- United States

- /

- Chemicals

- /

- NYSE:RYAM

Returns Are Gaining Momentum At Rayonier Advanced Materials (NYSE:RYAM)

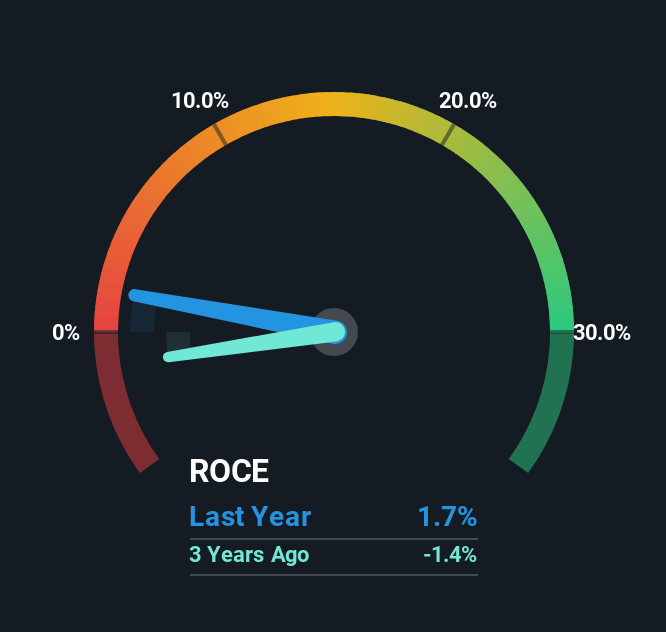

What are the early trends we should look for to identify a stock that could multiply in value over the long term? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. With that in mind, we've noticed some promising trends at Rayonier Advanced Materials (NYSE:RYAM) so let's look a bit deeper.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Rayonier Advanced Materials:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.017 = US$24m ÷ (US$1.8b - US$372m) (Based on the trailing twelve months to June 2025).

Therefore, Rayonier Advanced Materials has an ROCE of 1.7%. In absolute terms, that's a low return and it also under-performs the Chemicals industry average of 9.3%.

Check out our latest analysis for Rayonier Advanced Materials

Above you can see how the current ROCE for Rayonier Advanced Materials compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for Rayonier Advanced Materials .

What Does the ROCE Trend For Rayonier Advanced Materials Tell Us?

Like most people, we're pleased that Rayonier Advanced Materials is now generating some pretax earnings. While the business is profitable now, it used to be incurring losses on invested capital five years ago. Additionally, the business is utilizing 35% less capital than it was five years ago, and taken at face value, that can mean the company needs less funds at work to get a return. The reduction could indicate that the company is selling some assets, and considering returns are up, they appear to be selling the right ones.

What We Can Learn From Rayonier Advanced Materials' ROCE

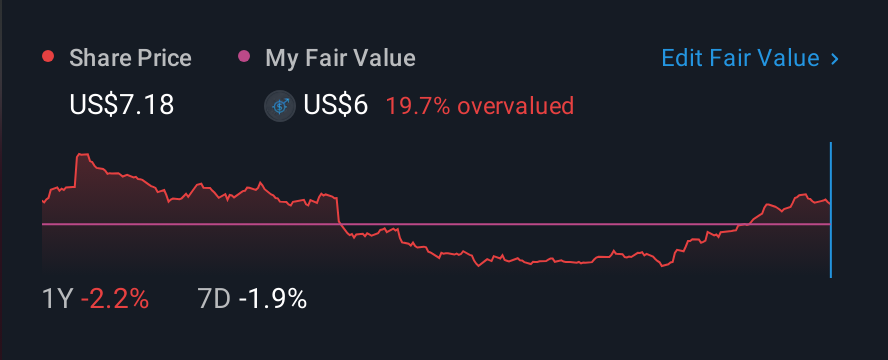

From what we've seen above, Rayonier Advanced Materials has managed to increase it's returns on capital all the while reducing it's capital base. And investors seem to expect more of this going forward, since the stock has rewarded shareholders with a 70% return over the last five years. In light of that, we think it's worth looking further into this stock because if Rayonier Advanced Materials can keep these trends up, it could have a bright future ahead.

One more thing, we've spotted 1 warning sign facing Rayonier Advanced Materials that you might find interesting.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RYAM

Rayonier Advanced Materials

Manufactures and sells cellulose specialty products in the United States, China, Europe, Japan, rest of Asia, Canada, Latin America, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026