- United States

- /

- Chemicals

- /

- NYSE:SQM

A Fresh Look at SQM (NYSE:SQM) Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Sociedad Química y Minera de Chile.

Sociedad Química y Minera de Chile’s recent 6% share price jump comes on the back of a steadily positive trend in 2024, with a year-to-date share price return of 20%. The stock’s momentum is building after a tough stretch, as reflected in its 12-month total shareholder return of nearly 8%. However, three-year total returns remain under pressure. Overall, investors are responding to renewed optimism around the company’s prospects and improving sentiment across the broader materials space.

If SQM’s renewed momentum sparks your curiosity, this is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

After recent gains and persistent upbeat sentiment, the real question is whether Sociedad Química y Minera de Chile’s run leaves it undervalued, or if the market has already priced in its future growth and potential upside.

Most Popular Narrative: 15% Undervalued

With the narrative's fair value estimate at $50.99, and Sociedad Química y Minera de Chile last closing at $43.35, the stage is set for a debate: does the market's skepticism miss key upside catalysts, or are some bullish assumptions a stretch?

Expansion of lithium and specialty chemical production capacity positions the company for sustained revenue and margin growth, supported by strong demand and tight global supply. Operational efficiency, diverse product streams, and rising barriers to entry protect the company's competitive strength and earnings resilience against market volatility.

Wondering what ambitious growth benchmarks underpin this valuation? Discover which bold revenue, margin, and earnings forecasts drive the narrative. The powerhouse financial assumptions may surprise you. See which big-picture projections are fueling bullish fair value calls.

Result: Fair Value of $50.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued lithium price volatility and regulatory uncertainties in Chile could challenge these upbeat forecasts and put pressure on SQM’s future earnings growth.

Find out about the key risks to this Sociedad Química y Minera de Chile narrative.

Another View: Is SQM Really This Cheap?

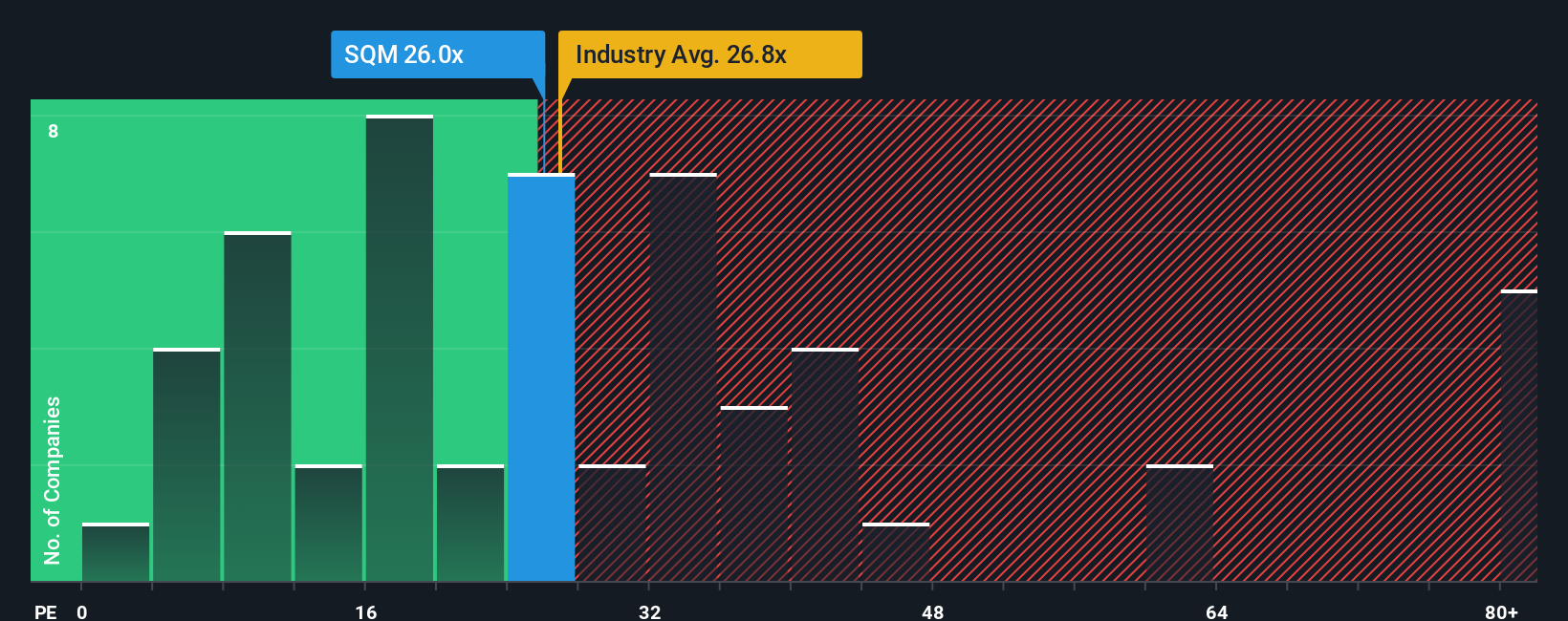

Looking at valuation from another angle, SQM's earnings multiple sits above both industry and peer averages, suggesting the stock could be priced for significant growth already. However, the fair ratio indicates that over the long term, the market might support an even higher multiple if growth meets expectations. Is there more upside ahead or are investors overlooking the risks?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sociedad Química y Minera de Chile for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sociedad Química y Minera de Chile Narrative

Prefer a hands-on approach or want to challenge these assumptions? You can explore the numbers and assemble your own view in just minutes by using Do it your way

A great starting point for your Sociedad Química y Minera de Chile research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the best opportunities slip by. Use the Simply Wall Street Screener to pinpoint stocks with serious growth potential and strong fundamentals, tailored for your next smart move.

- Catch rising trends with these 25 AI penny stocks, capitalizing on artificial intelligence breakthroughs and industry-defining innovation.

- Maximize your passive income by targeting these 18 dividend stocks with yields > 3%, offering yields above 3% for steady, growing payouts.

- Spot value others might miss and get ahead of the market with these 893 undervalued stocks based on cash flows, backed by robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SQM

Sociedad Química y Minera de Chile

Operates as a mining company worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives