The board of Valhi, Inc. (NYSE:VHI) has announced that it will pay a dividend on the 21st of September, with investors receiving $0.08 per share. Based on this payment, the dividend yield will be 2.3%, which is fairly typical for the industry.

View our latest analysis for Valhi

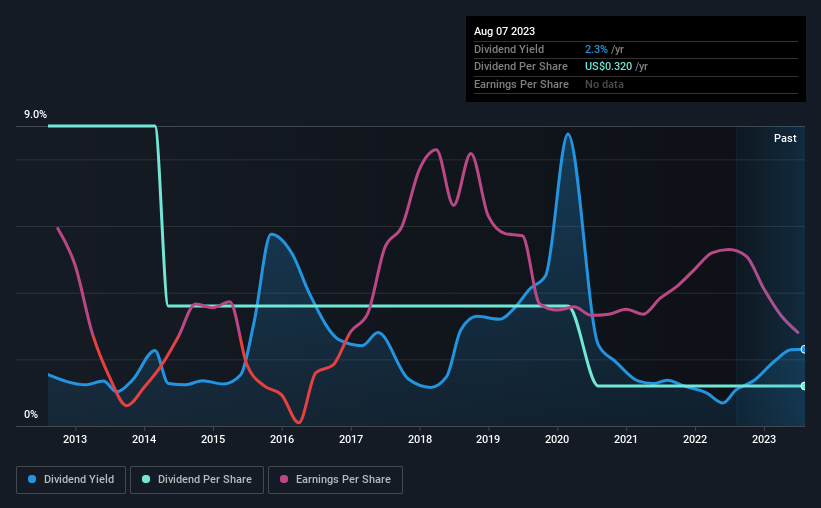

Valhi Doesn't Earn Enough To Cover Its Payments

We aren't too impressed by dividend yields unless they can be sustained over time. Prior to this announcement, the dividend made up 134% of earnings, and the company was generating negative free cash flows. This high of a dividend payment could start to put pressure on the balance sheet in the future.

EPS is set to fall by 51.2% over the next 12 months if recent trends continue. If the dividend continues along recent trends, we estimate the payout ratio could reach 225%, which could put the dividend in jeopardy if the company's earnings don't improve.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2013, the dividend has gone from $2.40 total annually to $0.32. This works out to a decline of approximately 87% over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Has Limited Growth Potential

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. Valhi's earnings per share has shrunk at 51% a year over the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

We're Not Big Fans Of Valhi's Dividend

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Overall, this doesn't get us very excited from an income standpoint.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 4 warning signs for Valhi (2 are a bit unpleasant!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:VHI

Valhi

Engages in the chemicals, component products, and real estate management and development businesses in Europe, North America, the Asia Pacific, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives