- United States

- /

- Chemicals

- /

- NYSE:OEC

Orion (OEC): Evaluating Valuation After 2025 EBITDA Guidance Cut and Strategic Shift Toward Cash Flow

Reviewed by Kshitija Bhandaru

Orion (NYSE:OEC) attracted attention after it lowered its adjusted EBITDA guidance for 2025, citing softer demand in Western markets, inventory revaluation tied to oil prices, and changes in product mix. The company is now prioritizing cash flow and debt reduction.

See our latest analysis for Orion.

Orion’s share price plunged 31.2% over the last month and is down 59.3% year-to-date, with its latest strategic pivot toward cash flow and debt reduction following a downward revision of its 2025 earnings guidance. Over the past year, the total shareholder return was -64.3%, highlighting how recent momentum has faded sharply even after a brief 1-day rebound. These moves suggest that investors have grown more cautious on Orion’s near-term prospects, even as management takes steps to adapt to shifting market conditions.

If Orion’s recent volatility has you rethinking your strategy, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With Orion trading at a steep discount to analyst targets and recent guidance resets, the pressing question is whether investors are looking at an undervalued recovery play, or if the market is already pricing in limited future growth potential.

Most Popular Narrative: 45.5% Undervalued

Orion’s latest close at $6.21 is well below the most widely followed narrative’s fair value estimate of $11.40. This frames the company as an undervalued opportunity based on forward-looking expectations mapped out by analysts.

The significant reduction in capital expenditures following 2025 should lead to a sharp improvement in free cash flow, which can be utilized for share buybacks, positively impacting earnings per share (EPS). The reshoring trend in tire manufacturing and increased localized supply chains could enhance demand for Orion's products, leading to potential revenue growth.

Want to uncover what’s fueling such a wide valuation gap? This narrative is powered by bold assumptions about profit margins, earnings growth, and Orion’s shift toward high-value markets. Intrigued by how these forecasts stack up? Find out what Wall Street believes will spark a turnaround. Read the full narrative for the inside story.

Result: Fair Value of $11.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand in Orion’s Rubber segment and continued currency headwinds could quickly undermine even the most optimistic recovery outlook.

Find out about the key risks to this Orion narrative.

Another View: Benchmarking Against Peers

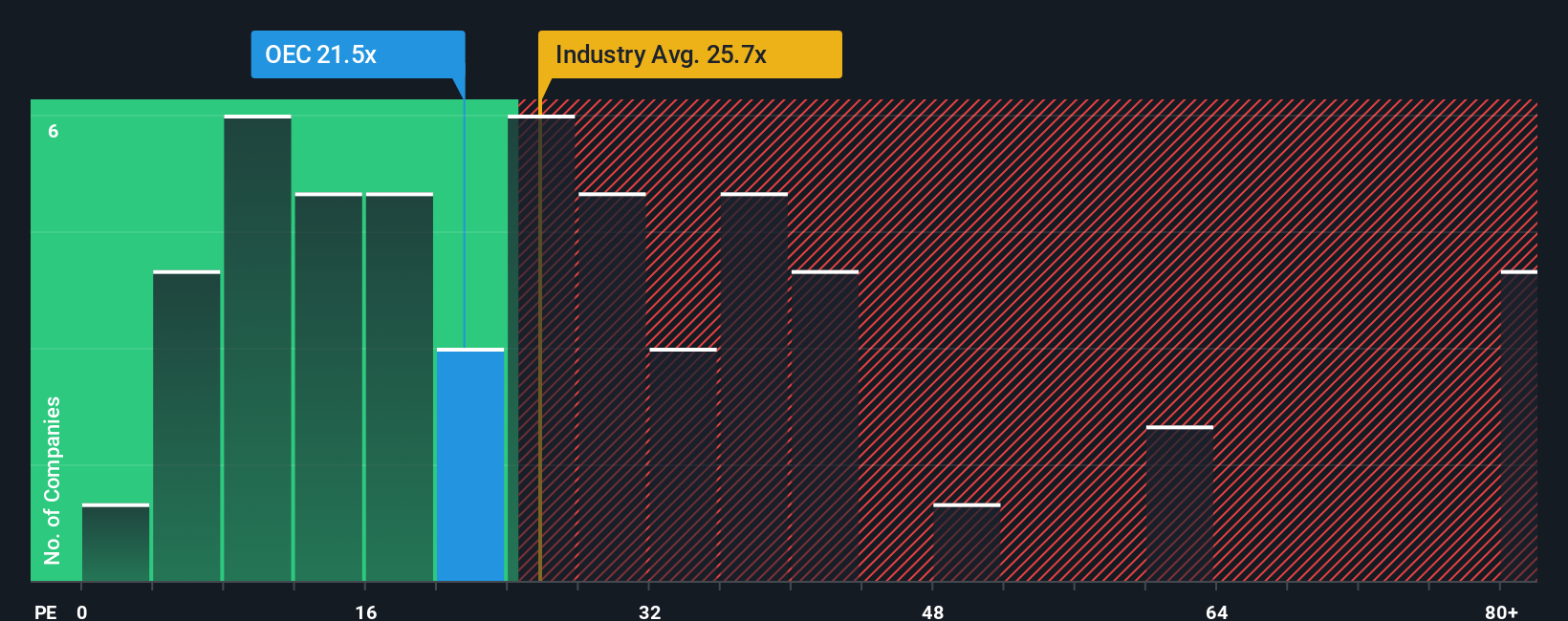

While many see Orion as undervalued, a check on its price-to-earnings ratio tells a more cautious story. Orion trades at 23.1 times earnings, which is higher than peers at 16 and the industry average of 25, but well below its fair ratio of 54.7. That gap suggests both risk and opportunity, depending on how the market shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Orion Narrative

If you see the numbers differently or want to dig deeper on your own terms, you can shape your own story in just a few minutes with Do it your way.

A great starting point for your Orion research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't miss out on a world of opportunities. Take the next step and level up your investing strategy with fresh ideas from specialist stock screeners on Simply Wall Street.

- Uncover unique growth potential by targeting these 3567 penny stocks with strong financials poised for strong financial performance and market breakthroughs.

- Boost your portfolio’s income with these 18 dividend stocks with yields > 3% featuring yields that could outpace standard returns and provide reliable cash flow.

- Capitalize on cutting-edge trends by tracking these 26 quantum computing stocks that put you at the forefront of innovation and the future of technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OEC

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)