- United States

- /

- Packaging

- /

- NYSE:PACK

Ranpak Holdings (NYSE:PACK) shareholders are still up 54% over 3 years despite pulling back 12% in the past week

It's been a soft week for Ranpak Holdings Corp. (NYSE:PACK) shares, which are down 12%. On the other hand the share price is higher than it was three years ago. In that time, it is up 54%, which isn't bad, but not amazing either.

While this past week has detracted from the company's three-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Ranpak Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

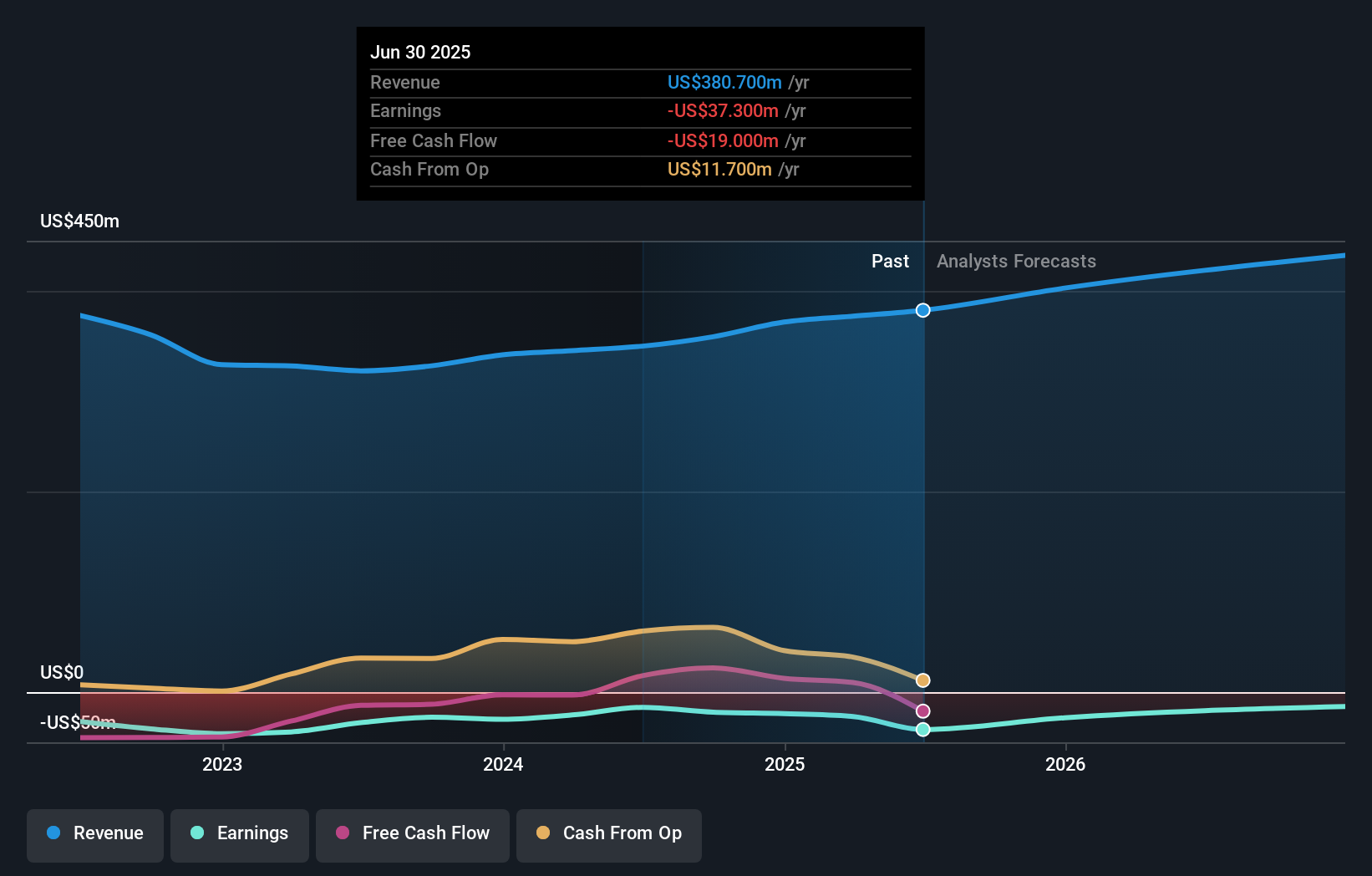

Ranpak Holdings' revenue trended up 2.8% each year over three years. Considering the company is losing money, we think that rate of revenue growth is uninspiring. The market doesn't seem too pleased with the revenue growth rate, given the modest 15% annual share price gain over three years. It seems likely that we'll have to zoom in on the data more closely to understand if there is an opportunity here.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Ranpak Holdings' financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 15% in the last year, Ranpak Holdings shareholders lost 21%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Ranpak Holdings is showing 3 warning signs in our investment analysis , and 1 of those is significant...

Of course Ranpak Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PACK

Ranpak Holdings

Provides product protection solutions and end-of-line automation solutions for e-commerce and industrial supply chains in North America, Europe, and Asia.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives