- United States

- /

- IT

- /

- NasdaqGM:BIGC

3 Undervalued Small Caps With Insider Buying To Consider In Your Regional Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a slight decline of 1.3%, but it remains up by 15% over the past year, with earnings forecasted to grow at an annual rate of 14%. In this context, identifying stocks that are potentially undervalued and show signs of insider confidence can be a strategic consideration for investors looking to enhance their regional portfolios.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First Mid Bancshares | 11.5x | 2.9x | 47.44% | ★★★★★☆ |

| Shore Bancshares | 11.5x | 2.6x | -1.49% | ★★★★☆☆ |

| Quanex Building Products | 27.5x | 0.7x | 43.40% | ★★★★☆☆ |

| Eagle Financial Services | 7.4x | 1.6x | 37.35% | ★★★★☆☆ |

| S&T Bancorp | 11.7x | 4.0x | 37.70% | ★★★★☆☆ |

| German American Bancorp | 14.1x | 4.7x | 47.04% | ★★★☆☆☆ |

| Citizens & Northern | 12.8x | 3.1x | 40.11% | ★★★☆☆☆ |

| Limbach Holdings | 35.6x | 1.8x | 48.29% | ★★★☆☆☆ |

| Alpha Metallurgical Resources | 9.5x | 0.6x | -362.25% | ★★★☆☆☆ |

| Union Bankshares | 15.1x | 2.8x | 29.24% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

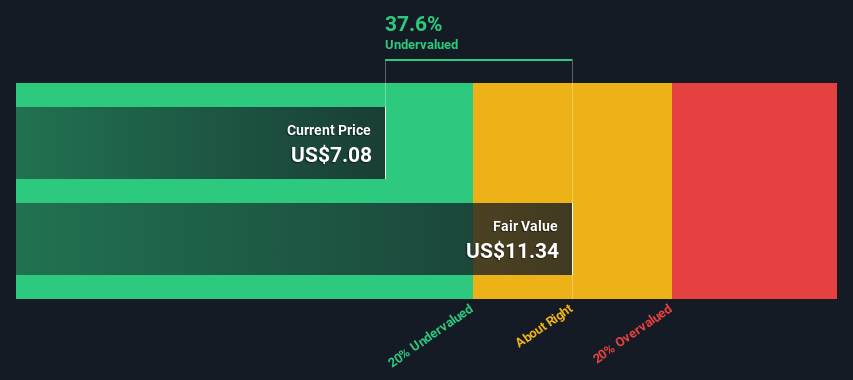

BigCommerce Holdings (NasdaqGM:BIGC)

Simply Wall St Value Rating: ★★★★★☆

Overview: BigCommerce Holdings operates as a software-as-a-service company providing an e-commerce platform for businesses, with a market capitalization of approximately $1.07 billion.

Operations: The company generates revenue primarily from its Internet Information Providers segment, with a recent figure of $332.93 million. Its cost structure includes significant expenses in sales and marketing, research and development, and general administrative areas. The gross profit margin has shown a positive trend, reaching 76.69% recently.

PE: -20.6x

BigCommerce Holdings, a dynamic player in the ecommerce space, is drawing attention for its potential value among smaller U.S. stocks. The company reported a significant reduction in net loss from US$64.67 million to US$27.03 million year-over-year, signaling improved financial health despite relying entirely on external borrowing for funding. Recent insider confidence is evident with share purchases throughout 2024, aligning with strategic leadership changes and innovative product updates like Catalyst, enhancing flexibility and performance for ecommerce storefronts. With earnings projected to grow at 47.9% annually, BigCommerce's future prospects appear promising amidst its ongoing transformation efforts and new executive appointments aimed at driving revenue growth and market expansion.

- Click here and access our complete valuation analysis report to understand the dynamics of BigCommerce Holdings.

Gain insights into BigCommerce Holdings' past trends and performance with our Past report.

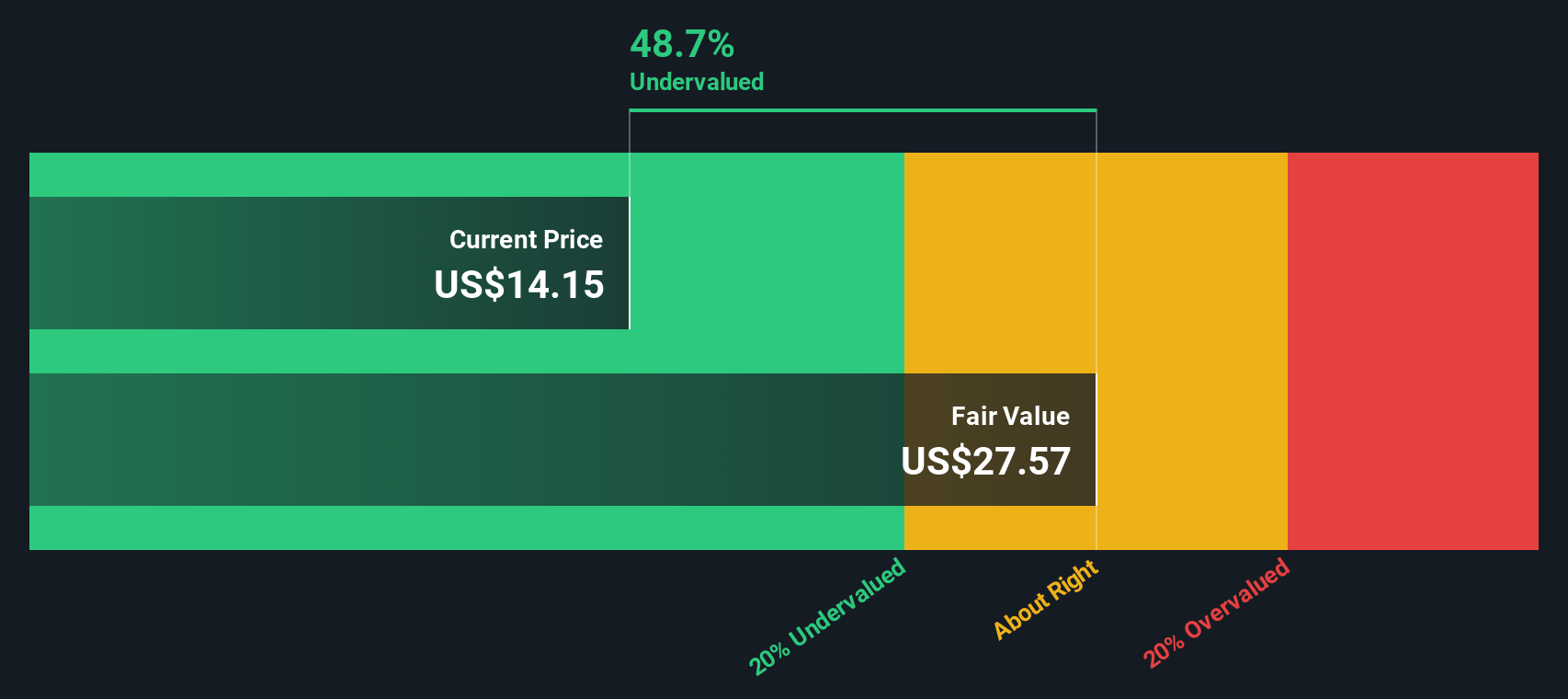

Trinity Capital (NasdaqGS:TRIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Trinity Capital operates as a provider of debt and equity capital to growth-stage companies, with a market capitalization of approximately $0.56 billion.

Operations: Trinity Capital's revenue has shown a progressive increase, reaching $226.73 million by the end of 2024. The company consistently achieves a gross profit margin of 100%, indicating that it retains all its revenue as gross profit. Operating expenses have also gradually risen, with general and administrative expenses being a notable component. The net income margin has fluctuated over time, peaking at 50.98% in late 2024, reflecting varying impacts from non-operating expenses on profitability.

PE: 9.0x

Trinity Capital, a smaller player in the U.S. market, showcases potential for value with its recent financial performance and strategic moves. In Q4 2024, revenue jumped to US$70.83 million from US$47.83 million year-over-year, while net income rose significantly to US$45.86 million from US$17.7 million. Despite relying solely on external borrowing for funding, they maintain growth prospects with earnings expected to increase by 7.77% annually and have initiated a fixed-income offering of US$100 million at a 7.875% rate due in 2029, reflecting their proactive capital management strategy amidst insider confidence reflected through increased stock purchases recently.

- Click to explore a detailed breakdown of our findings in Trinity Capital's valuation report.

Evaluate Trinity Capital's historical performance by accessing our past performance report.

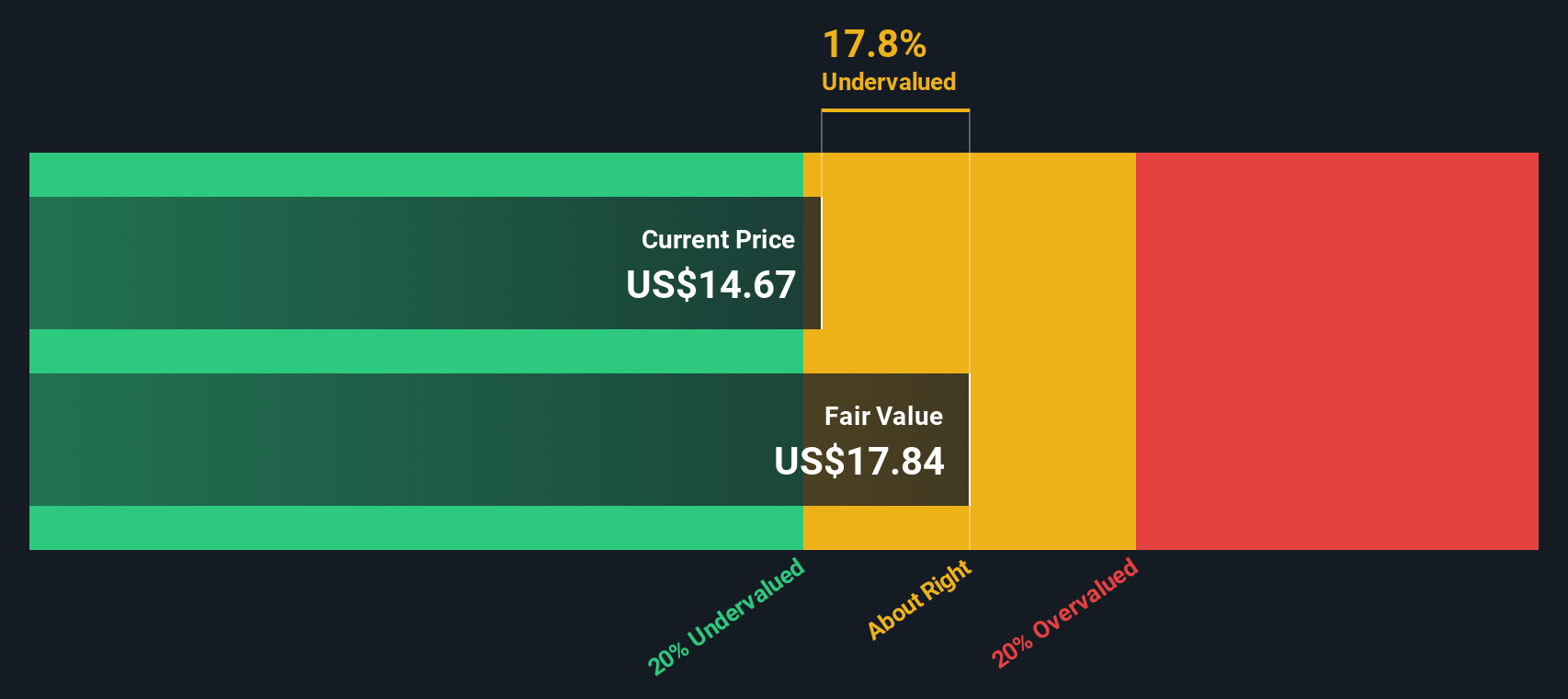

Myers Industries (NYSE:MYE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Myers Industries operates in the manufacturing and distribution sectors, focusing on material handling products and services, with a market cap of approximately $0.82 billion.

Operations: The company generates revenue primarily through its Material Handling segment, contributing $595.87 million, and its Distribution segment with $227.73 million in sales. The gross profit margin has shown an upward trend from 26.26% in December 2014 to 32.83% by June 2024, indicating improved cost efficiency over the periods analyzed.

PE: 26.4x

Myers Industries, a small company in the U.S., shows potential despite certain challenges. Their profit margins have dipped to 1.9% from last year's 6%, but earnings are projected to grow by 72.92% annually. Insider confidence is evident with recent share purchases, hinting at belief in future prospects. However, the company's reliance on external borrowing poses risks as interest payments aren't well covered by earnings. Balancing these factors could lead to interesting opportunities for investors seeking value-driven stocks.

Seize The Opportunity

- Access the full spectrum of 60 Undervalued US Small Caps With Insider Buying by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BigCommerce Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BIGC

BigCommerce Holdings

Operates a software-as-a-service ecommerce platform for brands and retailers in the United States, North and South America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives