity if forecasts materialize, confidence is tentative given mixed growth signals.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Worthington Steel on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Wondering if your read on the numbers points in a new direction? In just a few minutes, share your own take and shape the narrative: Do it your way

A great starting point for your Worthington Steel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite gradual margin improvement and new markets, Worthington Steel continues to struggle with consistent earnings declines and weak core sector revenue. This raises growth concerns.

If you want companies showing steadier progress, take a look at stable growth stocks screener for businesses that deliver reliable revenue and earnings expansion year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Worthington Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WS

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives