- United States

- /

- Metals and Mining

- /

- NYSE:NUE

A Look at Nucor's Valuation as It Targets U.S. Nuclear Supply Chain Growth

Reviewed by Kshitija Bhandaru

Nucor (NUE) has just entered a strategic partnership with The Nuclear Company to help rebuild the U.S. nuclear supply chain. The goal is to support the next wave of American manufacturing and energy infrastructure expansion.

See our latest analysis for Nucor.

Momentum around Nucor has been shaped by its latest push into the nuclear sector, but share price returns have remained relatively muted, with the 1-year total shareholder return slipping about 0.06% despite heavy industry headlines. Over the past five years, however, Nucor’s total shareholder return is up over 200%, underscoring its long-term value for investors who believe in the revival of American manufacturing.

If this focus on critical industries inspires you, now is an excellent moment to broaden your watchlist and discover fast growing stocks with high insider ownership

With Nucor’s long-term strength but subdued recent returns, and new growth drivers on the horizon, the critical question for investors is whether today’s price reflects future opportunity or if the upside is already included in the current valuation.

Most Popular Narrative: 13% Undervalued

Based on analyst consensus, Nucor's fair value is anchored at $159.75 versus its last close of $139.02, highlighting a meaningful gap. The widely-followed narrative supports this view and ties future fair value to big strategic catalysts already underway.

Nucor's significant capital reinvestment of $860 million, with two-thirds directed towards projects commencing operations within two years, is expected to diversify and strengthen future earnings. This impacts revenue and net margins through enhanced production capacity and efficiencies.

Want to know why big money bets on Nucor's transformation? The real fuel for this price target comes from rapid growth, ambitious profitability goals, and a forward earnings multiple not seen in legacy steel names. Curious which aggressive forecasts are behind this bullish outlook? Jump in for details that could flip your view on the stock's future.

Result: Fair Value of $159.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharp fall in steel demand or setbacks in launching new facilities could quickly challenge the positive outlook for Nucor’s future performance.

Find out about the key risks to this Nucor narrative.

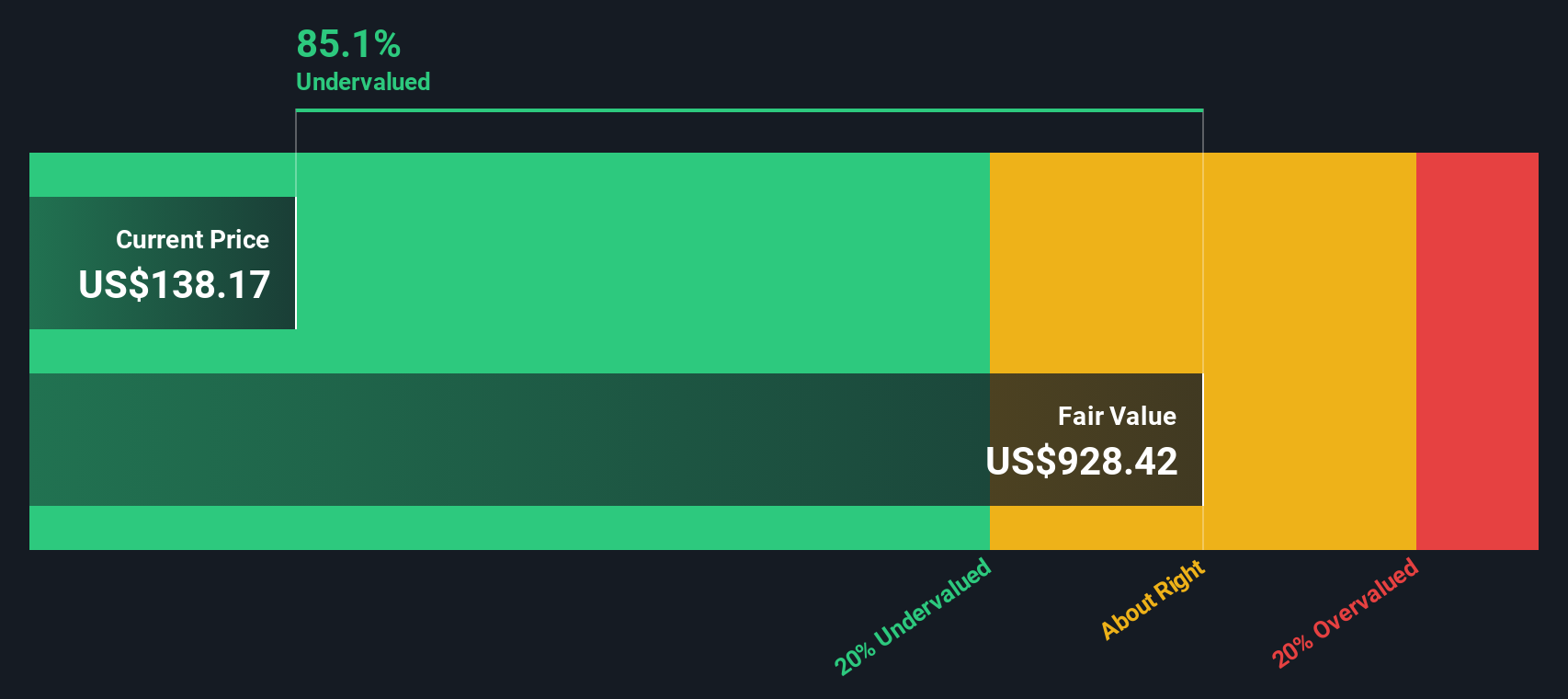

Another View: The SWS DCF Model

While analyst targets point to Nucor being undervalued by about 13%, our DCF model suggests the gap could be even more dramatic. The model estimates today’s price is 85% below its calculated fair value. This significant difference raises the question: which model better reflects reality, and can both be right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nucor Narrative

If you want to see what the numbers say for yourself or challenge the consensus story, it only takes a few minutes to build your own perspective. Do it your way

A great starting point for your Nucor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your momentum stop here. The best investment opportunities often come where few are looking, so seize the moment and broaden your horizons:

- Tap into future growth by checking out these 907 undervalued stocks based on cash flows which may offer compelling value before the rest of the market catches on.

- Capitalize on the surge in biotech innovation through these 31 healthcare AI stocks that is driving breakthroughs across healthcare and medical research.

- Capture regular income streams by exploring these 19 dividend stocks with yields > 3% with yields above 3%, ideal for building a resilient and rewarding portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nucor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUE

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives