- United States

- /

- Metals and Mining

- /

- NYSE:RS

How Analyst Optimism on Q1 Results at Reliance (RS) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Reliance Industries Limited recently announced its Q1 FY2026 results after market close, with investors closely monitoring updates on its Rs 75,000 crore new energy investment, retail expansion, and telecom strategies.

- Analyst expectations of an earnings beat and a positive outlook on the company’s major growth initiatives have drawn strong investor attention ahead of the results.

- To understand the impact of analyst optimism about an earnings beat, we’ll now examine how this could reshape Reliance’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Reliance Investment Narrative Recap

To be a Reliance shareholder, it's essential to believe in the company's ability to drive growth through its diversified business portfolio, including energy, retail, and telecom. The latest expectation of an earnings beat, highlighted by a positive Earnings ESP and recent analyst upgrades, points to earnings as a short-term catalyst, but does not materially alter the company's most significant risk: ongoing macro and policy uncertainties that could affect expansion plans.

Among Reliance's latest announcements, the plan to raise up to Rs 6,000 crore via equity or equity-linked instruments and an additional Rs 3,000 crore in debentures stands out. This move is especially relevant in the context of growth catalysts, as access to additional capital could influence the pace of new energy investments and retail expansion at a time when investor focus is shifting to upcoming results.

However, investors should not lose sight of the risks that could slow Reliance’s acquisition pipeline if macro conditions shift, especially given that...

Read the full narrative on Reliance (it's free!)

Reliance's narrative projects $15.4 billion revenue and $1.0 billion earnings by 2028. This requires 3.9% yearly revenue growth and a $228 million earnings increase from $772 million today.

Uncover how Reliance's forecasts yield a $320.41 fair value, a 5% downside to its current price.

Exploring Other Perspectives

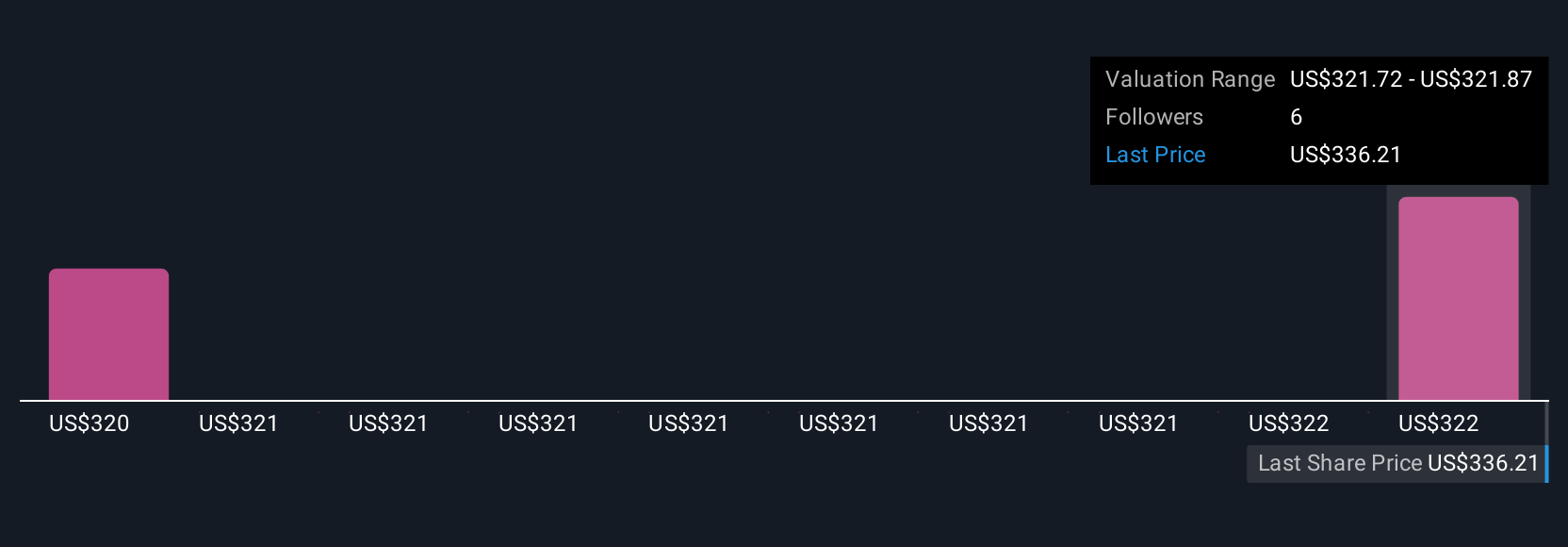

Simply Wall St Community members provided two fair value estimates for Reliance between Rs 320.41 and Rs 321.94, showing closely aligned views. Yet, with ongoing macroeconomic uncertainty threatening growth plans, investors may find it valuable to compare such perspectives to their own assumptions.

Explore 2 other fair value estimates on Reliance - why the stock might be worth just $320.41!

Build Your Own Reliance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reliance research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Reliance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reliance's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RS

Reliance

Operates as a diversified metal solutions provider and metals service center company primarily in the United States and Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives