- United States

- /

- Chemicals

- /

- NYSE:MTX

Is Minerals Technologies’ (MTX) Growth Momentum and Expansion Reshaping Its Long-Term Investment Case?

Reviewed by Sasha Jovanovic

- Minerals Technologies Inc. recently reported strong second quarter 2025 results, with an 8% sequential increase in revenue and a 36% rise in earnings per share, driven by growth initiatives such as new product lines and facility expansions.

- An interesting aspect of these results is the company's expectation that ongoing investments could add US$100 million in revenue, while maintaining focus on sustainability and operational efficiency despite market challenges and tariff impacts.

- We'll explore how Minerals Technologies' strong quarterly earnings momentum and commitment to facility expansion may influence its broader investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Minerals Technologies Investment Narrative Recap

To be a Minerals Technologies shareholder, one needs confidence in the company's ability to generate consistent growth through facility expansions and new product lines, particularly as it seeks to offset weaker segments like Specialty Additives. While recent strong quarterly results may support optimism around near-term earnings momentum, the most important short-term catalyst remains successful execution of growth investments, and the biggest risk continues to be pressures from soft demand in North American and European paper markets. The latest news does not appear to materially change these priorities, but it may strengthen belief in the company's execution capabilities.

Among recent announcements, the expansion in SIVO pet care manufacturing facilities directly reflects Minerals Technologies' willingness to capitalize on growing segments with investment. As these upgrades reach completion, their impact could provide added visibility around volume and margin recovery in the Household and Personal Care business, reinforcing growth catalysts while putting greater emphasis on management's ability to manage competition and costs.

However, investors should also keep in mind, in contrast to solid quarterly momentum, that volumes in core paper-related businesses remain subdued and...

Read the full narrative on Minerals Technologies (it's free!)

Minerals Technologies' narrative projects $2.3 billion revenue and $818.2 million earnings by 2028. This requires 3.3% yearly revenue growth and a $816.1 million increase in earnings from $2.1 million today.

Uncover how Minerals Technologies' forecasts yield a $84.00 fair value, a 41% upside to its current price.

Exploring Other Perspectives

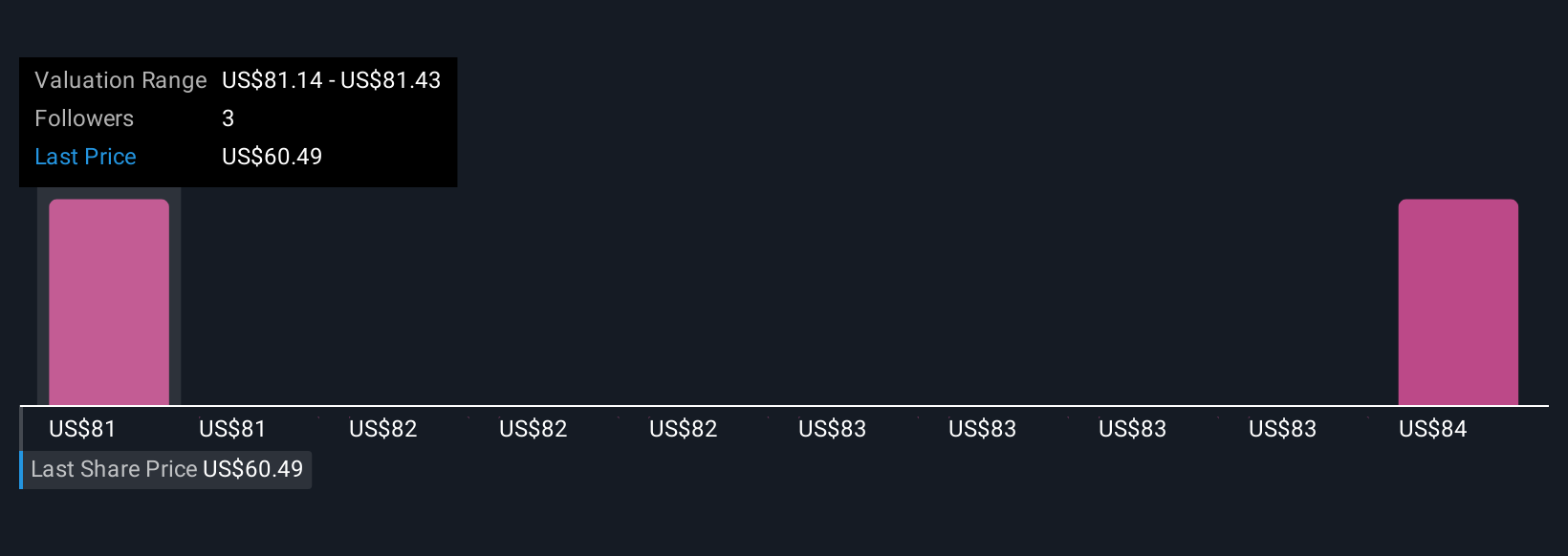

Simply Wall St Community members provided two fair value estimates for Minerals Technologies, ranging from US$81.08 to US$84. With forecasts highlighting the ongoing expansion of high-growth product lines as a major catalyst, you can explore several contrasting viewpoints on the company’s performance and future potential.

Explore 2 other fair value estimates on Minerals Technologies - why the stock might be worth as much as 41% more than the current price!

Build Your Own Minerals Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Minerals Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Minerals Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Minerals Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTX

Minerals Technologies

Develops, produces, and markets various mineral, mineral-based, and related systems and services.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives