- United States

- /

- Packaging

- /

- NYSE:SON

Sonoco (SON): $302.5M One-Off Loss Sparks Margin Debate Despite Earnings Growth Outpacing History

Reviewed by Simply Wall St

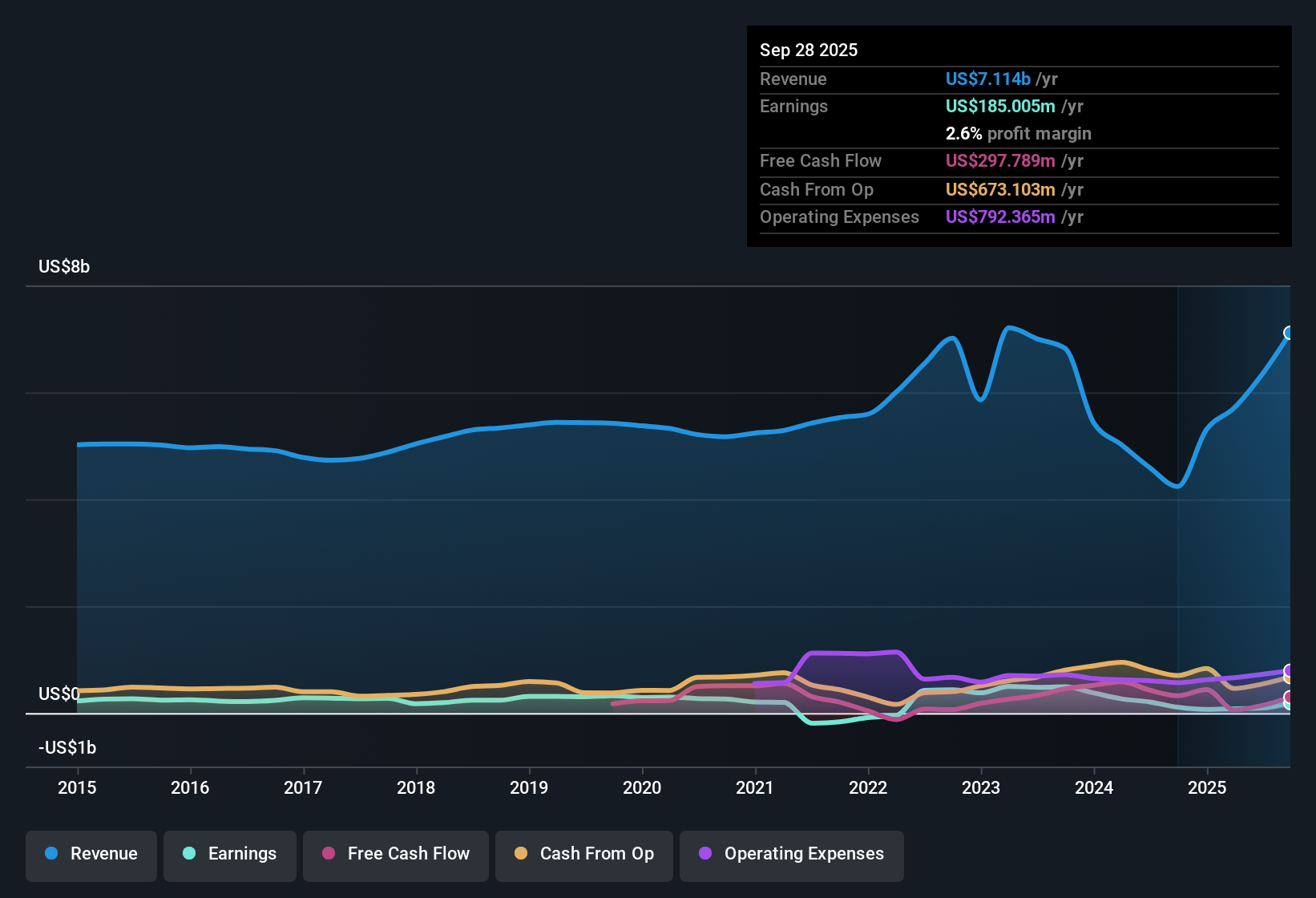

Sonoco Products (SON) reported a net profit margin of 2.6% for the past year, slightly below the prior year’s 2.8%, while posting impressive annual earnings growth of 42.5%. This result is well ahead of its five-year average of 7.4% per year. Despite earnings volatility from a one-off $302.5 million loss, forecasts call for earnings to climb 19.1% per year and revenue to grow at 4.3% per year, even as shares trade at a premium 22.1x price-to-earnings multiple. Investors now face a balancing act between the company’s robust profit outlook and recent margin compression and valuation concerns.

See our full analysis for Sonoco Products.Next up, we’ll put these earnings results in context by comparing them against the widely followed narratives. We will focus on where investor sentiment and the numbers match and where they diverge.

See what the community is saying about Sonoco Products

Synergy Targets Raised to $100 Million by 2026

- Management expects to realize $100 million or more in cost savings from recent acquisitions and productivity initiatives by 2026, an increase from the previously targeted $40 to $50 million.

- Analysts’ consensus view highlights how these new synergy targets, combined with automation and an optimized footprint, are expected to strengthen EBITDA and support improving profit margins.

- Consensus notes long-term runway for procurement and operational efficiencies, especially following the SMP EMEA (Eviosys) deal, which is projected to drive top-line synergies in both the US and Europe.

- Analysts point to ongoing $65 million and above productivity initiatives and cost elimination from divestitures as supporting evidence for margin expansion beyond current levels.

Revenue Growth Outpacing US Market Expectations

- While Sonoco’s revenue is forecast to grow at 4.3% per year, which trails the broader US market’s 10%, analysts model a much higher 9.5% annual growth for the next three years, substantially lifting expectations.

- Analysts’ consensus view calls out Sonoco’s expanding premium and sustainable packaging lines as catalysts for higher organic volume growth.

- New contract wins, including a 400 million unit pet food can deal and a five-year specialty powder nutrition project, are expected to drive above-market revenue growth into 2026 and beyond.

- Consensus also connects Sonoco’s ability to secure sustainability awards and long-term contracts to increased pricing power and share gains in core product lines.

Share Price Discount to Analysts’ Target

- With shares trading at $41.43, Sonoco’s price sits well below the $55.63 analyst consensus target, implying more than 34% upside if forecasts play out as expected.

- Analysts’ consensus view suggests valuation tension: although the company screens expensive relative to the global packaging industry on a price-to-earnings basis (22.1x vs 16x), the current share price is below most fair value estimates and consensus targets.

- Consensus notes that despite headline risks like a nonrecurring $302.5 million loss and ongoing integration challenges, investors are weighing robust profit growth outlooks against margin compression and quality concerns.

- This disconnect presents both risk and opportunity depending on whether Sonoco can deliver on its cost-saving and growth commitments.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sonoco Products on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something unique in the results? Share your viewpoint and craft a personal narrative in just a few minutes. Do it your way.

A great starting point for your Sonoco Products research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite robust growth forecasts, Sonoco faces valuation pressures and margin compression. Shares are trading above industry averages, and profit margins are under strain.

If you want more attractive entry points and fewer premium-price worries, discover these 876 undervalued stocks based on cash flows offering strong upside with lower valuation risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SON

Sonoco Products

Designs, develops, manufactures, and sells various engineered and sustainable packaging products in the United States, Europe, Canada, the Asia Pacific, and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)