- United States

- /

- Packaging

- /

- NYSE:PKG

Should You Reassess Packaging Corporation of America Stock After Recent Price Slides in 2025?

Reviewed by Bailey Pemberton

If you have been watching Packaging Corporation of America’s stock lately, you might be wondering if now is the right time to take action. The company’s shares have been on quite a journey, drifting down by 0.8% over the last week and 2.6% this past month, with a 4.8% drop since the start of the year. Yet, when you zoom out, it is a different story. Looking back over five years, the stock boasts an impressive 113.7% return. Even the one-year and three-year returns, at 3.0% and 105.3% respectively, suggest this is no ordinary packaging company.

So what is driving this mix of recent volatility and long-term growth? Industry players, investors, and market watchers are all considering shifts in market demand and longer-term trends in packaging and logistics, leading to both short bursts of uncertainty and long stretches of strong performance for PCA. These moves have caught the eye of value-focused investors, who are looking past the daily ups and downs and focusing on what the company is actually worth today.

According to our valuation scoring system, Packaging Corporation of America currently earns a value score of 3 out of 6, meaning it meets the undervaluation criteria in half of the key categories we check. Is that enough to justify investing, or just a sign to keep watching? Let’s break down each valuation method to see what is really driving that score. Stay tuned, because there is an even smarter approach to understanding what PCA is worth that we will cover at the end of this article.

Approach 1: Packaging Corporation of America Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and then discounting them back to today’s dollars. For Packaging Corporation of America, this approach considers the cash the business is expected to generate for shareholders over time and adjusts for the time value of money.

PCA’s latest reported Free Cash Flow stands at $629.5 million. Analyst estimates forecast steady growth over the coming years, with Free Cash Flow expected to reach $1.33 billion by the end of 2029. Estimates from 2026 through 2029 are supported by analyst coverage and longer-term trends are projected based on industry estimates.

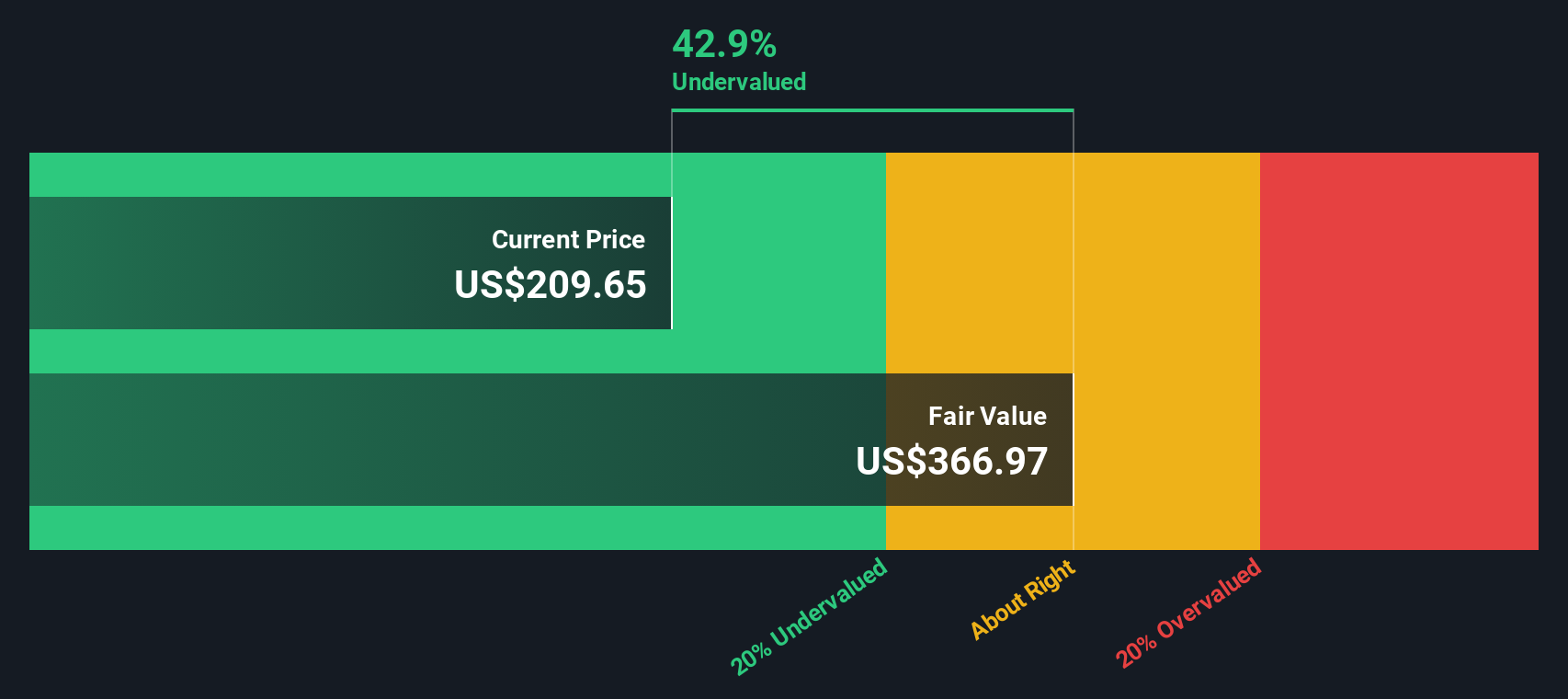

Taking all of these projections and discounting those values to the present gives an estimated intrinsic value of $379.02 per share. This valuation implies that, at current prices, PCA stock is trading at a 43.4% discount to its intrinsic worth.

In summary, this model suggests the shares are significantly undervalued at today’s price, which may appeal to patient, value-focused investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Packaging Corporation of America is undervalued by 43.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Packaging Corporation of America Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Packaging Corporation of America because it reflects how much investors are willing to pay for each dollar of earnings. When a company is consistently generating solid profits, the PE ratio helps investors quickly assess whether the stock is priced attractively compared to its earnings power.

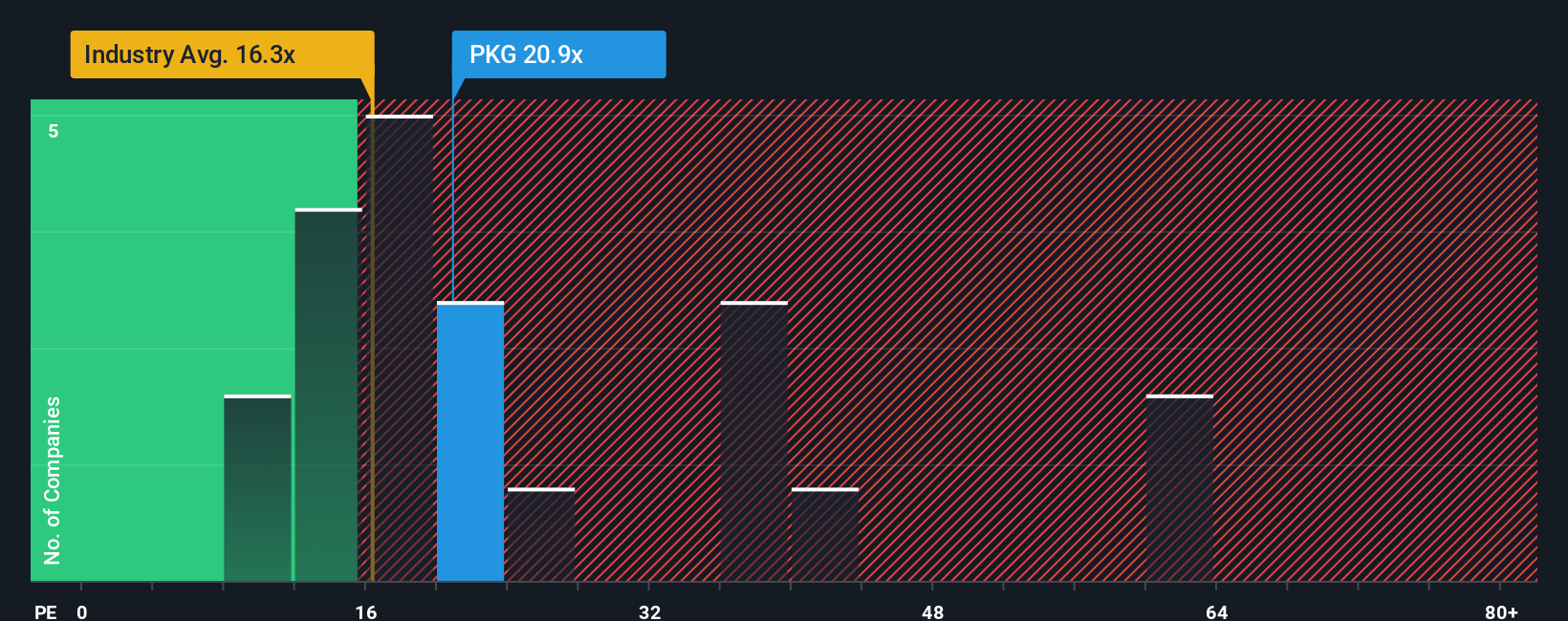

Generally, companies with higher expected growth, stronger profit margins, or lower risk profiles can justify higher PE ratios. Those facing headwinds or greater uncertainty may see their fair multiples trend lower. Industry benchmarks offer some context as well. Packaging Corporation of America trades at 21.3x earnings, higher than the packaging industry average of 16.2x but well below its peer average of 31.9x. On the surface, this could make PCA appear reasonably priced or even a potential bargain compared to similar stocks.

However, Simply Wall St's proprietary "Fair Ratio" goes a step further by tailoring the benchmark to Packaging Corporation of America's specific fundamentals, such as its earnings growth outlook, profit margins, size, and risk profile. For PCA, the Fair Ratio is 20.9x, nearly identical to its current PE ratio. This approach offers a more nuanced and company-specific way to judge valuation than simply measuring against industry or peer averages, providing a sharper picture of whether the stock is really under- or overvalued given its unique qualities.

With the actual PE at 21.3x and the Fair Ratio at 20.9x, the difference is minor, suggesting that PCA's stock price aligns well with its fundamentals at this time.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Packaging Corporation of America Narrative

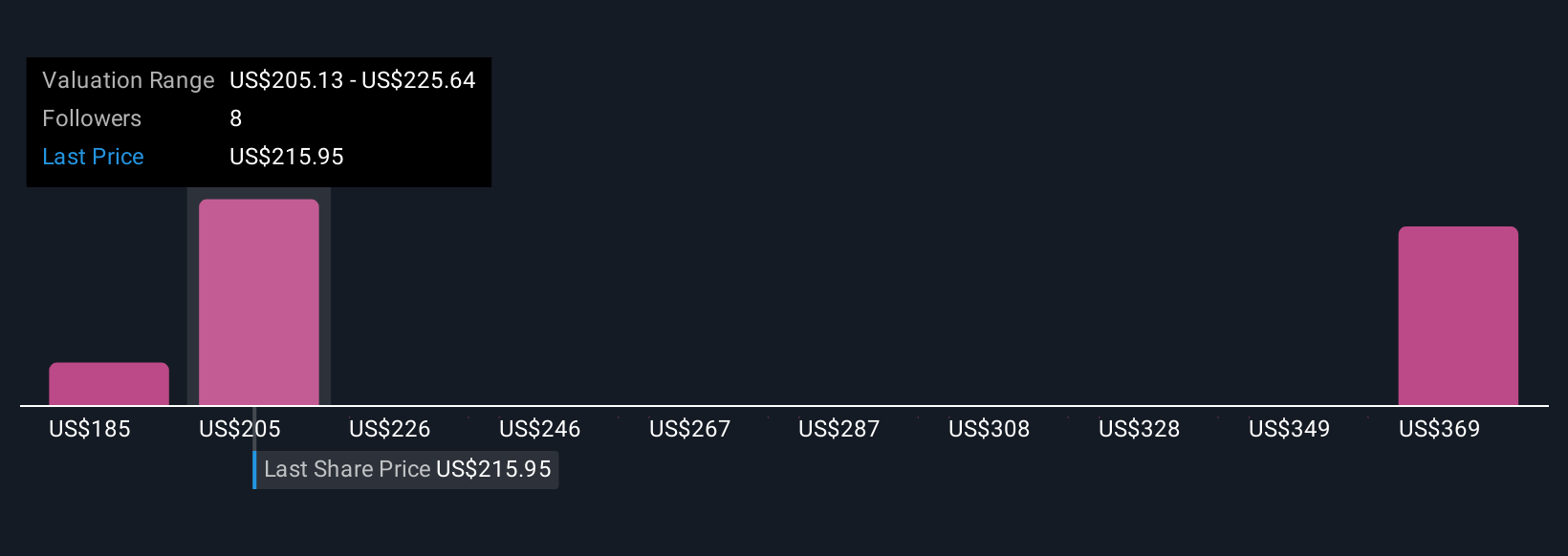

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a straightforward new approach that lets you shape the story behind a company's numbers by connecting your perspective, how you see future revenue, profit margins, and fair value estimates, to a real-time forecast and fair value calculation. By linking what is happening at Packaging Corporation of America to your own assumptions or outlook, you create a clear and personal roadmap from company story to financial outcome.

Narratives are easy to access on Simply Wall St's Community page and are used by millions of investors to help make sense of market moves. They let you visually compare your personalized Fair Value with the current share price, helping you decide when the odds look right to buy or sell. Plus, Narratives are dynamic, automatically updating as soon as new earnings or breaking news arrive so your view always reflects the latest facts.

For example, some investors see significant upside for Packaging Corporation of America, estimating a fair value of $244.00 per share thanks to expectations of improved operations and margins, while others take a more cautious view with a fair value as low as $152.00 due to concerns about costs and demand. This highlights just how uniquely your Narrative can fit your approach.

Do you think there's more to the story for Packaging Corporation of America? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PKG

Packaging Corporation of America

Manufactures and sells containerboard and uncoated freesheet (UFS) paper products in North America.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives