- United States

- /

- Metals and Mining

- /

- NYSE:MUX

A Look at McEwen (NYSE:MUX) Valuation After Key Drilling Milestones and Strong Recent Share Price Gains

Reviewed by Simply Wall St

McEwen (NYSE:MUX) just checked off two important milestones, completing its 2025 drill program at Lookout Mountain in Nevada and extending high grade mineralization at the Froome Mine in Ontario, sharpening the stock’s long term growth story.

See our latest analysis for McEwen.

Those steady operational wins appear to be feeding into sentiment, with a roughly 35% 3 month share price return and a year to date share price gain of about 131% signaling strong positive momentum alongside a robust 1 year total shareholder return above 120%.

If McEwen’s surge has you rethinking where growth might come from next, this could be a good time to explore fast growing stocks with high insider ownership.

With drilling success accelerating and the share price already more than doubling this year, the key question now is whether McEwen still trades below its intrinsic value or if the market is already pricing in the next leg of growth.

Most Popular Narrative Narrative: 14.2% Undervalued

With McEwen last closing at $19.04 against a narrative fair value of $22.20, the story hinges on aggressive growth translating into outsized cash generation.

Bullish analysts see significant value creation potential following the release of the Feasibility Study for the Los Azules copper project. This study outlines a robust post tax NPV and an attractive internal rate of return, supporting a higher valuation for McEwen.

Curious how a single copper project can reset McEwen’s entire earnings profile and justify a richer future multiple than many peers? Unlock the narrative to see the revenue trajectory, margin shift, and valuation math that turn today’s losses into tomorrow’s high return assumptions.

Result: Fair Value of $22.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operational setbacks or prolonged permitting delays at key projects could derail growth expectations and challenge the view that the company is currently undervalued.

Find out about the key risks to this McEwen narrative.

Another Angle on Value

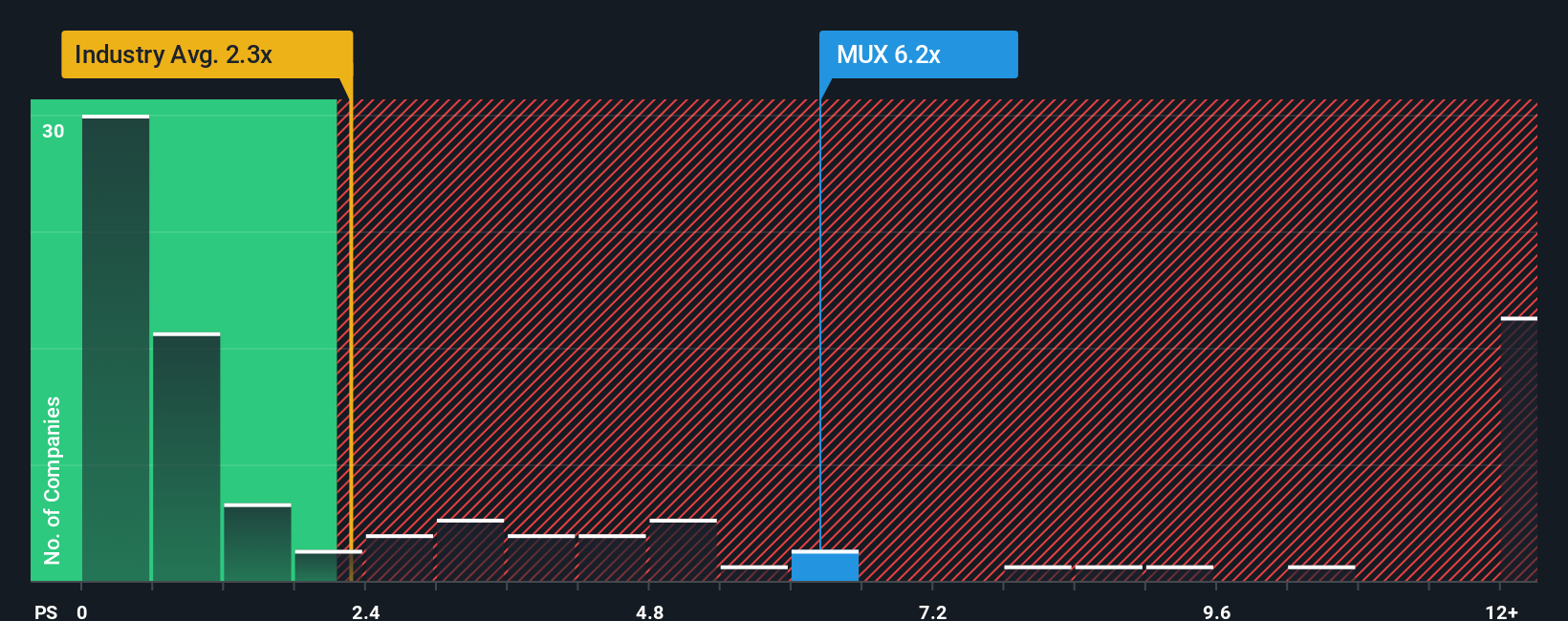

Not everyone sees McEwen as a clear bargain. On a price to sales basis, shares trade at about 6.2 times revenue, far richer than the US metals and mining industry at 1.7 times and above a fair ratio of 3.2 times, raising the risk of a pullback if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own McEwen Narrative

If you see the story differently or want to test your own assumptions using the same data, you can build a full narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding McEwen.

Ready for more high potential opportunities?

Use the Simply Wall Street Screener now to spot overlooked winners, sharpen your strategy, and avoid regretting the opportunities everyone else acted on first.

- Capture potential multi baggers early by scanning these 3612 penny stocks with strong financials that already show strong balance sheets and improving fundamentals.

- Target powerful secular growth by focusing on these 26 AI penny stocks reshaping industries with real world artificial intelligence solutions.

- Strengthen your value strategy by zeroing in on these 908 undervalued stocks based on cash flows where cash flows suggest the market has not caught up yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUX

McEwen

Engages in the exploration, development, production, and sale of gold and silver deposits in the United States, Canada, Mexico, and Argentina.

High growth potential and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)