- United States

- /

- Paper and Forestry Products

- /

- NYSE:SLVM

Here's Why We Think Sylvamo (NYSE:SLVM) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Sylvamo (NYSE:SLVM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Sylvamo with the means to add long-term value to shareholders.

Check out our latest analysis for Sylvamo

How Quickly Is Sylvamo Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Sylvamo has managed to grow EPS by 25% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied. Getting in to the the finer details, it important to know that the EPS growth has been helped by share buybacks, demonstrating that the business is positioned to return capital to its shareholders.

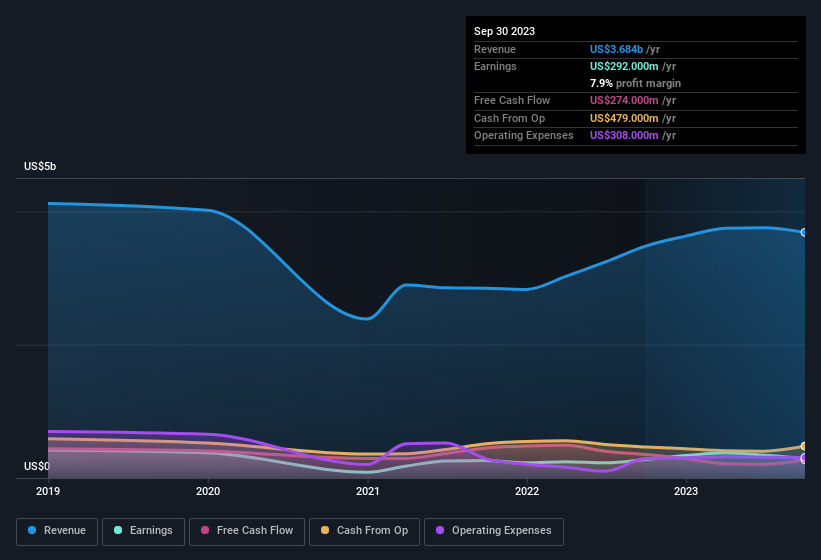

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Sylvamo maintained stable EBIT margins over the last year, all while growing revenue 5.9% to US$3.7b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Sylvamo Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Sylvamo insiders both bought and sold shares over the last twelve months, but they did end up spending US$8.9k more on stock than they received from selling it. When you weigh that up, it is a mild positive, indicating increased alignment between shareholders and management. We also note that it was the Independent Director, Karl Meyers, who made the biggest single acquisition, paying US$492k for shares at about US$49.17 each.

Does Sylvamo Deserve A Spot On Your Watchlist?

For growth investors, Sylvamo's raw rate of earnings growth is a beacon in the night. The growth rate should be enticing enough to consider researching the company, and the insider buying is a great added bonus. To put it succinctly; Sylvamo is a strong candidate for your watchlist. We don't want to rain on the parade too much, but we did also find 3 warning signs for Sylvamo (1 is a bit concerning!) that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Sylvamo, you'll probably love this curated collection of companies in the US that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SLVM

Sylvamo

Produces and markets uncoated freesheet for cutsize, offset paper, and pulp in Europe, Latin America, and North America.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)