- United States

- /

- Software

- /

- NasdaqGM:DOMO

Exploring 3 Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

The United States market has shown robust performance recently, climbing 3.4% in the last week and rising 14% over the past year, with earnings anticipated to grow by 15% annually in the coming years. In such an environment, identifying small-cap stocks with potential for growth can be particularly appealing, especially when combined with insider buying signals that may indicate confidence from those closest to the company.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | NA | 0.5x | 39.50% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | 46.25% | ★★★★★☆ |

| Citizens & Northern | 11.1x | 2.7x | 47.24% | ★★★★☆☆ |

| Southside Bancshares | 10.0x | 3.5x | 41.82% | ★★★★☆☆ |

| S&T Bancorp | 10.9x | 3.8x | 42.07% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 32.68% | ★★★★☆☆ |

| Standard Motor Products | 11.9x | 0.4x | -2229.43% | ★★★☆☆☆ |

| Farmland Partners | 9.2x | 9.3x | -17.66% | ★★★☆☆☆ |

| BlueLinx Holdings | 15.5x | 0.2x | -88.64% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -364.79% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Domo (DOMO)

Simply Wall St Value Rating: ★★★☆☆☆

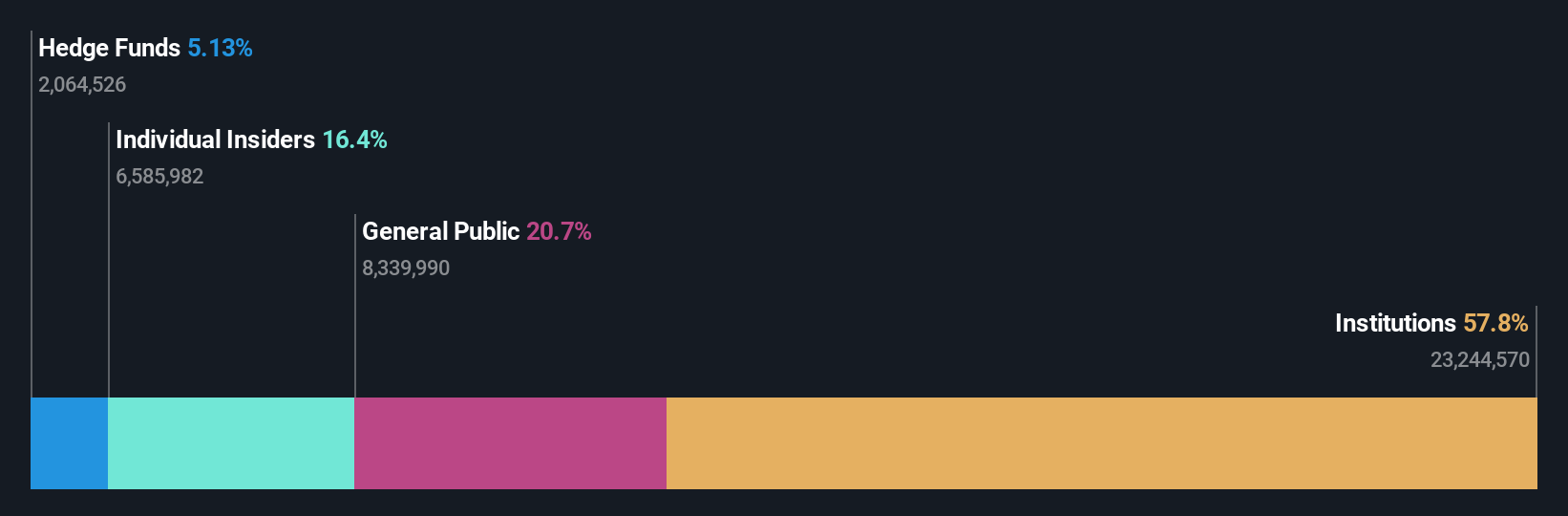

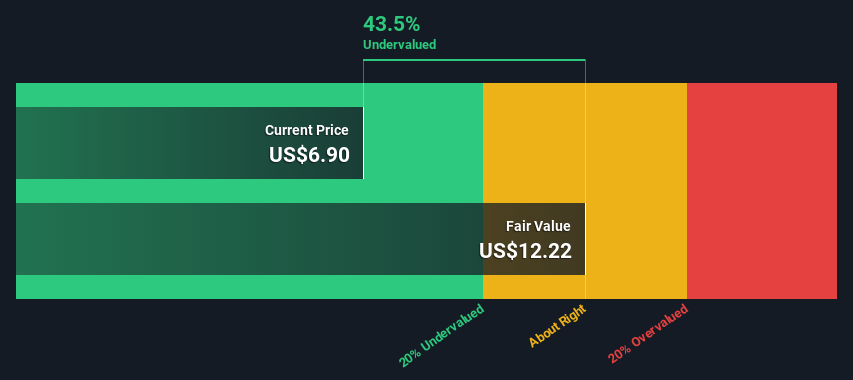

Overview: Domo is a software company that specializes in business intelligence and data visualization solutions, with a market cap of approximately $0.54 billion.

Operations: The company generates its revenue primarily from the Software & Programming segment, with a recent figure of $317.05 million. Over time, the gross profit margin has shown an upward trend, reaching 76.56% as of October 2023. The cost structure includes significant expenses in sales and marketing as well as research and development, contributing to its net income losses over multiple periods.

PE: -7.6x

Domo, a smaller company in the tech industry, has recently been added to multiple Russell indices, highlighting its potential for value recognition. Despite being unprofitable and reliant on external borrowing, recent partnerships with Snowflake and Burbio showcase its strategic focus on AI-driven analytics solutions. Revenue for Q1 2025 was US$80 million with a reduced net loss of US$18 million compared to the previous year. These developments suggest a focus on expanding data capabilities and market presence amidst financial challenges.

- Take a closer look at Domo's potential here in our valuation report.

Explore historical data to track Domo's performance over time in our Past section.

Herbalife (HLF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Herbalife is a global nutrition company that develops and sells dietary supplements, personal care products, and weight management solutions through a network of independent distributors, with a market cap of approximately $1.72 billion.

Operations: Herbalife's revenue streams are primarily derived from the United States, India, Mexico, China, and other regions. The company's gross profit margin shows a downward trend over the years, reaching 44.37% in June 2024. Operating expenses consistently form a significant portion of costs, with general and administrative expenses being the largest component.

PE: 3.2x

Herbalife, a company with a notable presence in the dietary supplement industry, recently experienced changes impacting its market positioning. Dropped from several Russell 2000 indices on June 28, 2025, it faces challenges yet continues to show potential. The redemption of US$50 million in senior notes indicates active debt management. Although earnings guidance for 2025 suggests modest growth, first-quarter results showed improved net income at US$50.4 million compared to last year. Herbalife's AOAC certification for aloe vera products underscores its commitment to quality and innovation in product safety standards across global markets.

- Delve into the full analysis valuation report here for a deeper understanding of Herbalife.

Gain insights into Herbalife's historical performance by reviewing our past performance report.

Ryerson Holding (RYI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ryerson Holding operates as a metals service center, providing a wide range of metal products and processing services, with a market capitalization of approximately $1.43 billion.

Operations: The company primarily generates revenue from its Metals Service Centers, with a recent quarterly revenue of $4.50 billion. The cost of goods sold (COGS) for the same period was $3.67 billion, resulting in a gross profit of $821 million and a gross profit margin of 18.26%. Operating expenses totaled $784.9 million, which includes general and administrative expenses and sales & marketing costs among others.

PE: -107.8x

Ryerson Holding's recent activities highlight its potential as an undervalued opportunity in the U.S. market. The company declared a quarterly dividend of US$0.1875 per share, reflecting stable returns for investors despite reporting a net loss of US$5.6 million for Q1 2025, down from US$7.6 million in the previous year. Notably, insider confidence is evident with Stephen Larson acquiring 10,000 shares valued at US$225,000 in April 2025, indicating belief in future prospects despite current challenges like reliance on external borrowing and insufficient earnings to cover interest payments fully.

- Click here to discover the nuances of Ryerson Holding with our detailed analytical valuation report.

Examine Ryerson Holding's past performance report to understand how it has performed in the past.

Key Takeaways

- Click this link to deep-dive into the 81 companies within our Undervalued US Small Caps With Insider Buying screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:DOMO

Domo

Operates a cloud-based modern AI and data products platform in North America, Western Europe, Australia, Japan, and India.

Fair value low.

Similar Companies

Market Insights

Community Narratives