- United States

- /

- Chemicals

- /

- NYSE:RPM

RPM International (RPM): Assessing Valuation as Share Price Momentum Cools

Reviewed by Kshitija Bhandaru

RPM International (RPM) saw its shares edge up slightly in the latest session, closing at $116.83. Over the past month, the stock is down about 5%, yet it is still showing strong gains when viewed over the past 3 years.

See our latest analysis for RPM International.

Although RPM International’s share price has pulled back over the past month, momentum remains intact considering the 3-year total shareholder return of more than 35%. With performance cooling off in the near term, investors are watching for catalysts that could revive the company’s upward trend.

If RPM’s recent moves have you thinking bigger picture, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With RPM International’s shares trading below analyst price targets and recent gains appearing to slow, the question remains: Is this pause an attractive entry point for buyers, or is the company’s future growth already reflected in the price?

Most Popular Narrative: 13% Undervalued

At $116.83, RPM International is trading below the fair value price proposed by the most-followed investment narrative. This sets up a scenario that contrasts recent share consolidation with forward-looking optimism.

Ongoing investment in turnkey systems and solutions for high-performance buildings, combined with a shift from component sales to integrated asset management offerings and expansion in developing markets, aligns well with the rising demand for renovation and maintenance of aging global infrastructure. This is likely to produce sustained top-line growth and support recurring revenues.

Curious what’s behind that bullish fair value? Dive in to uncover the bold projections, including new verticals, margin lifts, and a massive overhaul in business mix, that are driving this standout price target. Clues within the full narrative reveal the financial linchpins that could make or break this outlook.

Result: Fair Value of $134.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent consumer weakness or higher input costs could put pressure on RPM’s profit margins and present challenges to achieving sustained top-line growth.

Find out about the key risks to this RPM International narrative.

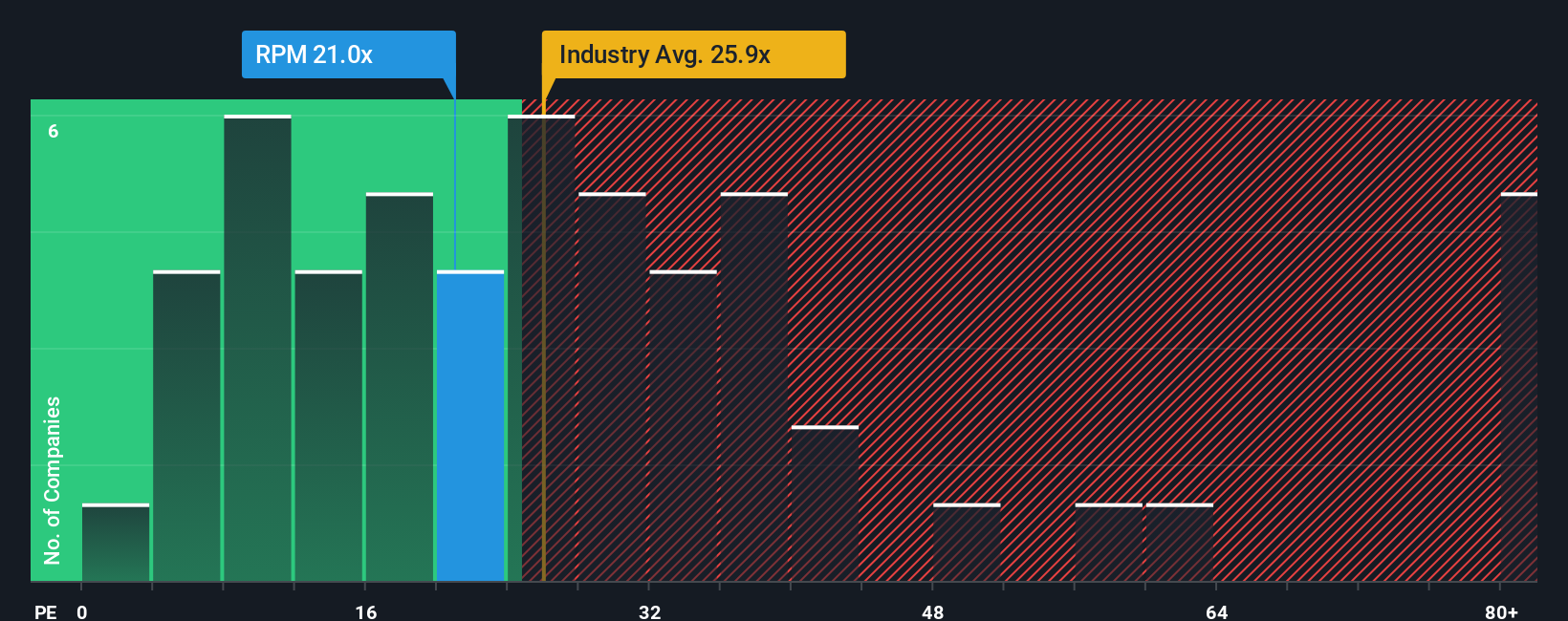

Another View: Multiples Tell a Different Story

While fair value estimates suggest RPM shares are undervalued, market-based valuation using the price-to-earnings ratio tells a different story. RPM trades at 21.8 times earnings, which is higher than the peer average of 17.4 and also above its fair ratio of 19.8. This raises questions about whether investors are paying a premium for quality or overlooking valuation risk. Is the market setting up for a pullback, or does this premium signal lasting appeal?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RPM International Narrative

If you see things differently or want to dig deeper into the numbers, you can craft your own take in just a few minutes. Do it your way.

A great starting point for your RPM International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize your edge by expanding beyond RPM International. The market moves fast, and the next big performer could be just a click away.

- Uncover overlooked potential by scanning for value bargains among these 901 undervalued stocks based on cash flows with stable cash flows and strong fundamentals supporting unexpected growth.

- Tap into innovation by spotting emerging trends in healthcare with these 31 healthcare AI stocks, where advanced AI is transforming patient outcomes and shaping investment opportunities.

- Target reliable income streams by focusing on these 19 dividend stocks with yields > 3% that consistently deliver yields above 3%, an option if you want steadier gains even when markets get volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RPM

RPM International

Provides specialty chemicals for the construction, industrial, specialty, and consumer markets.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives