- United States

- /

- Metals and Mining

- /

- NYSE:TX

A Fresh Look at Ternium (NYSE:TX) Valuation After Steady Multi-Year Gains

Reviewed by Simply Wall St

See our latest analysis for Ternium.

After a vibrant run so far this year, Ternium's share price has notched a year-to-date return of 21.5 percent, with short-term momentum continuing to build following a strong 13.3 percent share price return over the last three months. Looking at the bigger picture, long-term investors have seen total shareholder returns of 56.8 percent over three years and an impressive 170.8 percent across five years. This demonstrates Ternium's ability to deliver steady value well beyond the latest headlines.

If you’re interested in finding other stocks on a solid growth path, now’s the perfect time to discover fast growing stocks with high insider ownership

With Ternium's recent momentum and robust multiyear gains, investors must weigh whether the current share price reflects untapped potential or if optimism about the company’s future growth is already fully factored in. Is there still room to buy?

Most Popular Narrative: Fairly Valued

With Ternium's fair value pegged at $35.31, almost identical to the recent closing price of $35.60, the current trading level leaves little margin between price and projected worth. The stage is set for a closer look into the key factors driving this view.

Substantial ongoing investment in the Pesqueria Industrial Center in Mexico is set to increase capacity by 1.5 million tons annually, with new cold rolling and galvanized lines starting ramp-up from late 2025 onward. This positions Ternium to capitalize on potential long-term demand growth from nearshoring and infrastructure projects, boosting future top-line growth and operational leverage.

Curious what bold assumptions are baked into this narrative? Want to uncover which growth levers and margin improvements could define Ternium’s next chapter? Intrigued by what financial bets lay behind the analysts’ consensus? Find out how high-stakes projections shape this fair value call. Dive in before the full story moves the market.

Result: Fair Value of $35.31 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global overcapacity and rising imports could pressure margins. In addition, high capital spending may strain Ternium’s earnings if demand underdelivers.

Find out about the key risks to this Ternium narrative.

Another View: Looking Through the DCF Lens

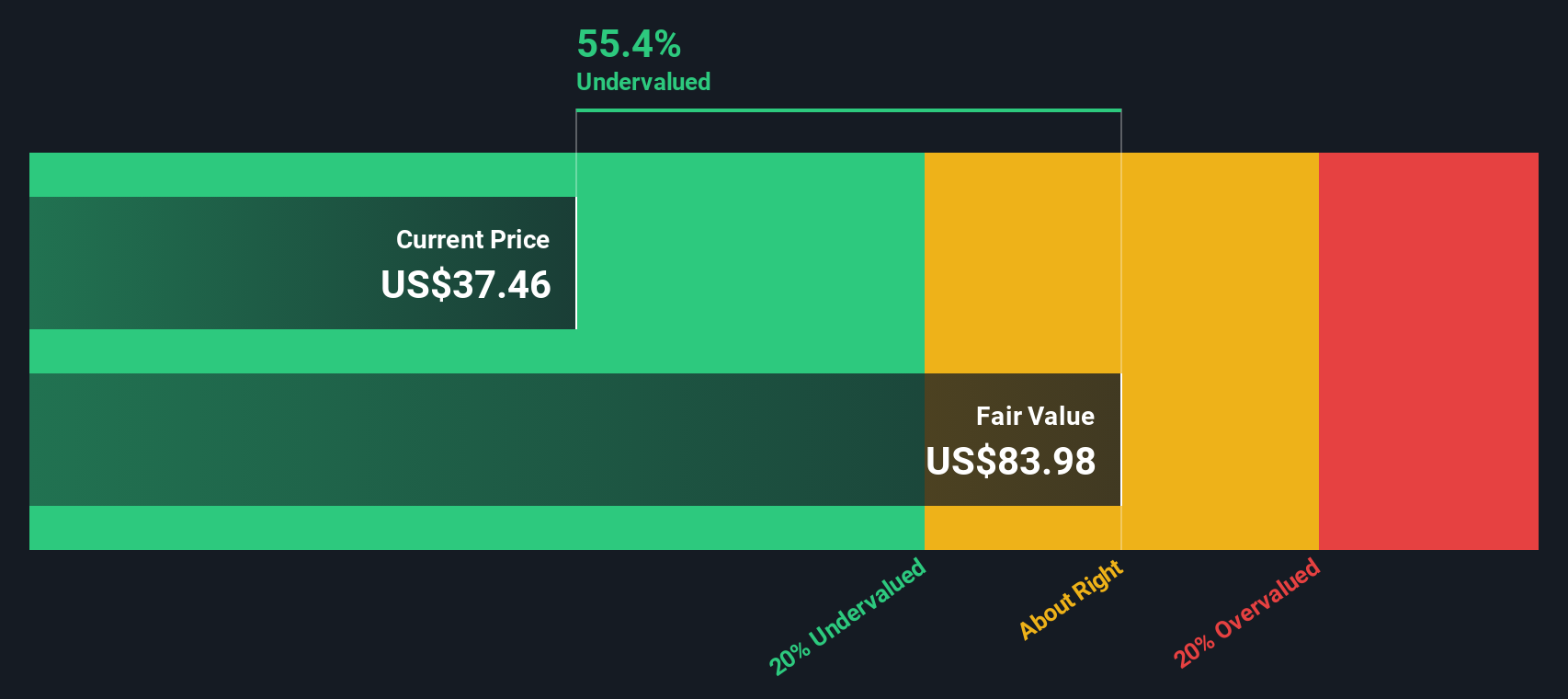

While analysts peg Ternium as fairly valued based on earnings multiples, our SWS DCF model tells a different story. It suggests Ternium is trading significantly below its estimated intrinsic value, which hints at possible undervaluation. Why does one method imply hidden upside while the other remains cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ternium Narrative

If you see the story differently or want a hands-on look at the numbers, you can build your own narrative in just minutes. Do it your way

A great starting point for your Ternium research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Get ahead of the curve and tap into new stock opportunities tailored to different strategies or emerging sectors. Take action today and don’t let winning ideas pass you by.

- Supercharge your search for regular income and stable growth by checking out these 17 dividend stocks with yields > 3% with impressive yields above 3%.

- Capitalize on the future of healthcare by investigating these 33 healthcare AI stocks, which is raising the bar with AI-driven medical advancements.

- Catch the next big wave in digital finance when you analyze these 80 cryptocurrency and blockchain stocks, as it rides the momentum in cryptocurrency and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ternium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TX

Ternium

Manufactures and distributes steel products in Mexico, Southern Region, Brazil, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives