- United States

- /

- Chemicals

- /

- NYSE:WLK

A Look at Westlake’s (WLK) Valuation After FTSE All-World Index Removal

Reviewed by Kshitija Bhandaru

Westlake’s Removal from FTSE All-World Index: What Does It Mean for Investors?

Westlake (NYSE:WLK) just experienced a jolt that could easily shake up investor sentiment. The company was recently dropped from the FTSE All-World Index, a benchmark tracked by institutional funds and ETFs around the world. This event has drawn attention because when a stock leaves a widely tracked index, there is often a wave of repositioning as funds rebalance their portfolios. These adjustments can trigger shifts in the share price, even if the underlying business has not changed overnight.

For Westlake, this index exit comes shortly after its presentation at a global industrials conference, putting the company on the radar for both strategic reasons and market mechanics. While the stock saw a modest gain in the past quarter, its performance over the last year has been lackluster, slipping nearly 47 percent and giving back three-year gains. Momentum appears to be in flux, with recent moves highlighting investor uncertainty about Westlake’s growth prospects and risk profile.

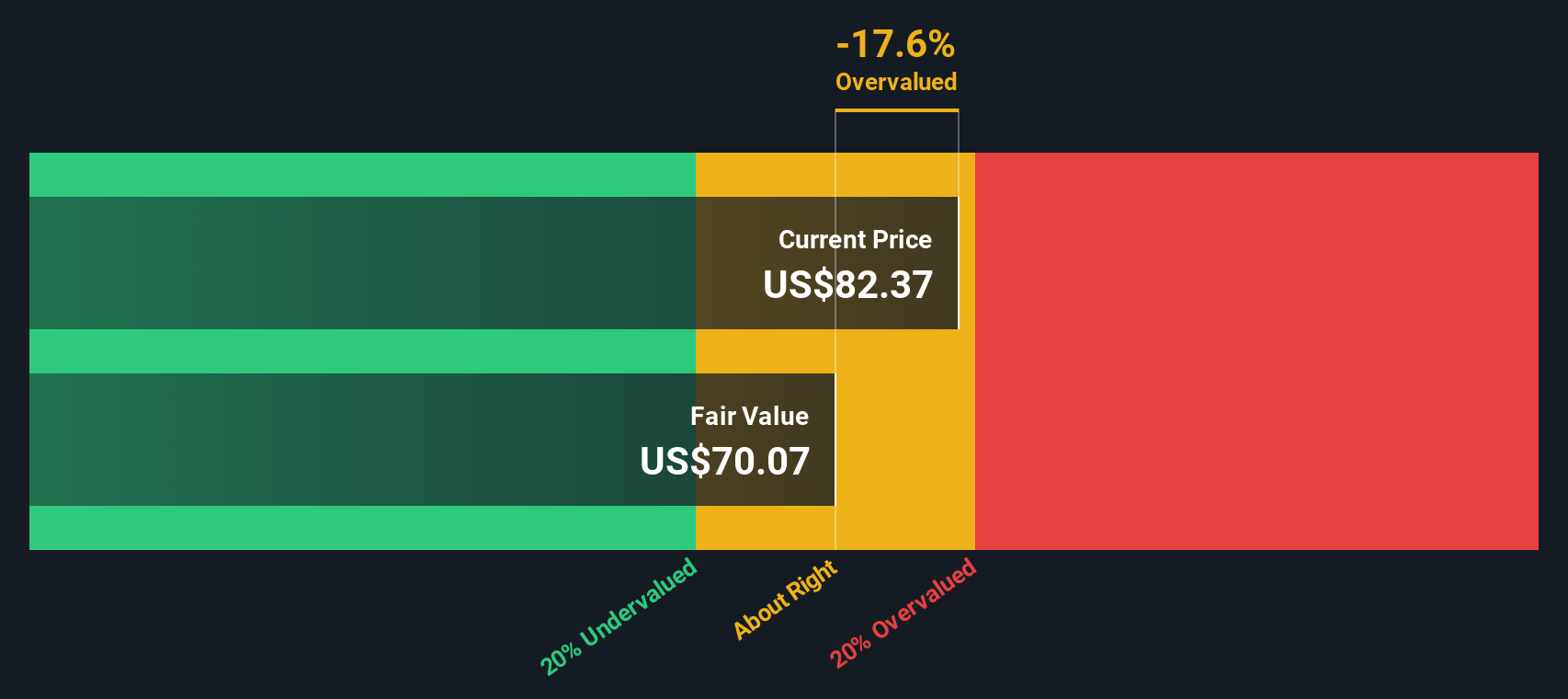

Now, the key question for investors is whether this shake-up leaves Westlake undervalued and overlooked, or if the market is fairly pricing in the company’s long-term outlook after a turbulent year.

Most Popular Narrative: 13.8% Undervalued

According to the most widely followed narrative, Westlake is priced significantly below its estimated fair value, with a discount rate applied to measure future potential returns. This perspective suggests investors may be overlooking key drivers that could boost both top-line growth and profitability in coming years.

Increased emphasis on vertical integration, advantaged U.S. feedstock positions, and diversified end markets help insulate Westlake from cyclical energy and raw material price swings. This supports margin stability and consistent cash flow generation as the global energy transition continues and demand for lightweight building materials accelerates.

Want to know which assumptions could send Westlake’s valuation to new heights? The narrative hinges on bold forecasts for revenue growth, earnings recovery, and stronger margins. Is the market sleeping on a turnaround story supported by sweeping industry tailwinds? Find out what underpins this bullish outlook and what it could mean for future returns.

Result: Fair Value of $90.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent global oversupply and margin compression could continue to weigh on earnings. This may result in a recovery that is slower and more unpredictable than expected.

Find out about the key risks to this Westlake narrative.Another View: Discounted Cash Flow Perspective

Looking at Westlake through the lens of our DCF model gives another angle. This is a calculation grounded in long-term cash flows and future expectations. This method also suggests the shares are undervalued. Are fundamentals or market mood more important?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Westlake Narrative

If you think there’s more to Westlake’s story or want to dig into the numbers yourself, you can explore the data and build your own narrative in just minutes. Do it your way

A great starting point for your Westlake research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Compelling Investment Opportunities?

Make your next investment move count by tapping into a world of stocks shaping tomorrow’s markets. Don’t miss out on these exciting ideas that could give your portfolio an edge:

- Uncover growth potential by spotting pioneering healthcare firms applying smart technology to real-world medical challenges: healthcare AI stocks

- Capture steady returns from companies with attractive yields and proven dividend histories: dividend stocks with yields > 3%

- Tap into the future of finance by finding innovators leading blockchain and digital asset adoption: cryptocurrency and blockchain stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westlake might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WLK

Westlake

Manufactures and markets performance and essential materials, and housing and infrastructure products in the United States, Canada, Germany, China, Mexico, Brazil, France, Italy, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives