- United States

- /

- Industrial REITs

- /

- NYSE:PLYM

Undervalued Small Caps With Insider Action In US For December 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a slight decline of 1.1%, yet it remains robust with a 22% increase over the past year and an anticipated annual earnings growth of 15%. In this context, identifying small-cap stocks that are perceived as undervalued and have insider action can be particularly appealing to investors looking for potential opportunities amidst fluctuating market dynamics.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| OptimizeRx | NA | 1.1x | 45.15% | ★★★★★☆ |

| German American Bancorp | 14.7x | 4.9x | 45.91% | ★★★★☆☆ |

| Quanex Building Products | 34.2x | 0.9x | 38.49% | ★★★★☆☆ |

| Franklin Financial Services | 9.4x | 1.9x | 40.80% | ★★★★☆☆ |

| McEwen Mining | 3.9x | 2.0x | 49.41% | ★★★★☆☆ |

| ProPetro Holding | NA | 0.6x | 37.82% | ★★★★☆☆ |

| Douglas Dynamics | 10.0x | 1.0x | -9.64% | ★★★☆☆☆ |

| ChromaDex | 280.9x | 4.6x | 35.36% | ★★★☆☆☆ |

| First United | 13.5x | 3.1x | 47.84% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

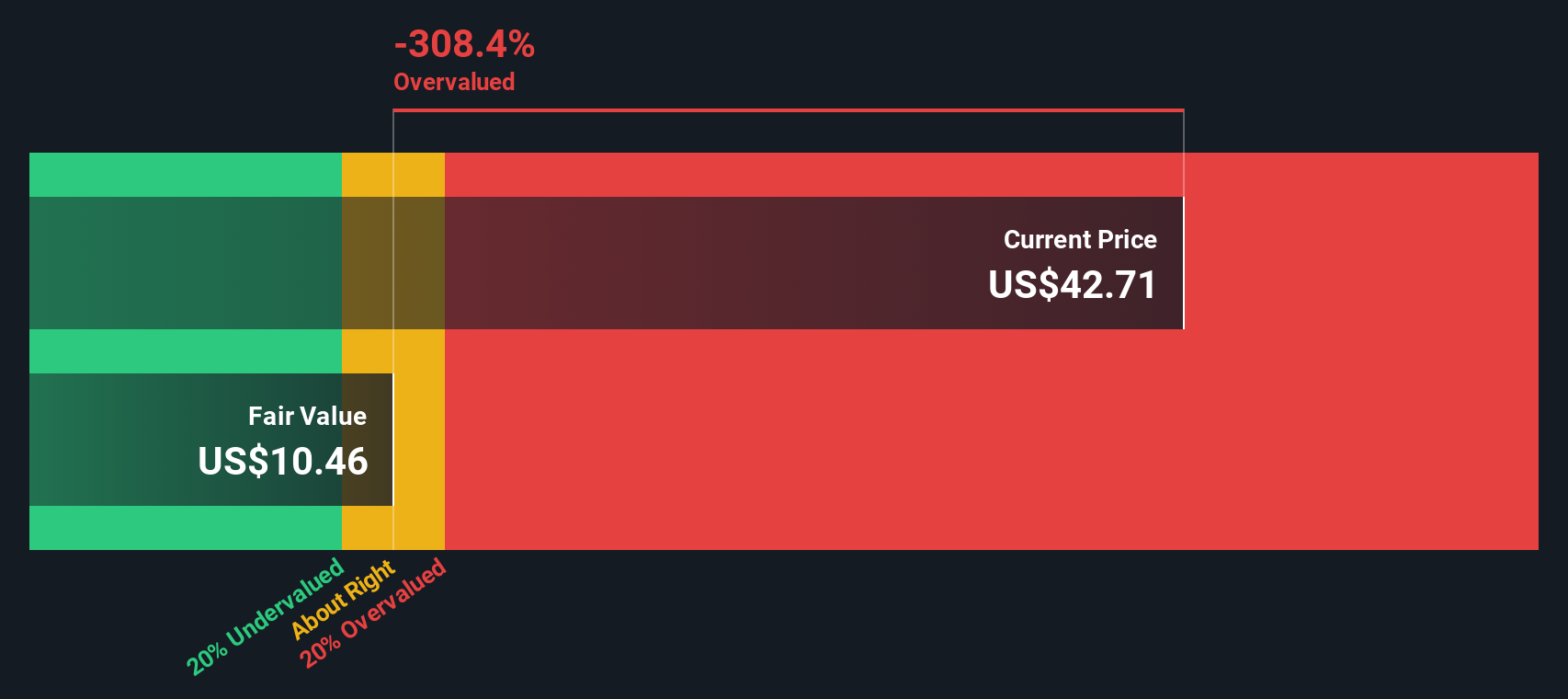

Semler Scientific (NasdaqCM:SMLR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Semler Scientific is a company that develops, manufactures, and markets diagnostic kits and equipment, with a market capitalization of $0.23 billion.

Operations: The company generates revenue primarily from diagnostic kits and equipment, with recent quarterly revenue reaching $58.94 million. Over the years, it has seen fluctuations in its gross profit margin, which was 88.05% most recently. Operating expenses are notable, with significant allocations towards sales and marketing as well as research and development activities.

PE: 29.3x

Semler Scientific, a small company in the U.S., has drawn attention for its insider confidence. Eric Semler purchased 50,000 shares worth US$1.9 million, increasing their stake by nearly 9%. Despite recent volatility and reliance on external borrowing, the company reported Q3 net income of US$5.6 million against last year's US$5.5 million. However, sales fell to US$13.51 million from US$16.32 million year-over-year, highlighting potential challenges ahead amidst growth opportunities in healthcare technology solutions.

- Click to explore a detailed breakdown of our findings in Semler Scientific's valuation report.

Assess Semler Scientific's past performance with our detailed historical performance reports.

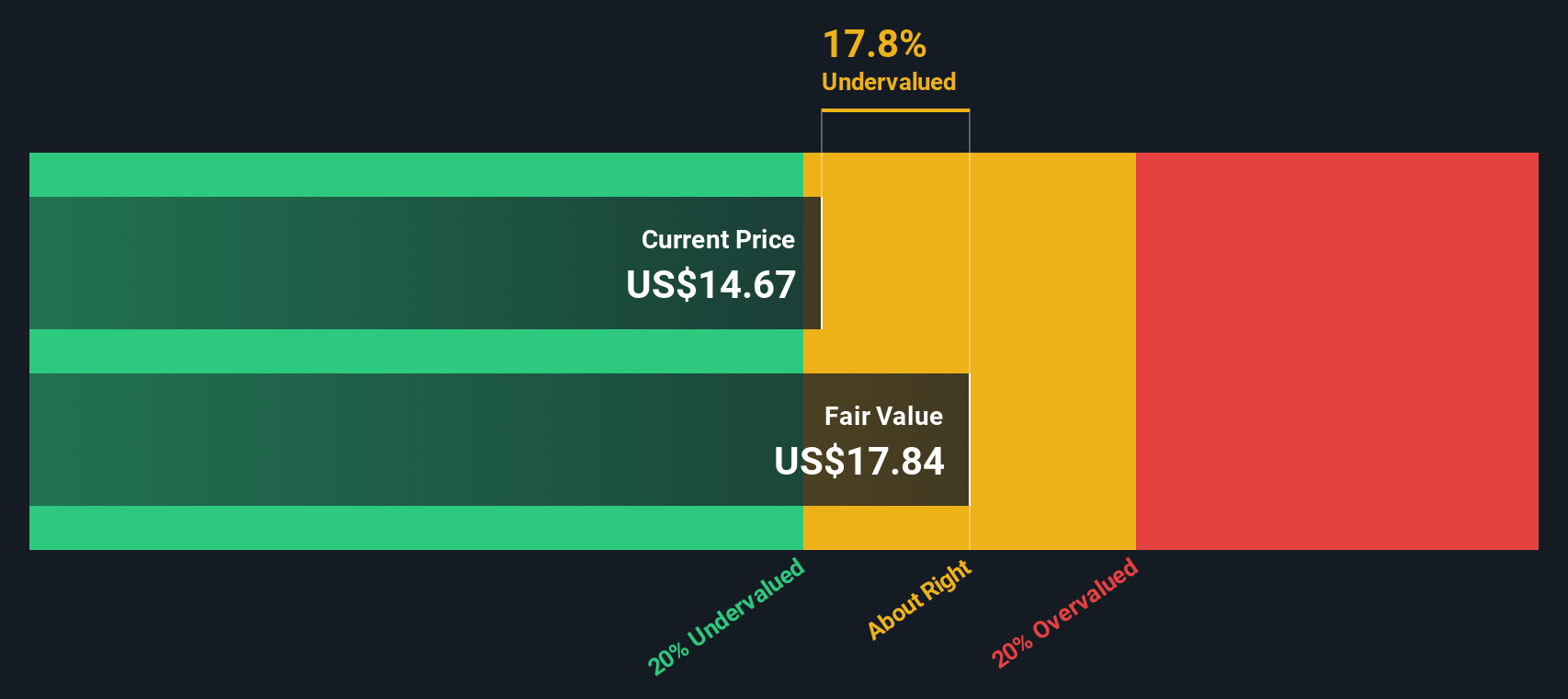

Myers Industries (NYSE:MYE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Myers Industries operates in the distribution and material handling sectors, with a market cap of approximately $0.76 billion.

Operations: The company generates revenue primarily from its Material Handling and Distribution segments, with recent figures showing $595.87 million and $227.73 million, respectively. Over the analyzed periods, the gross profit margin has shown variability, peaking at 33.22% in late 2019 before settling around 31.83% by late 2024. Operating expenses have consistently included significant allocations for general and administrative purposes, often exceeding $180 million annually in recent years.

PE: 26.4x

Myers Industries, a smaller company in the U.S., has seen insider confidence with David Basque purchasing 15,000 shares for US$179,350. Despite recent drops from major indices and a challenging financial year—reporting a net loss of US$10.88 million in Q3 compared to last year's profit—the company anticipates earnings growth of 72.92% annually. Leadership changes are underway with Aaron Schapper set to become CEO in January 2025, bringing extensive industrial experience that may steer future growth.

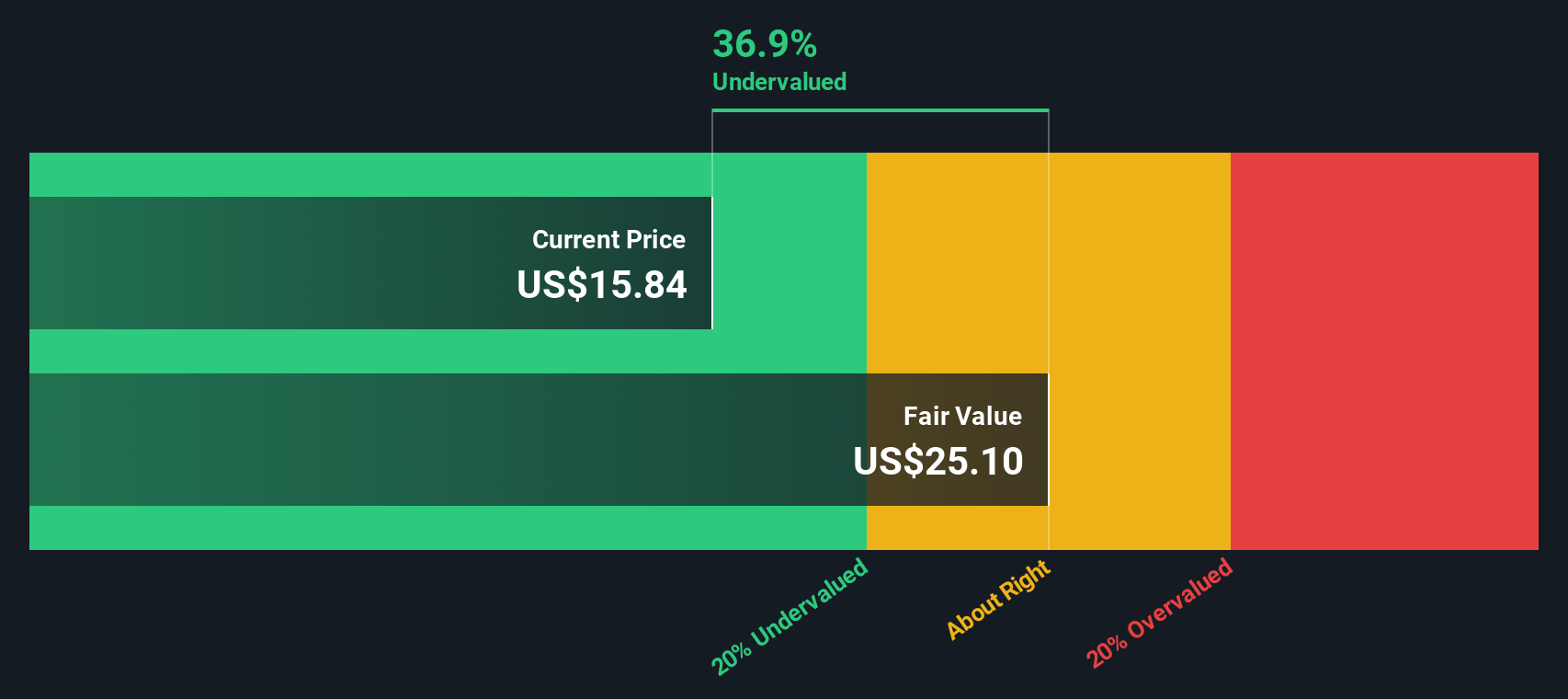

Plymouth Industrial REIT (NYSE:PLYM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Plymouth Industrial REIT is a real estate investment trust focused on owning and operating industrial properties, with a market capitalization of $1.01 billion.

Operations: The company's revenue primarily comes from its industrial properties, with a recent revenue of $201.57 million. The gross profit margin has shown fluctuations, reaching 68.88% in the latest period. Operating expenses have been significant, with general and administrative expenses contributing notably to the costs. Net income has varied over time, recently achieving a positive figure of $0.85 million after periods of losses.

PE: 956.1x

Plymouth Industrial REIT, a company focused on industrial properties, has shown insider confidence with recent share purchases. Their financial position remains stable despite higher-risk external borrowing. Recent expansions include a $20.1 million acquisition of industrial properties in Cincinnati, boasting a 6.8% NOI yield and strong occupancy rates. However, the company reported a net loss for Q3 2024 due to delayed lease commencements and vacancies but anticipates earnings growth of 44% annually moving forward.

Summing It All Up

- Investigate our full lineup of 51 Undervalued US Small Caps With Insider Buying right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLYM

Plymouth Industrial REIT

Plymouth Industrial REIT, Inc. (NYSE: PLYM) is a full service, vertically integrated real estate investment company focused on the acquisition, ownership and management of single and multi-tenant industrial properties.

Undervalued average dividend payer.