- United States

- /

- Metals and Mining

- /

- NYSE:MUX

Can McEwen (MUX) Turn Strong Grey Fox Drilling Into Sustainable Production Growth?

Reviewed by Simply Wall St

- McEwen Inc. recently reported ongoing drilling success at the Fox Complex’s Grey Fox Project in Ontario, with new intercepts from the Gibson Expansion Zone and Grey Fox South indicating attractive gold grades and widths.

- Geological similarities with major regional deposits and updated resource modelling suggest Grey Fox could play a significant role in McEwen's long-term gold production potential.

- We'll explore how consistent gold exploration results at Grey Fox could affect McEwen's investment narrative and outlook for resource growth.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

McEwen Investment Narrative Recap

For shareholders, the investment case for McEwen Inc. relies on confidence in the company's ability to grow its gold resources and deliver operational improvements at key assets like the Fox Complex. The latest Grey Fox drill results support near-term resource growth, potentially the most important catalyst as McEwen targets increased production guidance; however, the long-term story still hinges on execution at major projects and meeting production targets, with shortfalls remaining the key risk to the business.

One particularly relevant recent announcement is McEwen’s reaffirmation of its 2025 production guidance at 120,000 to 140,000 GEOs, issued just last month. News from Grey Fox, which could enhance near-term resource estimates, provides further context to this goal and indicates progress toward sustaining and expanding gold output in the company's Ontario operations.

Conversely, investors should also factor in the possibility that operational underperformance, particularly continued shortfalls at core mines, could still threaten McEwen's ability to deliver on its growth ambitions...

Read the full narrative on McEwen (it's free!)

McEwen's narrative projects $446.1 million revenue and $201.4 million earnings by 2028. This requires 38.4% yearly revenue growth and a $214.9 million increase in earnings from -$13.5 million currently.

Uncover how McEwen's forecasts yield a $15.31 fair value, a 11% upside to its current price.

Exploring Other Perspectives

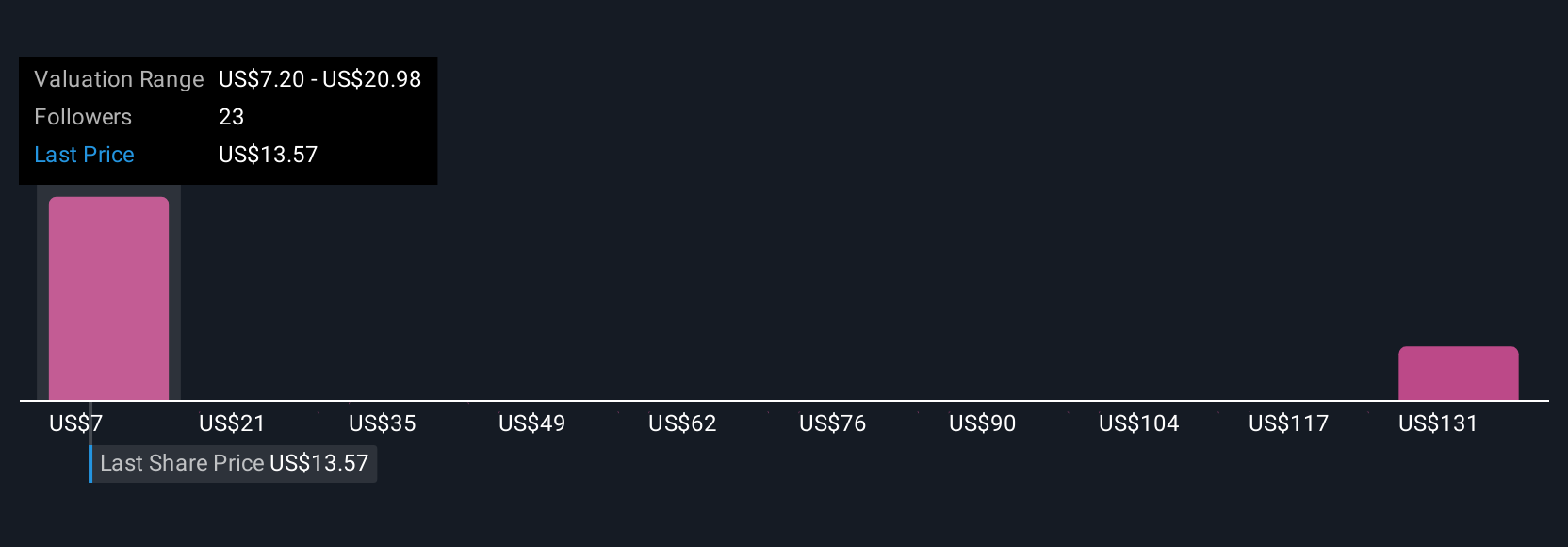

Retail fair value opinions from the Simply Wall St Community span US$7.20 to US$146.83, synthesized from six distinct viewpoints. While the resource upgrade prospects are encouraging, the range underlines how much expectations differ and why you should explore several perspectives.

Explore 6 other fair value estimates on McEwen - why the stock might be worth 48% less than the current price!

Build Your Own McEwen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McEwen research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free McEwen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McEwen's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUX

McEwen

Engages in the exploration, development, production, and sale of gold and silver deposits in the United States, Canada, Mexico, and Argentina.

High growth potential and fair value.

Market Insights

Community Narratives