- United States

- /

- Metals and Mining

- /

- NYSE:WS

Worthington Steel (NYSE:WS) Expands in EV Market with New Facility in Germany Despite Earnings Challenges

Reviewed by Simply Wall St

Worthington Steel (NYSE:WS) is strategically positioning itself in the electrical steel market, focusing on electrified vehicles and infrastructure to capitalize on industry trends like transportation decarbonization. Recent developments include expansion projects in Mexico and Canada, as well as a new facility in Germany, underscoring its commitment to growth despite challenges such as declining first-quarter earnings and market volatility. The company report will explore key areas such as competitive advantages, internal limitations, emerging market opportunities, and the impact of market volatility on Worthington Steel's position.

See the full analysis report here for a deeper understanding of Worthington Steel.

Competitive Advantages That Elevate Worthington Steel

Worthington Steel's strategic investments in the electrical steel market are a testament to its forward-thinking approach. By focusing on electrified vehicles and infrastructure, the company is well-positioned to leverage industry trends like transportation decarbonization. CEO Geoffrey Gilmore highlights this proactive stance, emphasizing growth through capital expenditures and selective acquisitions, which enhance profitability. Operationally, the company's commitment to safety and efficiency is evident, with six facilities achieving top Safeworks Environmental Health and Safety Program levels. COO Jeffrey Klingler notes that these efforts result in higher productivity and customer responsiveness. Financially, their earnings growth of 7.9% over the past year surpasses the industry average, reflecting strong financial health. The company's net profit margin has improved to 3.7%, and its net debt to equity ratio of 7.5% is satisfactory, ensuring a stable cash runway.

Internal Limitations Hindering Worthington Steel's Growth

Worthington Steel faces challenges that could hinder its growth. The decline in first-quarter earnings to $28.4 million, as CFO Timothy Adams reports, is a concern, primarily due to lower gross margins and reduced equity earnings from Serviacero. Additionally, the automotive market, which constitutes 51% of sales, saw a 10% drop in direct sales volume, attributed to model changeover delays and shifts to toll processing. This volatility in customer relationships, as noted by Klingler, poses risks to sales forecasts. Furthermore, the company's return on equity is 12.3%, below the desired 20% threshold, indicating room for improvement. Revenue is projected to decline by 0.3% annually over the next three years, which could impact long-term profitability.

Emerging Markets or Trends for Worthington Steel

Opportunities abound in the electrical steel market, where Worthington Steel remains optimistic about electrified vehicles and transformers. Investments in Mexico and Canada are expanding capacity to meet growing demand for electric vehicles, data centers, and AI infrastructure. COO Klingler emphasizes the potential for growth in the plug-in hybrid and EV market, bolstered by investments in the Mexico facility. Expansion projects in Canada and Mexico are on track, with new capabilities expected by 2025. The acquisition of a facility in Nagold, Germany, marks Worthington Steel's initial foray into Europe, gaining traction with customers and suggesting potential for international expansion.

Market Volatility Affecting Worthington Steel's Position

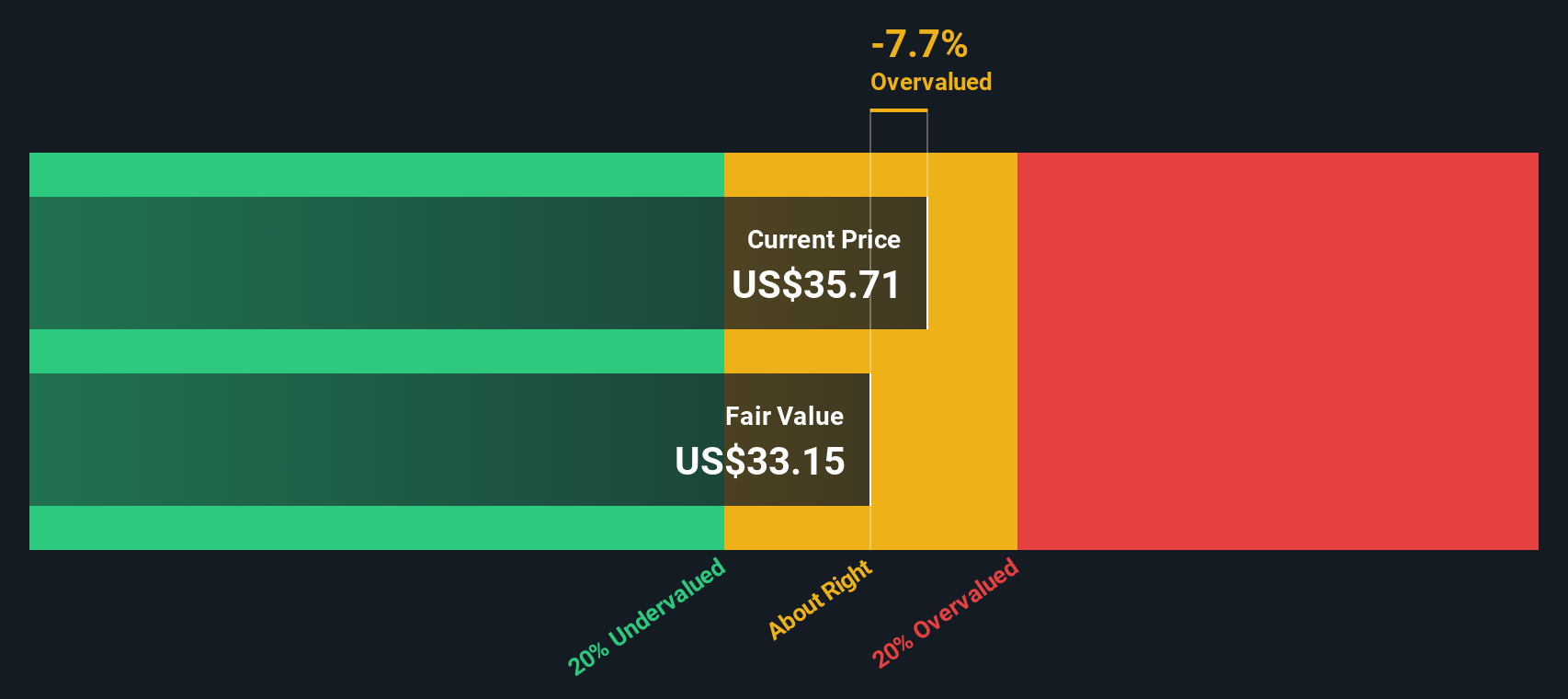

Market volatility poses significant threats to Worthington Steel's position. Steel prices have trended lower, with August prices hitting $660 per ton, leading to expected inventory holding losses, as CFO Adams notes. The Mexican peso's volatility further complicates matters, impacting Serviacero's results and highlighting risks in international operations. Additionally, the entry of Cleveland-Cliffs into the transformer market could heighten competition, though Gilmore remains confident due to existing backlogs and market growth potential. Regulatory challenges, such as new steel-related fair trade initiatives in North America, could pressure steel prices, affecting cost structures and competitive dynamics. Despite trading at 13% below its estimated fair value of $52.37, with an SWS fair ratio of 18.6x, the company's valuation remains a point of strategic consideration.

See what the latest analyst reports say about Worthington Steel's future prospects and potential market movements.Conclusion

Worthington Steel's strategic focus on electrified vehicles and infrastructure positions it to capitalize on industry trends, enhancing profitability through growth initiatives and operational efficiency. However, challenges such as declining earnings and automotive market volatility pose risks to its financial performance, necessitating improvements in gross margins and return on equity. The company's expansion into international markets and investments in emerging sectors like EVs and AI infrastructure offer promising growth avenues. Trading at 13% below its estimated fair value of $52.37, with a Price-To-Earnings Ratio of 18.6x, Worthington Steel is priced attractively relative to its peers, suggesting potential for future appreciation as it navigates market volatility and leverages its strategic investments.

Key Takeaways

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Worthington Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:WS

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives