- United States

- /

- Chemicals

- /

- NYSE:UAN

CVR Partners (UAN): Valuation Insights Following Recent Share Price Strength

Reviewed by Kshitija Bhandaru

See our latest analysis for CVR Partners.

Building on its rally, CVR Partners has shown impressive momentum. Its year-to-date share price return stands at 20.8%, and over the past twelve months, total shareholder return has soared 52%. The steady climb hints that investors are warming to its growth and earnings outlook.

If strong performance in the fertilizer sector piques your interest, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With such robust returns, the key question for investors becomes clear: is CVR Partners still undervalued at current levels, or has the market already priced in the company’s potential for future growth?

Price-to-Earnings of 11.2x: Is it justified?

CVR Partners trades at a price-to-earnings ratio of 11.2x, based on the last close price of $93.01. Compared to both peers and the industry, this suggests an attractive entry point for investors seeking value.

The price-to-earnings ratio measures what investors are willing to pay for each dollar of earnings. For a fertilizer producer like CVR Partners, this multiple reflects the market’s expectations for sustainable profits and sector-specific risks. A lower ratio often means the market may be discounting the company’s future prospects.

Right now, CVR Partners’ price-to-earnings ratio is not just below the US Chemicals industry average of 26.3x but also below the peer average of 32x. This deep discount stands out, especially given CVR Partners’ strong earnings growth and competitive positioning within its sector.

See what the numbers say about this price, find out in our valuation breakdown. See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 11.2x (UNDERVALUED)

However, investors should remember that industry volatility or unexpected earnings declines could quickly change the favorable outlook for CVR Partners.

Find out about the key risks to this CVR Partners narrative.

Another View: The DCF Perspective

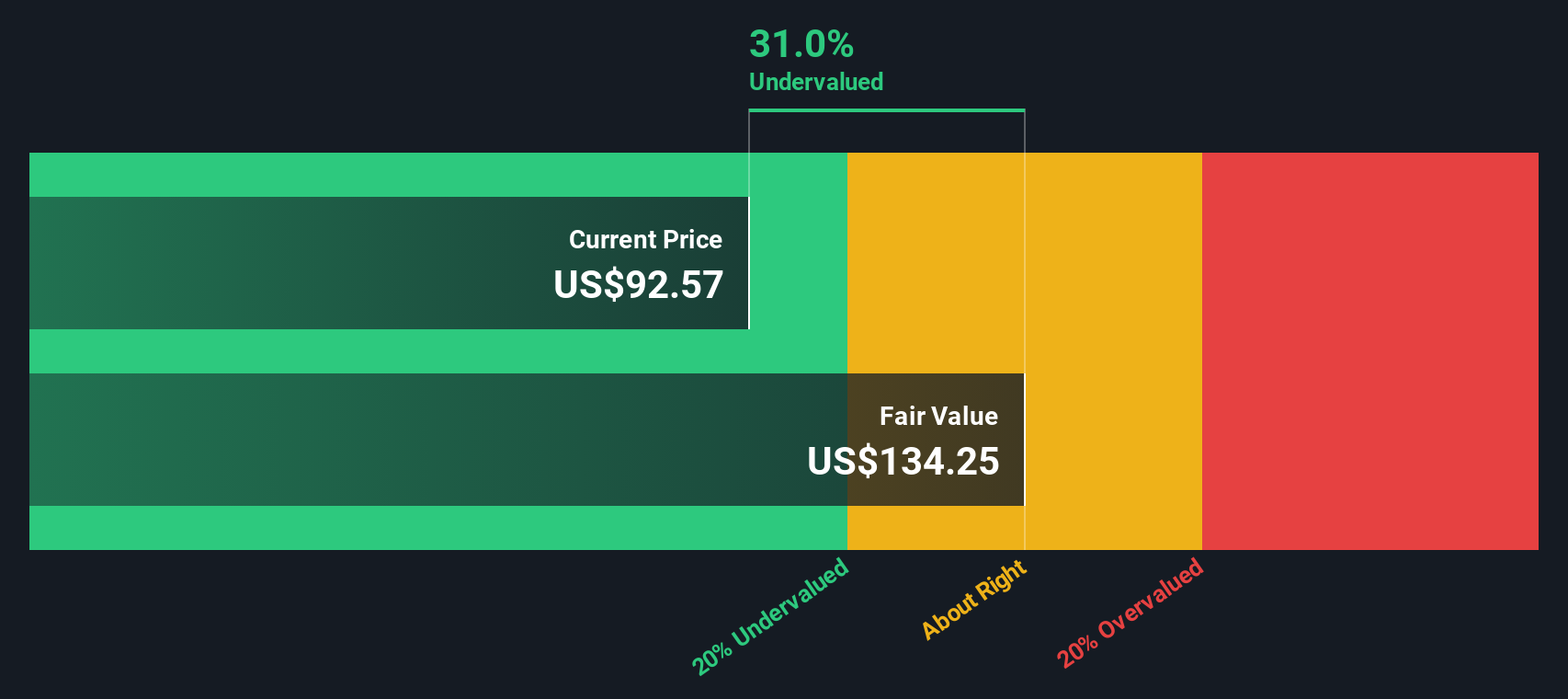

While the price-to-earnings comparison paints a picture of value, our DCF model tells a similar story. Based on discounted cash flow analysis, CVR Partners is trading 30.6% below its estimated fair value. This further supports its undervalued status. However, are both methods capturing the bigger picture, or is something hidden beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CVR Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CVR Partners Narrative

If you want a different perspective or enjoy diving into the numbers yourself, you can build your own view in just a few minutes. Do it your way.

A great starting point for your CVR Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

There is a world of stocks beyond CVR Partners that could match your ambitions. Rely on the Simply Wall Street Screener to spot fresh, credible investment ideas with strong fundamentals and real momentum.

- Uncover high-yield potential by checking out these 19 dividend stocks with yields > 3% which offers attractive returns for income-focused portfolios.

- Tap into tomorrow’s breakthrough innovations and technologies when you explore these 26 quantum computing stocks, a resource driving advancements in modern computing.

- Boost your strategy by finding these 887 undervalued stocks based on cash flows stocks trading at compelling discounts to their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UAN

CVR Partners

Engages in the production and sale of nitrogen fertilizer in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026